Hasbro 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

asset or liability. The Company believes that this is the best information available for use in the fair value

measurement. There were no changes in these valuation techniques during 2011.

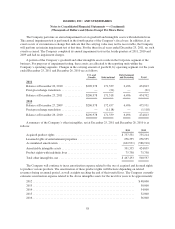

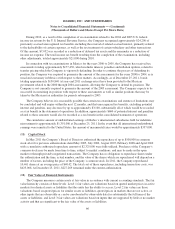

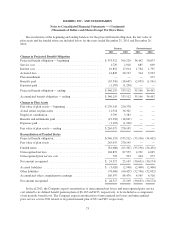

The following is a reconciliation of the beginning and ending balances of the fair value measurements of the

Company’s warrants to purchase common stock that use significant unobservable inputs (Level 3):

2011 2010

Balance at beginning of year ........................................... $9,155 6,808

(Loss) gain from change in fair value .................................... (5,431) 2,347

Balance at end of year ................................................ $3,724 9,155

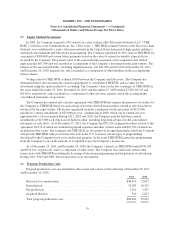

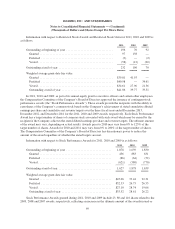

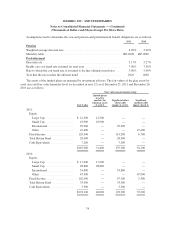

(13) Stock Options, Other Stock Awards and Warrants

Hasbro has reserved 18,471 shares of its common stock for issuance upon exercise of options and the grant

of other awards granted or to be granted under stock incentive plans for employees and for non-employee

members of the Board of Directors (collectively, the “plans”). These options and other awards generally vest in

equal annual amounts over three to five years. The plans provide that options be granted at exercise prices not

less than the market value of the underlying common stock on the date the option is granted and options are

adjusted for such changes as stock splits and stock dividends. Generally, options are exercisable for periods of no

more than ten years after date of grant. Upon exercise in the case of stock options, grant in the case of restricted

stock or vesting in the case of performance based contingent stock grants, shares are issued out of available

treasury shares. The Company’s current plan permits the granting of awards in the form of stock, stock

appreciation rights, stock awards and cash awards in addition to stock options.

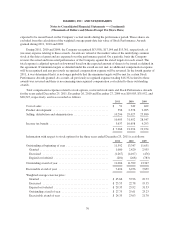

The Company on occasion will issue restricted stock or grant restricted stock units to certain key employees.

These shares or units are nontransferable and subject to forfeiture for periods prescribed by the Company. These

awards are valued at the market value of the underlying common stock at the date of grant and are subsequently

amortized over the periods during which the restrictions lapse, generally between three and five years. During

2011, 2010 and 2009, the Company recognized compensation expense, net of forfeitures, on these awards of

$1,761, $1,209 and $768, respectively. At December 26, 2011, the amount of total unrecognized compensation

cost related to restricted stock units is $7,574 and the weighted average period over which this will be expensed

is 48 months. Of the shares vested in 2011, the receipt of 58 shares has been deferred to the date upon which the

recipient is no longer employed by the Company.

68