GE 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100 GE 2011 ANNUAL REPORT

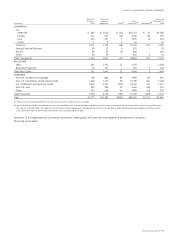

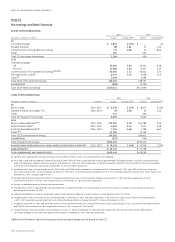

Note 10.

Borrowings and Bank Deposits

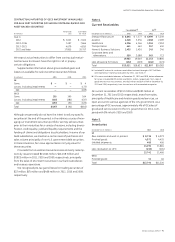

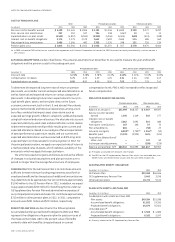

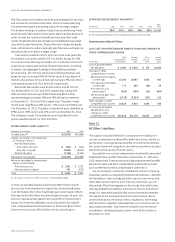

SHORT-TERM BORROWINGS

2011 2010

December 31 (Dollars in millions) Amount Average rate (a) Amount Average rate (a)

GE

Commercial paper $ 1,801 0.13% $ — —%

Payable to banks 88 1.81 73 2.44

Current portion of long-term borrowings 41 4.89 21 8.35

Other 254 362

Total GE short-term borrowings 2,184 456

GECS

Commercial paper

U.S. 33,591 0.23 32,547 0.28

Non-U.S. 10,569 1.63 9,497 1.42

Current portion of long-term borrowings (b)(c)(d)(f) 82,650 2.72 65,612 3.24

GE Interest Plus notes (e) 8,474 1.32 9,058 1.59

Other (d) 1,049 2,083

Total GECS short-term borrowings 136,333 118,797

ELIMINATIONS (906) (1,294)

Total short-term borrowings $137,611 $117,959

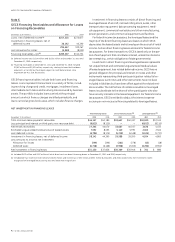

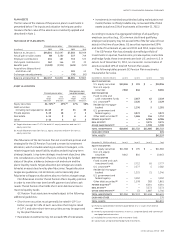

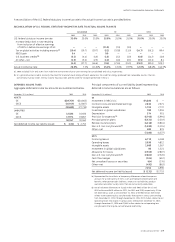

LONG-TERM BORROWINGS

2011 2010

December 31 (Dollars in millions) Maturities Amount Average rate (a) Amount Average rate (a)

GE

Senior notes 2013–2017 $ 8,976 5.21% $ 8,971 5.21%

Payable to banks, principally U.S. 2013–2023 18 2.89 25 3.10

Other 411 660

Total GE long-term borrowings 9,405 9,656

GECS

Senior unsecured notes (b)(c) 2013–2055 210,154 3.49 262,789 3.29

Subordinated notes (f) 2014–2037 4,862 3.42 2,575 5.48

Subordinated debentures (g) 2066–2067 7,215 6.66 7,298 6.63

Other (d)(h) 12,160 11,745

Total GECS long-term borrowings 234,391 284,407

ELIMINATIONS (337) (740)

Total long-term borrowings $243,459 $293,323

NON-RECOURSE BORROWINGS OF CONSOLIDATED SECURITIZATION ENTITIES (i) 2012–2022 $ 29,258 1.40% $ 30,018 1.20%

BANK DEPOSITS

(j) $ 43,115 $ 37,298

TOTAL BORROWINGS AND BANK DEPOSITS $453,443 $478,598

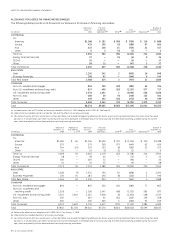

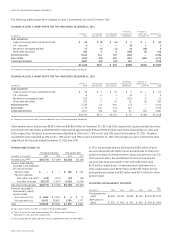

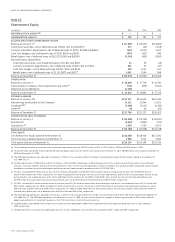

(a) Based on year-end balances and year-end local currency effective interest rates, including the effects from hedging.

(b) GECC had issued and outstanding $35,040 million and $53,495 million of senior, unsecured debt that was guaranteed by the Federal Deposit Insurance Corporation (FDIC)

under the Temporary Liquidity Guarantee Program at December 31, 2011 and 2010, respectively. Of the above amounts, $35,040 million and $18,455 million are included in

current portion of long-term borrowings at December 31, 2011 and 2010, respectively.

(c) Included in total long-term borrowings were $1,845 million and $2,395 million of obligations to holders of GICs at December 31, 2011 and 2010, respectively. If the long-

term credit rating of GECC were to fall below AA-/Aa3 or its short-term credit rating were to fall below A-1+/P-1, GECC could be required to provide up to $1,718 million as of

December 31, 2011, to repay holders of GICs.

(d) Included $8,538 million and $11,135 million of funding secured by real estate, aircraft and other collateral at December 31, 2011 and 2010, respectively, of which

$2,983 million and $4,671 million is non-recourse to GECS at December 31, 2011 and 2010, respectively.

(e) Entirely variable denomination floating-rate demand notes.

(f) Included $417 million of subordinated notes guaranteed by GE at both December 31, 2011 and 2010, of which $117 million is included in current portion of long-term

borrowings at December 31, 2011.

(g) Subordinated debentures receive rating agency equity credit and were hedged at issuance to the U.S. dollar equivalent of $7,725 million.

(h) Included $1,955 million and $1,984 million of covered bonds at December 31, 2011 and 2010, respectively. If the short-term credit rating of GECC were reduced below

A-1/P-1, GECC would be required to partially cash collateralize these bonds in an amount up to $727 million at December 31, 2011.

(i) Included at December 31, 2011 and 2010 were $10,714 million and $10,499 million of current portion of non-recourse borrowings of CSEs, respectively, and $18,544 million

and $19,519 million of long-term non-recourse borrowings of CSEs, respectively. See Note 18.

(j) Included $16,281 million and $18,781 million of deposits in non-U.S. banks at December 31, 2011 and 2010, respectively, and $17,201 million and $11,606 million of

certificates of deposits with maturities greater than one year at December 31, 2011 and 2010, respectively.

Additional information about borrowings and associated swaps can be found in Note 22.