GE 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.’

58 GE 2011 ANNUAL REPORT

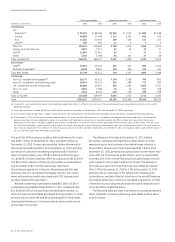

partially offset by amortization expense. Goodwill and intangible

assets were reduced by $19.6 billion and $2.6 billion in 2010 in

connection with our decision to transfer the assets of the NBCU

business to a joint venture. See Note 8.

ALL OTHER ASSETS comprise mainly real estate equity properties

and investments, equity and cost method investments, derivative

instruments and assets held for sale, and totaled $111.7 billion at

December 31, 2011, an increase of $17.4 billion, primarily related

to our investment in NBCU LLC ($18.0 billion), increases in the fair

value of derivative instruments ($4.6 billion) and our investment in

PTL ($1.2 billion), partially offset by a decrease in real estate equity

investments ($3.3 billion) and the sale of a substantial portion of

our equity investment in Garanti Bank ($3.0 billion). During 2011,

we recognized other-than-temporary impairments of cost and

equity method investments, excluding those related to real

estate, of $0.1 billion.

Included in other assets are Real Estate equity investments

of $23.9 billion and $27.2 billion at December 31, 2011 and

December 31, 2010, respectively. Our portfolio is diversifi ed, both

geographically and by asset type. We review the estimated values

of our commercial real estate investments at least annually, or

more frequently as conditions warrant. Based on the most recent

valuation estimates available, the carrying value of our Real Estate

investments exceeded their estimated value by about $2.6 bil-

lion. Commercial real estate valuations in 2011 showed signs of

improved stability and liquidity in certain markets, primarily in

the U.S.; however, the pace of improvement varies signifi cantly

by asset class and market. Accordingly, there continues to be

risk and uncertainty surrounding commercial real estate values.

Declines in estimated value of real estate below carrying amount

result in impairment losses when the aggregate undiscounted

cash fl ow estimates used in the estimated value measurement

are below the carrying amount. As such, estimated losses in the

portfolio will not necessarily result in recognized impairment

losses. During 2011, Real Estate recognized pre-tax impairments

of $1.2 billion in its real estate held for investment, which were

driven by declining cash fl ow projections for properties in certain

markets, most notably Japan and Spain, as well as properties

we have identifi ed for short-term disposition based upon our

updated outlook of local market conditions. Real Estate invest-

ments with undiscounted cash fl ows in excess of carrying value

of 0% to 5% at December 31, 2011 had a carrying value of $1.6 bil-

lion and an associated estimated unrealized loss of approximately

$0.2 billion. Continued deterioration in economic conditions or

prolonged market illiquidity may result in further impairments

being recognized.

Contract costs and estimated earnings refl ect revenues

earned in excess of billings on our long-term contracts to con-

struct technically complex equipment (such as power generation,

aircraft engines and aeroderivative units) and long-term prod-

uct maintenance or extended warranty arrangements. Our total

contract costs and estimated earnings balances at December 31,

2011 and 2010, were $9.0 billion and $8.1 billion, respectively,

refl ecting the timing of billing in relation to work performed,

as well as changes in estimates of future revenues and costs.

Our total contract costs and estimated earnings balance at

December 31, 2011, primarily related to customers in our Energy,

Aviation and Transportation businesses. Further information is

provided in the Critical Accounting Estimates section.

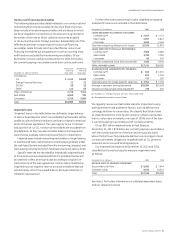

LIQUIDITY AND BORROWINGS

We maintain a strong focus on liquidity. At both GE and GECS we

manage our liquidity to help ensure access to suffi cient funding to

meet our business needs and fi nancial obligations throughout

business cycles.

Our liquidity and borrowing plans for GE and GECS are estab-

lished within the context of our annual fi nancial and strategic

planning processes. At GE, our liquidity and funding plans take

into account the liquidity necessary to fund our operating com-

mitments, which include primarily purchase obligations for

inventory and equipment, payroll and general expenses (including

pension funding). We also take into account our capital allocation

and growth objectives, including paying dividends, repurchas-

ing shares, investing in research and development and acquiring

industrial businesses. At GE, we rely primarily on cash generated

through our operating activities and also have historically main-

tained a commercial paper program that we regularly use to fund

operations in the U.S., principally within fi scal quarters.

GECS’ liquidity position is targeted to meet our obligations

under both normal and stressed conditions. GECS establishes a

funding plan annually that is based on the projected asset size

and cash needs of the Company, which over the past few years,

has included our strategy to reduce our ending net investment in

GE Capital. GECS relies on a diversifi ed source of funding, includ-

ing the unsecured term debt markets, the global commercial

paper markets, deposits, secured funding, retail funding prod-

ucts, bank borrowings and securitizations to fund its balance

sheet, in addition to cash generated through collection of princi-

pal, interest and other payments on our existing portfolio of loans

and leases to fund its operating and interest expense costs.

Our 2012 GECS funding plan anticipates repayment of princi-

pal on outstanding short-term borrowings, including the current

portion of its long-term debt ($82.7 billion at December 31, 2011,

which includes $2.7 billion of alternative and other funding),

through issuance of long-term debt and reissuance of com-

mercial paper, cash on hand, collections of fi nancing receivables

exceeding originations, dispositions, asset sales, and deposits

and other alternative sources of funding. Interest on borrowings

is primarily repaid through interest earned on existing fi nancing

receivables. During 2011, GECS earned interest income on fi nanc-

ing receivables of $22.4 billion, which more than offset interest

expense of $13.9 billion.

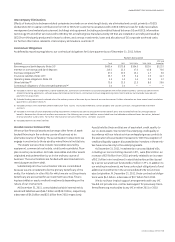

We maintain a detailed liquidity policy for GECS which includes

a requirement to maintain a contingency funding plan. The

liquidity policy defi nes GECS’ liquidity risk tolerance under dif-

ferent stress scenarios based on its liquidity sources and also

establishes procedures to escalate potential issues. We actively

monitor GECS’ access to funding markets and its liquidity profi le

through tracking external indicators and testing various stress

scenarios. The contingency funding plan provides a framework

for handling market disruptions and establishes escalation proce-

dures in the event that such events or circumstances arise.