GE 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.’

GE 2011 ANNUAL REPORT 49

Financial Resources and Liquidity

This discussion of fi nancial resources and liquidity addresses the

Statement of Financial Position, Liquidity and Borrowings, Debt

and Derivative Instruments, Guarantees and Covenants, the

Consolidated Statement of Changes in Shareowners’ Equity, the

Statement of Cash Flows, Contractual Obligations, and Variable

Interest Entities.

Overview of Financial Position

Major changes to our shareowners’ equity are discussed in the

Consolidated Statement of Changes in Shareowners’ Equity

section. In addition, other signifi cant changes to balances in our

Statement of Financial Position follow.

Statement of Financial Position

Because GE and GECS share certain signifi cant elements of their

Statements of Financial Position—property, plant and equipment

and borrowings, for example—the following discussion addresses

signifi cant captions in the “consolidated” statement. Within the

following discussions, however, we distinguish between GE and

GECS activities in order to permit meaningful analysis of each

individual consolidating statement.

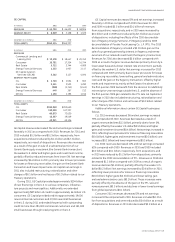

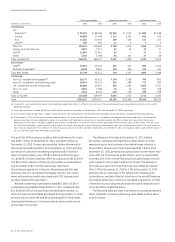

INVESTMENT SECURITIES comprise mainly investment grade debt

securities supporting obligations to annuitants, policyholders and

holders of guaranteed investment contracts (GICs) in our run-off

insurance operations and Trinity, and investment securities at our

treasury operations and investments held in our CLL business

collateralized by senior secured loans of high-quality, middle-

market companies in a variety of industries. The fair value of

investment securities increased to $47.4 billion at December 31,

2011 from $43.9 billion at December 31, 2010. Of the amount at

December 31, 2011, we held debt securities with an estimated fair

value of $46.3 billion, which included corporate debt securities,

asset-backed securities (ABS), residential mortgage-backed secu-

rities (RMBS) and commercial mortgage-backed securities (CMBS)

with estimated fair values of $26.1 billion, $5.0 billion, $2.6 billion

and $2.8 billion, respectively. Net unrealized gains on debt securi-

ties were $3.0 billion and $0.6 billion at December 31, 2011 and

December 31, 2010, respectively. This amount included unrealized

losses on corporate debt securities, ABS, RMBS and CMBS of

$0.6 billion, $0.2 billion, $0.3 billion and $0.2 billion, respectively, at

December 31, 2011, as compared with $0.4 billion, $0.2 billion,

$0.4 billion and $0.2 billion, respectively, at December 31, 2010.

We regularly review investment securities for impairment

using both qualitative and quantitative criteria. We presently

do not intend to sell the vast majority of our debt securities and

believe that it is not more likely than not that we will be required

to sell these securities that are in an unrealized loss position

before recovery of our amortized cost. We believe that the unreal-

ized loss associated with our equity securities will be recovered

within the foreseeable future.

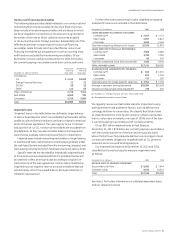

Our RMBS portfolio is collateralized primarily by pools of indi-

vidual, direct mortgage loans (a majority of which were originated

in 2006 and 2005), not other structured products such as collateral-

ized debt obligations. Substantially all of our RMBS are in a senior

position in the capital structure of the deals and more than 75% are

agency bonds or insured by Monoline insurers (on which we con-

tinue to place reliance). Of our total RMBS portfolio at December 31,

2011 and December 31, 2010, approximately $0.5 billion and

$0.7 billion, respectively, relate to residential subprime credit, pri-

marily supporting our guaranteed investment contracts. A majority

of exposure to residential subprime credit related to investment

securities backed by mortgage loans originated in 2006 and 2005.

Substantially all of the subprime RMBS were investment grade at

the time of purchase and approximately 70% have been subse-

quently downgraded to below investment grade.

Our CMBS portfolio is collateralized by both diversifi ed pools

of mortgages that were originated for securitization (conduit

CMBS) and pools of large loans backed by high quality properties

(large loan CMBS), a majority of which were originated in 2007 and

2006. Substantially all of the securities in our CMBS portfolio have

investment grade credit ratings and the vast majority of the secu-

rities are in a senior position in the capital structure.

Our ABS portfolio is collateralized by senior secured loans of

high-quality, middle-market companies in a variety of industries,

as well as a variety of diversifi ed pools of assets such as student

loans and credit cards. The vast majority of our ABS are in a senior

position in the capital structure of the deals. In addition, substan-

tially all of the securities that are below investment grade are in

an unrealized gain position.

If there has been an adverse change in cash fl ows for RMBS,

management considers credit enhancements such as Monoline

insurance (which are features of a specifi c security). In evaluating

the overall creditworthiness of the Monoline insurer (Monoline),

we use an analysis that is similar to the approach we use for cor-

porate bonds, including an evaluation of the suffi ciency of the

Monoline’s cash reserves and capital, ratings activity, whether

the Monoline is in default or default appears imminent, and the

potential for intervention by an insurance or other regulator.

Monolines provide credit enhancement for certain of our

investment securities, primarily RMBS and municipal securities.

The credit enhancement is a feature of each specifi c security that

guarantees the payment of all contractual cash fl ows, and is not

purchased separately by GE. The Monoline industry continues to

experience fi nancial stress from increasing delinquencies and

defaults on the individual loans underlying insured securities. We

continue to rely on Monolines with adequate capital and claims

paying resources. We have reduced our reliance on Monolines

that do not have adequate capital or have experienced regula-

tor intervention. At December 31, 2011, our investment securities

insured by Monolines on which we continue to place reliance

were $1.6 billion, including $0.3 billion of our $0.5 billion invest-

ment in subprime RMBS. At December 31, 2011, the unrealized loss