Hasbro 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

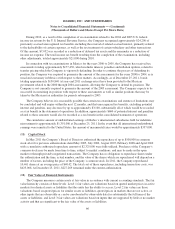

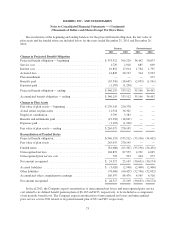

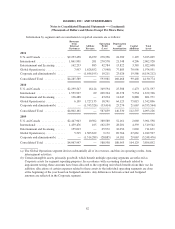

For 2011, 2010 and 2009, the Company measured the assets and obligations of the Plans as of the fiscal

year-end. The following is a detail of the components of the net periodic benefit cost for the three years ended

December 25, 2011.

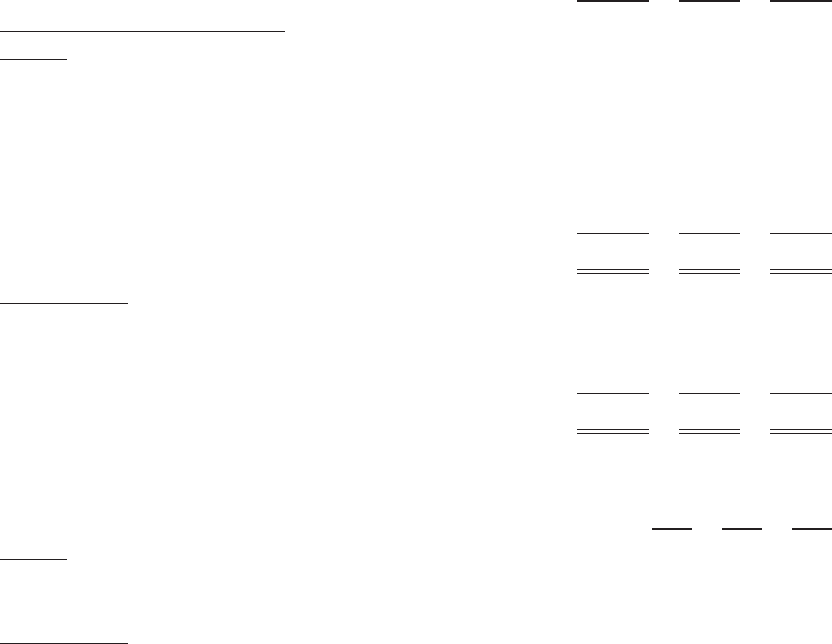

2011 2010 2009

Components of Net Periodic Cost

Pension

Service cost ............................................ $ 1,729 2,018 1,642

Interest cost ............................................ 16,852 17,014 17,358

Expected return on assets .................................. (19,012) (19,503) (18,982)

Amortization of prior service cost ........................... 198 198 266

Amortization of actuarial loss .............................. 4,624 4,026 4,495

Curtailment/settlement losses ............................... — — 3,957

Net periodic benefit cost .................................. $ 4,391 3,753 8,736

Postretirement

Service cost ............................................ $ 685 609 627

Interest cost ............................................ 1,764 1,795 1,903

Amortization of actuarial loss .............................. 67 — 12

Net periodic benefit cost .................................. $ 2,516 2,404 2,542

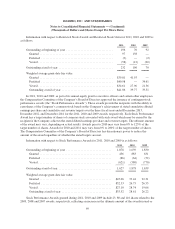

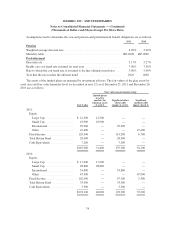

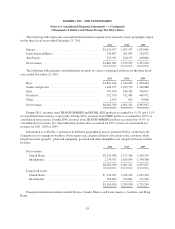

Assumptions used to determine net periodic benefit cost of the pension plan and postretirement plan for

each fiscal year follow:

2011 2010 2009

Pension

Weighted average discount rate ..................................... 5.20% 5.73% 6.20%

Long-term rate of return on plan assets ................................ 7.25% 8.00% 8.50%

Postretirement

Discount rate .................................................... 5.27% 5.75% 6.02%

Health care cost trend rate assumed for next year ........................ 7.50% 8.00% 8.50%

Rate to which the cost trend rate is assumed to decline (ultimate trend rate) . . . 5.00% 5.00% 5.00%

Year that the rate reaches the ultimate trend rate ........................ 2020 2016 2016

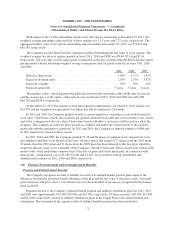

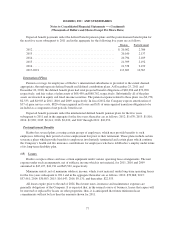

If the health care cost trend rate were increased one percentage point in each year, the accumulated

postretirement benefit obligation at December 25, 2011 and the aggregate of the benefits earned during the

period and the interest cost would have both increased by approximately 3%.

Hasbro works with external benefit investment specialists to assist in the development of the long-term rate

of return assumptions used to model and determine the overall asset allocation. Forecast returns are based on the

combination of historical returns, current market conditions and a forecast for the capital markets for the next 5-7

years. All asset class assumptions are within certain bands around the long-term historical averages. Correlations

are based primarily on historical return patterns.

76