Hasbro 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

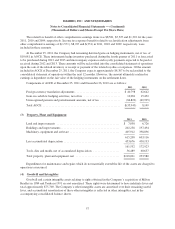

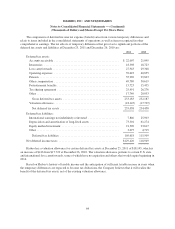

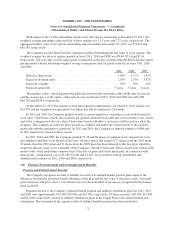

At December 25, 2011 and December 26, 2010, the Company’s net deferred income taxes are recorded in

the consolidated balance sheets as follows:

2011 2010

Prepaid expenses and other current assets ............................. $ 68,774 64,536

Other assets .................................................... 62,574 57,613

Accrued liabilities ............................................... (731) (2,135)

Other liabilities .................................................. (1,197) (1,065)

Net deferred income taxes ......................................... $129,420 118,949

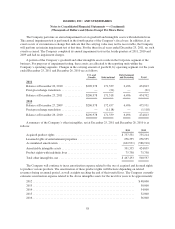

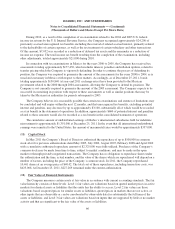

A reconciliation of unrecognized tax benefits, excluding potential interest and penalties, for the fiscal years

ended December 25, 2011, December 26, 2010, and December 27, 2009 is as follows:

2011 2010 2009

Balance at beginning of year ............................... $91,109 97,857 79,456

Gross increases in prior period tax positions ................. 811 706 1,430

Gross decreases in prior period tax positions ................. (33,501) (36,010) (14,250)

Gross increases in current period tax positions ............... 27,910 34,598 34,189

Decreases related to settlements with tax authorities ........... (792) (5,550) (269)

Decreases from the expiration of statute of limitations ......... (1,723) (492) (2,699)

Balance at end of year .................................... $83,814 91,109 97,857

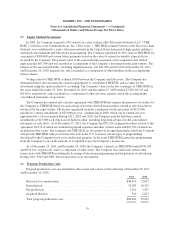

If the $83,814 balance as of December 25, 2011 is recognized, approximately $72,000 would decrease the

effective tax rate in the period in which each of the benefits is recognized. The remaining amount would be offset

by the reversal of related deferred tax assets.

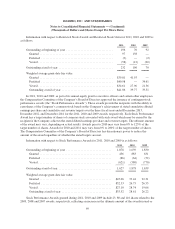

During 2011, 2010, and 2009 the Company recognized $3,100, $3,171 and $3,405, respectively, of potential

interest and penalties, which are included as a component of income taxes in the accompanying consolidated

statements of operations. At December 25, 2011, December 26, 2010 and December 27, 2009, the Company had

accrued potential interest and penalties of $13,847, $14,466 and $17,938, respectively.

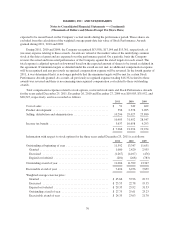

The Company and its subsidiaries file income tax returns in the United States and various state and

international jurisdictions. In the normal course of business, the Company is regularly audited by U.S. federal,

state and local and international tax authorities in various tax jurisdictions. The Company is no longer subject to

U.S. federal income tax examinations for years before 2008. With few exceptions, the Company is no longer

subject to U.S. state or local and non-U.S. income tax examinations by tax authorities in its major jurisdictions

for years before 2006.

The U.S. Internal Revenue Service commenced an examination related to the 2008 and 2009 U.S. federal

income tax returns. The Company is also under income tax examination in several U.S. state and local and

non-U.S. jurisdictions. The U.S. Internal Revenue Service recently completed an examination related to 2006 and

2007. During 2011, as the result of the completion of this examination, the Company recognized $22,101 of

previously accrued unrecognized tax benefits, including the reversal of related accrued interest, primarily related

to the deductibility of certain expenses, as well as the tax treatment of certain subsidiary and other transactions.

Of this amount, $1,482 was recorded as a reduction of deferred tax assets and the remainder as a reduction of

income tax expense. The total income tax benefit resulting from the completion of the examination, including

other adjustments, totaled $20,477 during 2011.

65