Hasbro 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LITTLE PONY and LITTLEST PET SHOP products. Preschool category net revenues increased primarily as the

result of stronger sales of PLAY-DOH and PLAYSKOOL products offset by decreased sales of IN THE NIGHT

GARDEN products. Net revenues in the games and puzzles category increased slightly as a result of increased

revenues from MAGIC: THE GATHERING trading card games.

International segment operating profit increased 29% to $209,704 in 2010 from $162,159 in 2009.

Operating profit for the International segment in 2010 was negatively impacted by approximately $11,500 due to

the translation of foreign currencies to the U.S. dollar. The increase in operating profit was primarily driven by

the increased revenues described above. In addition, operating profit was positively impacted by decreased

royalty expense and amortization. These were offset by increased selling, distribution and administration

expenses.

Entertainment and Licensing

The Entertainment and Licensing segment’s net revenues for the year ended December 25, 2011 increased

19% to $162,233 from $136,488 for the year ended December 26, 2010. The increase was primarily due to

growth in television programming and lifestyle licensing revenues. The increased television programming

revenues reflect a full year of U.S. and international program distribution in 2011 compared to a partial period in

2010, as program distribution primarily commenced during the third quarter of 2010. Higher lifestyle licensing

revenues primarily related to TRANSFORMERS, as a result of licensing programs based on the motion picture

release in 2011.

Entertainment and Licensing segment operating profit decreased 1% to $42,784 in 2011 from $43,234 in

2010. The impact of higher net revenues was offset by investments made by the Company to grow its global

licensing organization and increased program production cost amortization.

The Entertainment and Licensing segment’s net revenues for the year ended December 26, 2010 decreased

12% to $136,488 from $155,013 for the year ended December 27, 2009. The decrease was primarily due to

decreases in both lifestyle and digital gaming licensing revenues, primarily relating to lower licensing revenues

from TRANSFORMERS and, to a lesser extent, G.I. JOE, products following the motion picture releases in

2009.

Entertainment and Licensing segment operating profit decreased 34% to $43,234 in 2010 from $65,572 in

2009. Operating profit decreased as a result of the decreased revenues discussed above and program production

amortization costs associated with our television shows. This was partially offset by lower selling, distribution

and administration expenses. Selling, distribution and administration expenses in 2009 included approximately

$7,200 in transaction costs related to the Company’s investment in THE HUB.

While THE HUB is a component of our television operations, the Company’s 50% share in the earnings

from the joint venture is included in other (income) expense and therefore is not a component of operating profit

of the segment.

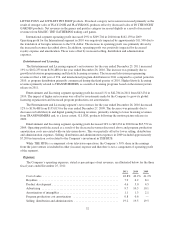

Expenses

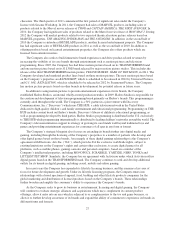

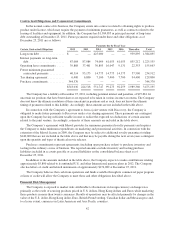

The Company’s operating expenses, stated as percentages of net revenues, are illustrated below for the three

fiscal years ended December 25, 2011:

2011 2010 2009

Cost of sales ................................................... 42.8% 42.2% 41.2%

Royalties ...................................................... 7.9 6.2 8.1

Product development ............................................. 4.6 5.0 4.5

Advertising .................................................... 9.7 10.5 10.1

Amortization of intangibles ........................................ 1.1 1.3 2.1

Program production cost amortization ............................... 0.8 0.6 —

Selling, distribution and administration .............................. 19.2 19.5 19.5

32