Hasbro 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

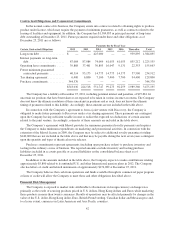

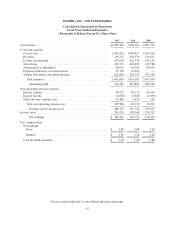

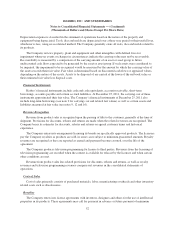

HASBRO, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

Fiscal Years Ended in December

(Thousands of Dollars)

2011 2010 2009

Cash flows from operating activities

Net earnings ....................................................... $385,367 397,752 374,930

Adjustments to reconcile net earnings to net cash provided by operating

activities:

Depreciation of plant and equipment ................................. 113,821 95,925 95,934

Amortization of intangibles ......................................... 46,647 50,405 85,029

Program production cost amortization ................................ 35,798 22,069 —

Deferred income taxes ............................................. (2,921) 25,172 19,136

Stock-based compensation ......................................... 12,463 33,392 29,912

Changes in operating assets and liabilities:

(Increase) decrease in accounts receivable ............................. (108,845) 71,173 (422,560)

Decrease (increase) in inventories .................................... 17,463 (151,634) 105,329

(Increase) decrease in prepaid expenses and other current assets ............ (85,076) 15,904 35,702

Program production costs .......................................... (80,983) (52,047) (1,837)

Increase (decrease) in accounts payable and accrued liabilities ............. 75,589 (129,531) 5,966

Other, including long-term advances ................................. (13,254) (10,599) (61,918)

Net cash provided by operating activities ............................ 396,069 367,981 265,623

Cash flows from investing activities

Additions to property, plant and equipment ............................ (99,402) (112,597) (104,129)

Investments and acquisitions, net of cash acquired ....................... (11,585) — (371,482)

Purchases of short-term investments .................................. — — (18,000)

Other investing activities ........................................... 3,372 8,409 (3,898)

Net cash utilized by investing activities ............................. (107,615) (104,188) (497,509)

Cash flows from financing activities

Net proceeds from borrowings with original maturities of more than three

months ....................................................... — 492,528 421,309

Repayments of borrowings with original maturities of more than three

months ....................................................... — (186) —

Net proceeds (repayments) of other short-term borrowings ................ 167,339 (381) 4,114

Purchases of common stock ........................................ (423,008) (639,563) (88,112)

Stock option transactions .......................................... 29,798 93,522 9,193

Excess tax benefits from stock-based compensation ..................... 9,657 22,517 1,733

Dividends paid ................................................... (154,028) (133,048) (111,458)

Other financing activities .......................................... (5,443) (5,984) —

Net cash (utilized) provided by financing activities .................... (375,685) (170,595) 236,779

Effect of exchange rate changes on cash ................................... 1,123 (1,447) 762

(Decrease) increase in cash and cash equivalents ...................... (86,108) 91,751 5,655

Cash and cash equivalents at beginning of year ............................. 727,796 636,045 630,390

Cash and cash equivalents at end of year .................................. $641,688 727,796 636,045

Supplemental information

Interest paid ................................................... $ 91,045 72,927 54,578

Income taxes paid .............................................. $ 78,104 93,995 107,948

See accompanying notes to consolidated financial statements.

48