Hasbro 2011 Annual Report Download - page 45

Download and view the complete annual report

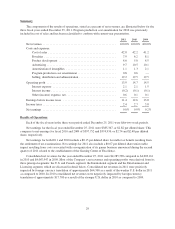

Please find page 45 of the 2011 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$364,194 at December 26, 2010 compared to $207,895 at December 27, 2009. The increased inventory balance

at December 26, 2010 reflects the lower sales in the fourth quarter of 2010 compared to 2009.

Prepaid expenses and other current assets increased to $243,431 at December 25, 2011 from $167,807 at

December 26, 2010 primarily due to higher non-income based tax receivables. These tax receivables are

primarily related to value added taxes in Europe that are due to the Company, primarily from France, Spain and

Germany, which are expected to be collected in 2012. The increase is primarily due to changes in the legal

structure of the Company’s European business, which have resulted in larger outstanding balances at year-end

2011. This increase was partially offset by decreases in foreign exchange contracts and income tax receivables.

Prepaid expenses and other current assets increased slightly to $167,807 at December 26, 2010 from $162,290 at

December 27, 2009. Increases in income tax receivables, current deferred income taxes and the values of the

Company’s forward currency contracts were partially offset by decreased prepaid royalties as the result of

utilization of advance royalty payments.

Accounts payable and accrued expenses increased to $761,914 at December 25, 2011 compared $704,233 at

December 26, 2010. The 2011 balance includes a decrease of approximately $15,100 as a result of the translation

of foreign currency balances. Increases in accrued expenses relate to higher accrued royalties as a result of

increased sales of royalty-bearing BEYBLADE and TRANSFORMERS products in 2011. The remainder of the

increase relates to higher accrued costs associated with cancelled purchase commitments and accrued income and

other taxes. These increases were partially offset by lower accrued payroll and management incentives. Accounts

payable and accrued expenses decreased to $704,233 at December 26, 2010 compared to $801,775 at

December 27, 2009. The decrease primarily related to lower accrued payroll and management incentives, lower

accrued royalties as a result of the decrease in entertainment-driven products, and lower accounts payable

balances due to the timing of payments in 2010.

Cash flows from investing activities were a net utilization of $107,615, $104,188, and $497,509 in 2011,

2010 and 2009, respectively. Additions to property, plant and equipment were approximately $99,400, $113,000

and $104,000 in 2011, 2010 and 2009, respectively. Of these amounts, 66% in 2011, 57% in 2010 and 58% in

2009 were for purchases of tools, dies and molds related to the Company’s products. In 2012, the Company

expects capital expenditures to be in the range of $125,000 to $135,000. During the three years ended

December 25, 2011, the depreciation of plant and equipment was $113,821, $95,925 and $95,934, respectively.

Cash utilized for investments and acquisitions were $11,585 in 2011, $0 in 2010, and $371,482 in 2009. The

2011 utilization includes the Company’s purchase of intellectual property. The 2009 utilization includes the

Company’s $300,000 payment to Discovery for its 50% interest in THE HUB, a payment of $45,000 to Lucas to

extend the term of the license agreement related to the STAR WARS brand and approximately $26,500 used to

acquire certain other intellectual properties. There were no investments or acquisitions in 2010.

The Company commits to inventory production, advertising and marketing expenditures prior to the peak

third and fourth quarter retail selling season. Accounts receivable increase during the third and fourth quarter as

customers increase their purchases to meet expected consumer demand in their holiday selling season. Due to the

concentrated timeframe of this selling period, payments for these accounts receivable are generally not due until

the fourth quarter or early in the first quarter of the subsequent year. This timing difference between expenditures

and cash collections on accounts receivable makes it necessary for the Company to borrow higher amounts

during the latter part of the year. During 2011, the Company primarily used cash from operations and borrowings

under its commercial paper program and available lines of credit. In 2010 and 2009, the Company primarily

utilized cash from operations, borrowings under its available lines of credit and, during a portion of 2009, its

accounts receivable securitization program to fund its operations.

During 2010 and 2009, the Company was party to an accounts receivable securitization program whereby

the Company sold, on an ongoing basis, substantially all of its U.S. trade accounts receivable to a bankruptcy

remote special purpose entity, Hasbro Receivables Funding, LLC (“HRF”). HRF was consolidated with the

Company for financial reporting purposes. The securitization program then allowed HRF to sell, on a revolving

basis, an undivided fractional ownership interest of up to $250,000 in the eligible receivables it held to certain

bank conduits. The program provided the Company with a source of working capital. In January 2011, the

Company terminated this program.

36