GE 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

’

GE 2011 ANNUAL REPORT 47

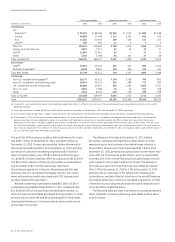

Corporate items and eliminations revenues of $7.6 billion in 2011

decreased $11.5 billion as a $14.9 billion reduction in revenues

from NBCU LLC operations resulting from the deconsolidation of

NBCU effective January 28, 2011 and $0.3 billion of lower rev-

enues from other disposed businesses were partially offset by a

$3.7 billion pre-tax gain related to the NBCU transaction.

Corporate items and eliminations costs decreased by $0.7 billion

as $3.6 billion of higher gains from disposed businesses, primarily

the NBCU transaction, and a $0.6 billion decrease in restructuring,

rationalization, acquisition-related and other charges were par-

tially offset by $1.4 billion of higher costs of our principal

retirement plans, $1.4 billion of lower earnings from NBCU/NBCU

LLC operations and a $0.6 billion increase in research and devel-

opment spending and global corporate costs.

Certain amounts included in Corporate items and eliminations

cost are not allocated to GE operating segments because they are

excluded from the measurement of their operating performance

for internal purposes. For 2011, these included $0.4 billion at

Energy Infrastructure for acquisition-related costs and $0.4 billion

at Healthcare, $0.3 billion at Energy Infrastructure, $0.2 billion at

Aviation and $0.1 billion at both Home & Business Solutions and

Transportation, primarily for technology and product develop-

ment costs and restructuring, rationalization and other charges.

In 2011, underabsorbed corporate overhead and other costs

was fl at compared with 2010, as increased costs at our global

research centers and global corporate costs were offset by lower

restructuring and other charges (including acquisition-related

costs) of $0.6 billion. In 2010, underabsorbed corporate overhead

and other costs increased by $0.1 billion as compared with 2009,

as increased costs at our global research centers and staff costs

and lower income from operations of disposed businesses were

partially offset by lower restructuring and other charges (includ-

ing environmental remediation costs related to the Hudson River

dredging project) of $0.6 billion.

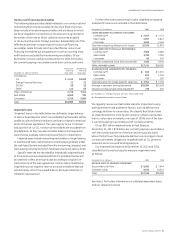

DISCONTINUED OPERATIONS

(In millions) 2011 2010 2009

Earnings (loss) from discontinued

operations, net of taxes $77 $(873) $219

Discontinued operations primarily comprised BAC, GE Money

Japan, WMC, Consumer RV Marine, Consumer Mexico, Consumer

Singapore and Australian Home Lending. Associated results of

operations, fi nancial position and cash fl ows are separately

reported as discontinued operations for all periods presented.

In 2011, earnings from discontinued operations, net of taxes,

included a $0.3 billion gain related to the sale of Consumer

Singapore and earnings from operations at Australian Home

Lending of $0.1 billion, partially offset by incremental reserves for

excess interest claims related to our loss-sharing arrangement

on the 2008 sale of GE Money Japan of $0.2 billion and the loss on

the sale of Australian Home Lending of $0.1 billion.

In 2010, loss from discontinued operations, net of taxes, primar-

ily refl ected incremental reserves for excess interest claims related

to our loss-sharing arrangement on the 2008 sale of GE Money

Japan of $1.7 billion and estimated after-tax losses of $0.2 billion

and $0.1 billion on the planned sales of Consumer Mexico and

Consumer RV Marine, respectively, partially offset by an after-tax

gain on the sale of BAC of $0.8 billion and earnings from operations

at Consumer Mexico of $0.2 billion and at BAC of $0.1 billion.

In 2009, earnings from discontinued operations, net of taxes,

primarily refl ected earnings from operations of BAC of $0.3 billion,

Australian Home Lending of $0.1 billion and Consumer Mexico

of $0.1 billion, partially offset by incremental reserves for excess

interest claims related to our loss-sharing arrangement on the

2008 sale of GE Money Japan of $0.2 billion and loss from opera-

tions at Consumer RV Marine of $0.1 billion.

For additional information related to discontinued operations,

see Note 2.

Geographic Operations

Our global activities span all geographic regions and primarily

encompass manufacturing for local and export markets, import

and sale of products produced in other regions, leasing of aircraft,

sourcing for our plants domiciled in other global regions and

provision of fi nancial services within these regional economies.

Thus, when countries or regions experience currency and/or

economic stress, we often have increased exposure to certain

risks, but also often have new profi t opportunities. New profi t

opportunities include, among other things, more opportunities

for expansion of industrial and fi nancial services activities

through purchases of companies or assets at reduced prices and

lower U.S. debt fi nancing costs.

Revenues are classifi ed according to the region to which prod-

ucts and services are sold. For purposes of this analysis, the U.S.

is presented separately from the remainder of the Americas. We

classify certain operations that cannot meaningfully be associated

with specifi c geographic areas as “Other Global” for this purpose.

GEOGRAPHIC REVENUES

(In billions) 2011 2010 2009

U.S. $ 69.8 $ 75.1 $ 75.8

Europe 29.1 31.0 36.3

Pacific Basin 23.2 20.8 19.3

Americas 13.2 11.7 11.3

Middle East and Africa 9.8 9.0 9.8

Other Global 2.2 2.0 1.9

Total $147.3 $149.6 $154.4

Global revenues increased 4% to $77.5 billion in 2011, compared

with $74.5 billion and $78.6 billion in 2010 and 2009, respectively.

Global revenues to external customers as a percentage of con-

solidated revenues were 53% in 2011, compared with 50% in