GE 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2011 ANNUAL REPORT 117

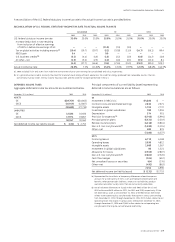

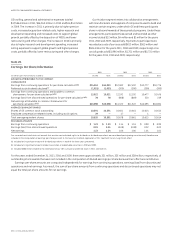

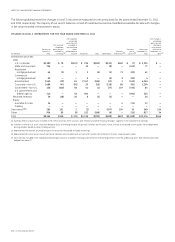

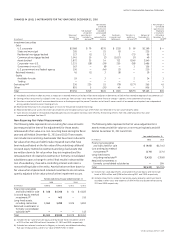

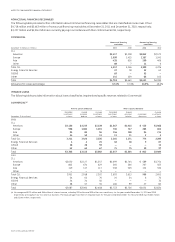

CHANGES IN LEVEL 3 INSTRUMENTS FOR THE YEAR ENDED DECEMBER 31, 2010

(In millions)

Balance at

January 1,

2010 (a)

Net realized/

unrealized

gains (losses)

included in

earnings (b)

Net realized/

unrealized

gains (losses)

included in

accumulated

other

comprehensive

income

Purchases,

Issuances and

Settlements

Transfers in

and/or out

of Level 3 (c)

Balance at

December 31,

2010

Net change in

unrealized

gains (losses)

relating to

instruments

still held at

December 31,

2010 (d)

Investment securities

Debt

U.S. corporate $3,068 $ 79 $276 $ (215) $ (9) $3,199 $ —

State and municipal 205 — 25 (5) — 225 —

Residential mortgage-backed 123 (1) 13 2 (71) 66 —

Commercial mortgage-backed 1,041 30 (2) (1,017) (3) 49 —

Asset-backed 1,872 25 14 733 (104) 2,540 —

Corporate—non-U.S. 1,331 (38) (39) 250 (18) 1,486 —

Government—non-U.S. 163 — (8) — 1 156 —

U.S. government and federal agency 256 — (44) (2) — 210 —

Retained interests 45 (1) 3 (8) — 39 —

Equity

Available-for-sale 19 — 3 — 2 24 1

Trading ———————

Derivatives (e)(f) 236 220 15 (79) (127) 265 41

Other 891 5 (30) 40 — 906 3

Total $9,250 $319 $226 $ (301) $(329) $9,165 $45

(a) Included $1,015 million in debt securities, a reduction in retained interests of $8,782 million and a reduction in derivatives of $365 million related to adoption of ASU 2009-16 & 17.

(b) Earnings effects are primarily included in the “GECS revenues from services” and “Interest and other financial charges” captions in the Statement of Earnings.

(c) Transfers in and out of Level 3 are considered to occur at the beginning of the period. Transfers out of Level 3 were a result of increased use of quotes from independent

pricing vendors based on recent trading activity.

(d) Represented the amount of unrealized gains or losses for the period included in earnings.

(e) Represented derivative assets net of derivative liabilities and included cash accruals of $9 million not reflected in the fair value hierarchy table.

(f) Gains (losses) included in net realized/unrealized gains (losses) included in earnings were offset by the earnings effects from the underlying items that were

economically hedged. See Note 22.

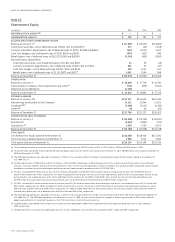

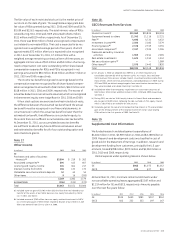

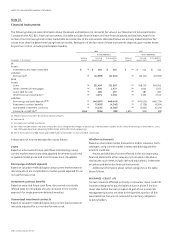

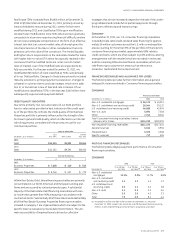

Non-Recurring Fair Value Measurements

The following table represents non-recurring fair value amounts

(as measured at the time of the adjustment) for those assets

remeasured to fair value on a non-recurring basis during the fi scal

year and still held at December 31, 2011 and 2010. These assets

can include loans and long-lived assets that have been reduced to

fair value when they are held for sale, impaired loans that have

been reduced based on the fair value of the underlying collateral,

cost and equity method investments and long-lived assets that

are written down to fair value when they are impaired and the

remeasurement of retained investments in formerly consolidated

subsidiaries upon a change in control that results in deconsolida-

tion of a subsidiary, if we sell a controlling interest and retain a

noncontrolling stake in the entity. Assets that are written down to

fair value when impaired and retained investments are not subse-

quently adjusted to fair value unless further impairment occurs.

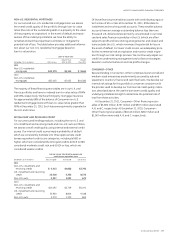

Remeasured during the year ended December 31

2011 2010

(In millions) Level 2 Level 3 Level 2 Level 3

Financing receivables

and loans held for sale $ 158 $5,348 $ 54 $ 6,833

Cost and equity method

investments (a) — 403 — 510

Long-lived assets,

including real estate 1,343 3,288 1,025 5,811

Retained investments in

formerly consolidated

subsidiaries (b) ——— 113

Total $1,501 $9,039 $1,079 $13,267

(a) Includes the fair value of private equity and real estate funds included in Level 3

of $123 million and $296 million at December 31, 2011 and 2010, respectively.

(b) Excluded our retained investment in Regency, a formerly consolidated subsidiary,

that was remeasured to a Level 1 fair value of $549 million in 2010.

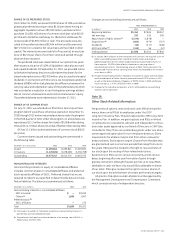

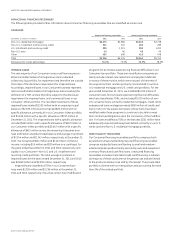

The following table represents the fair value adjustments to

assets measured at fair value on a non-recurring basis and still

held at December 31, 2011 and 2010.

Year ended December 31

(In millions) 2011 2010

Financing receivables

and loans held for sale $ (925) $(1,745)

Cost and equity method

investments (a) (274) (274)

Long-lived assets,

including real estate (b) (1,431) (2,958)

Retained investments in

formerly consolidated subsidiaries —184

Total $(2,630) $(4,793)

(a) Includes fair value adjustments associated with private equity and real estate

funds of $(24) million and $(198) million during 2011 and 2010, respectively.

(b) Includes impairments related to real estate equity properties and investments

recorded in other costs and expenses of $976 million and $2,089 million during

2011 and 2010, respectively.