Hasbro 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

Current accounting standards permit entities to choose to measure many financial instruments and certain

other items at fair value and establish presentation and disclosure requirements designed to facilitate comparisons

between entities that choose different measurement attributes for similar assets and liabilities. The Company has

elected the fair value option for certain investments. At December 25, 2011 and December 26, 2010, these

investments totaled $19,657 and $21,767, respectively, and are included in prepaid expenses and other current

assets in the consolidated balance sheets. The Company recorded net gains of $61, $1,218 and $1,019 on these

investments in other (income) expense, net for the years ended December 25, 2011, December 26, 2010 and

December 27, 2009, respectively, relating to the change in fair value of such investments.

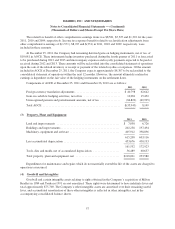

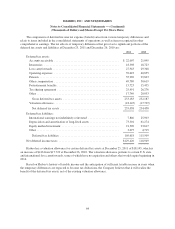

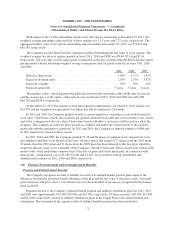

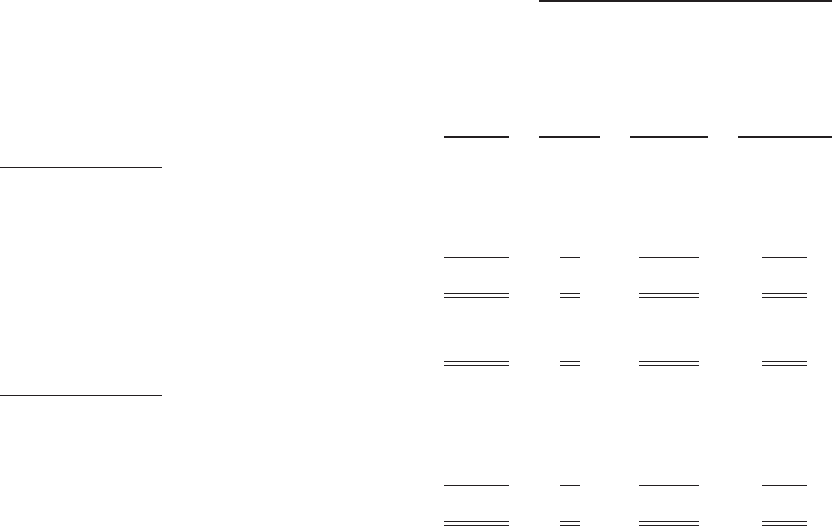

At December 25, 2011 and December 26, 2010, the Company had the following assets and liabilities

measured at fair value in its consolidated balance sheets:

Fair Value Measurements Using

Fair

Value

Quoted

Prices in

Active

Markets

for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

December 25, 2011

Assets:

Available-for-sale securities .................. $19,669 12 19,657 —

Derivatives ................................ 29,500 — 25,776 3,724

Total assets ................................ $49,169 12 45,433 3,724

Liabilities:

Derivatives ................................ $ 1,908 — 1,908 —

December 26, 2010

Assets:

Available-for-sale securities .................. $21,791 24 21,767 —

Derivatives ................................ 38,092 — 28,937 9,155

Total assets ................................ $59,883 24 50,704 9,155

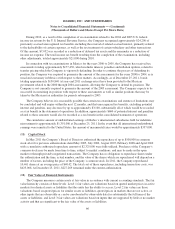

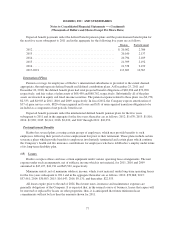

For a portion of the Company’s available-for-sale securities, the Company is able to obtain quoted prices

from stock exchanges to measure the fair value of these securities. Certain other available-for-sale securities held

by the Company are valued at the net asset value which is quoted on a private market that is not active; however,

the unit price is predominantly based on underlying investments which are traded on an active market. The

Company’s derivatives consist primarily of foreign currency forward contracts. The Company uses current

forward rates of the respective foreign currencies to measure the fair value of these contracts. The Company’s

derivatives also include interest rate swaps used to adjust the amount of long-term debt subject to fixed interest

rates. The fair values of the interest rate swaps are measured based on the present value of future cash flows

using the swap curve as of the valuation date. The remaining derivative securities consist of warrants to purchase

common stock of an unrelated company. The Company uses the Black-Scholes model to value these warrants.

One of the inputs used in the Black-Scholes model, historical volatility, is considered an unobservable input in

that it reflects the Company’s own assumptions about the inputs that market participants would use in pricing the

67