Hasbro 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

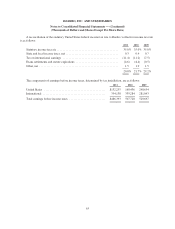

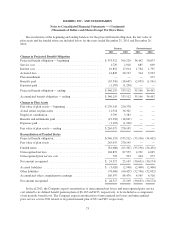

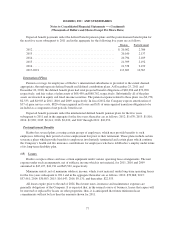

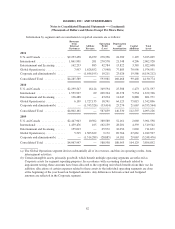

Reconciliations of the beginning and ending balances for the projected benefit obligation, the fair value of

plan assets and the funded status are included below for the years ended December 25, 2011 and December 26,

2010.

Pension Postretirement

2011 2010 2011 2010

Change in Projected Benefit Obligation

Projected benefit obligation — beginning ...................... $333,512 306,220 34,492 30,873

Service cost ............................................. 1,729 2,018 685 609

Interest cost ............................................. 16,852 17,014 1,764 1,795

Actuarial loss ............................................ 14,845 28,197 314 2,903

Plan amendment .......................................... — — — 273

Benefits paid ............................................ (19,596) (18,647) (2,059) (1,961)

Expenses paid ............................................ (1,187) (1,290) — —

Projected benefit obligation — ending ........................ $346,155 333,512 35,196 34,492

Accumulated benefit obligation — ending ..................... $346,155 333,512 35,196 34,492

Change in Plan Assets

Fair value of plan assets — beginning ......................... $270,145 250,378 — —

Actual return on plan assets ................................. 11,914 36,321 — —

Employer contribution ..................................... 3,799 3,383 — —

Benefits and settlements paid ............................... (19,596) (18,647) — —

Expenses paid ............................................ (1,187) (1,290) — —

Fair value of plan assets — ending ........................... $265,075 270,145 — —

Reconciliation of Funded Status

Projected benefit obligation ................................. $(346,155) (333,512) (35,196) (34,492)

Fair value of plan assets .................................... 265,075 270,145 — —

Funded status ............................................ (81,080) (63,367) (35,196) (34,492)

Unrecognized net loss ..................................... 104,872 87,553 4,321 4,045

Unrecognized prior service cost ............................. 725 923 244 273

Net amount recognized .................................... $ 24,517 25,109 (30,631) (30,174)

Accrued liabilities ........................................ $ (3,020) (2,940) (2,400) (2,400)

Other liabilities .......................................... (78,060) (60,427) (32,796) (32,092)

Accumulated other comprehensive earnings .................... 105,597 88,476 4,565 4,318

Net amount recognized .................................... $ 24,517 25,109 (30,631) (30,174)

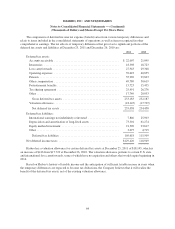

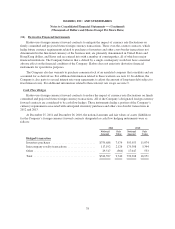

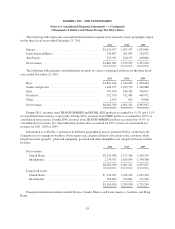

In fiscal 2012, the Company expects amortization of unrecognized net losses and unrecognized prior service

cost related to its defined benefit pension plans of $6,165 and $193, respectively, to be included as a component

of net periodic benefit cost. The Company expects amortization of unrecognized net losses and unrecognized

prior service cost in 2012 related to its postretirement plan of $51 and $29, respectively.

73