GE 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 GE 2011 ANNUAL REPORT

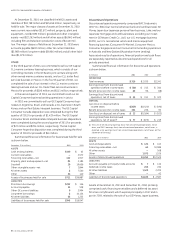

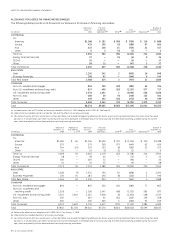

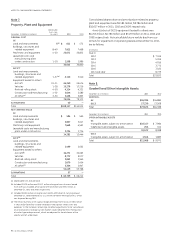

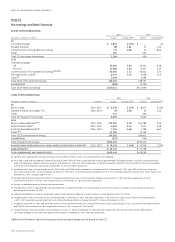

Note 7.

Property, Plant and Equipment

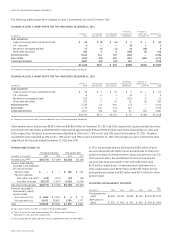

December 31 (Dollars in millions)

Depreciable

lives—new

(in years) 2011 2010

ORIGINAL COST

GE

Land and improvements 8 (a) $ 611 $ 573

Buildings, structures and

related equipment 8–40 7,823 7,468

Machinery and equipment 4–20 22,071 20,833

Leasehold costs and

manufacturing plant

under construction 1–10 2,538 1,986

33,043 30,860

GECS (b)

Land and improvements,

buildings, structures and

related equipment 1–37 (a) 3,110 3,510

Equipment leased to others

Aircraft 19–21 46,240 45,674

Vehicles 1–28 15,278 17,216

Railroad rolling stock 4–50 4,324 4,331

Construction and manufacturing 1–30 2,644 2,586

All other (c) 3–30 3,438 5,855

75,034 79,172

ELIMINATIONS 40 —

Total $108,117 $110,032

NET CARRYING VALUE

GE

Land and improvements $ 584 $ 550

Buildings, structures and

related equipment 3,827 3,617

Machinery and equipment 7,648 6,551

Leasehold costs and manufacturing

plant under construction 2,224 1,726

14,283 12,444

GECS (b)

Land and improvements,

buildings, structures and

related equipment 1,499 1,665

Equipment leased to others

Aircraft (d) 34,271 34,665

Vehicles 8,772 9,077

Railroad rolling stock 2,853 2,960

Construction and manufacturing 1,670 1,454

All other (c) 2,354 3,947

51,419 53,768

ELIMINATIONS 37 —

Total $ 65,739 $ 66,212

(a) Depreciable lives exclude land.

(b) Included $1,570 million and $1,571 million of original cost of assets leased

to GE with accumulated amortization of $470 million and $531 million at

December 31, 2011 and 2010, respectively.

(c) Included $2,404 million of original cost and $1,670 million of carrying value at

December 31, 2010 related to our CLL marine container leasing business, which

was disposed during 2011.

(d) The GECAS business of GE Capital recognized impairment losses of $301 million

in 2011 and $438 million in 2010 recorded in the caption “Other costs and

expenses” in the Statement of Earnings to reflect adjustments to fair value based

on an evaluation of average current market values (obtained from third parties)

of similar type and age aircraft, which are adjusted for the attributes of the

specific aircraft under lease.

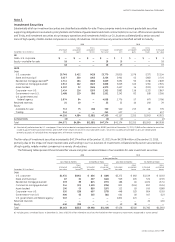

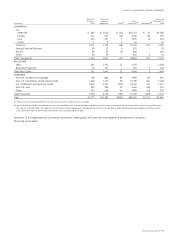

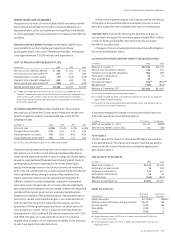

Consolidated depreciation and amortization related to property,

plant and equipment was $9,185 million, $9,786 million and

$10,617 million in 2011, 2010 and 2009, respectively.

Amortization of GECS equipment leased to others was

$6,253 million, $6,786 million and $7,179 million in 2011, 2010 and

2009, respectively. Noncancellable future rentals due from cus-

tomers for equipment on operating leases at December 31, 2011,

are as follows:

(In millions)

Due in

2012 $ 7,345

2013 5,995

2014 4,916

2015 3,772

2016 3,025

2017 and later 8,779

Total $33,832

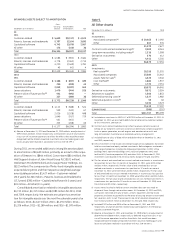

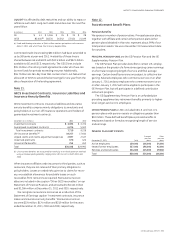

Note 8.

Goodwill and Other Intangible Assets

December 31 (In millions) 2011 2010

GOODWILL

GE $45,395 $36,880

GECS 27,230 27,508

Total $72,625 $64,388

December 31 (In millions) 2011 2010

OTHER INTANGIBLE ASSETS

GE

Intangible assets subject to amortization $10,317 $ 7,984

Indefinite-lived intangible assets 205 104

10,522 8,088

GECS

Intangible assets subject to amortization 1,546 1,883

Total $12,068 $ 9,971