Hasbro 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

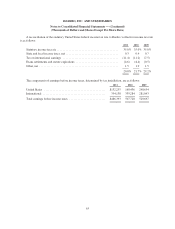

The related tax benefit of other comprehensive earnings items was $8,581, $5,327 and $1,322 for the years

2011, 2010 and 2009, respectively. Income tax expense (benefit) related to reclassification adjustments from

other comprehensive earnings of $(1,571), $8,767 and $(331) in 2011, 2010 and 2009, respectively, were

included in these amounts.

At December 25, 2011, the Company had remaining deferred gains on hedging instruments, net of tax, of

$10,081 in AOCE. These instruments hedge inventory purchased during the fourth quarter of 2011 or forecasted

to be purchased during 2012 and 2013 and intercompany expenses and royalty payments expected to be paid or

received during 2012 and 2013. These amounts will be reclassified into the consolidated statement of operations

upon the sale of the related inventory or receipt or payment of the related royalties or expenses. Of the amount

included in AOCE at December 25, 2011, the Company expects approximately $8,307 to be reclassified to the

consolidated statement of operations within the next 12 months. However, the amount ultimately realized in

earnings is dependent on the fair value of the hedging instruments on the settlement dates.

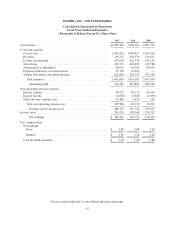

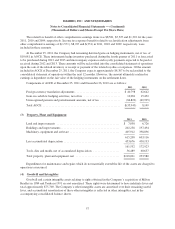

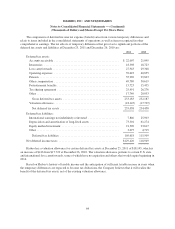

Components of AOCE at December 25, 2011 and December 26, 2010 are as follows:

2011 2010

Foreign currency translation adjustments ............................... $40,798 62,642

Gain on cash flow hedging activities, net of tax ......................... 10,081 15,432

Unrecognized pension and postretirement amounts, net of tax .............. (86,822) (69,925)

Total AOCE ..................................................... $(35,943) 8,149

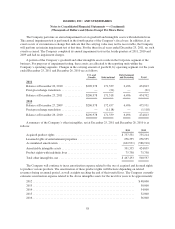

(3) Property, Plant and Equipment

2011 2010

Land and improvements ........................................... $ 7,038 6,726

Buildings and improvements ........................................ 202,258 197,494

Machinery, equipment and software .................................. 405,912 398,896

615,208 603,116

Less accumulated depreciation ...................................... 453,676 430,193

161,532 172,923

Tools, dies and molds, net of accumulated depreciation .................. 56,489 60,657

Total property, plant and equipment, net .............................. $218,021 233,580

Expenditures for maintenance and repairs which do not materially extend the life of the assets are charged to

operations as incurred.

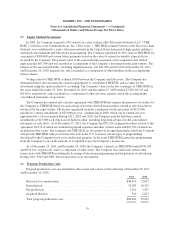

(4) Goodwill and Intangibles

Goodwill and certain intangible assets relating to rights obtained in the Company’s acquisition of Milton

Bradley in 1984 and Tonka in 1991 are not amortized. These rights were determined to have indefinite lives and

total approximately $75,700. The Company’s other intangible assets are amortized over their remaining useful

lives, and accumulated amortization of these other intangibles is reflected in other intangibles, net in the

accompanying consolidated balance sheets.

57