GE 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.98 GE 2011 ANNUAL REPORT

in the forecasts of future cash fl ows, are refl ected in the selec-

tion of the discount rate. Equally important, under this approach,

reasonably likely scenarios and associated sensitivities can be

developed for alternative future states that may not be refl ected

in an observable market price. A market approach allows for

comparison to actual market transactions and multiples. It can

be somewhat more limited in its application because the popula-

tion of potential comparables is often limited to publicly-traded

companies where the characteristics of the comparative business

and ours can be signifi cantly different, market data is usually not

available for divisions within larger conglomerates or non-public

subsidiaries that could otherwise qualify as comparable, and the

specifi c circumstances surrounding a market transaction (e.g.,

synergies between the parties, terms and conditions of the trans-

action, etc.) may be different or irrelevant with respect to our

business. It can also be diffi cult, under certain market conditions,

to identify orderly transactions between market participants in

similar businesses. We assess the valuation methodology based

upon the relevance and availability of the data at the time we per-

form the valuation and weight the methodologies appropriately.

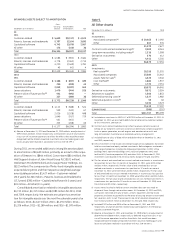

We performed our annual impairment test of goodwill for all

of our reporting units in the third quarter using data as of July 1,

2011. The impairment test consists of two steps: in step one, the

carrying value of the reporting unit is compared with its fair value;

in step two, which is applied when the carrying value is more

than its fair value, the amount of goodwill impairment, if any, is

derived by deducting the fair value of the reporting unit’s assets

and liabilities from the fair value of its equity, and comparing that

amount with the carrying amount of goodwill. In performing the

valuations, we used cash fl ows that refl ected management’s

forecasts and discount rates that included risk adjustments con-

sistent with the current market conditions. Based on the results

of our step one testing, the fair values of each of the GE industrial

reporting units and the CLL, Consumer, Energy Financial Services

and GECAS reporting units exceeded their carrying values; there-

fore, the second step of the impairment test was not required to

be performed and no goodwill impairment was recognized.

Our Real Estate reporting unit had a goodwill balance of

$1,001 million at December 31, 2011. As of July 1, 2011, the carry-

ing amount exceeded the estimated fair value of our Real Estate

reporting unit by approximately $0.7 billion. The estimated fair

value of the Real Estate reporting unit is based on a number of

assumptions about future business performance and investment,

including loss estimates for the existing fi nance receivable and

investment portfolio, new debt origination volume and margins,

and stabilization of the real estate market allowing for sales of real

estate investments at normalized margins. Our assumed discount

rate was 11.25% and was derived by applying a capital asset pric-

ing model and corroborated using equity analyst research reports

and implied cost of equity based on forecasted price to earnings

per share multiples for similar companies. Given the volatility and

uncertainty in the current commercial real estate environment,

there is uncertainty about a number of assumptions upon which

the estimated fair value is based. Different loss estimates for the

existing portfolio, changes in the new debt origination volume

and margin assumptions, changes in the expected pace of the

commercial real estate market recovery, or changes in the equity

return expectation of market participants may result in changes

in the estimated fair value of the Real Estate reporting unit.

Based on the results of the step one testing, we performed the

second step of the impairment test described above as of July 1,

2011. Based on the results of the second step analysis for the Real

Estate reporting unit, the estimated implied fair value of goodwill

exceeded the carrying value of goodwill by approximately $3.9 bil-

lion. Accordingly, no goodwill impairment was required. In the

second step, unrealized losses in an entity’s assets have the effect of

increasing the estimated implied fair value of goodwill. The results

of the second step analysis were attributable to several factors.

The primary driver was the excess of the carrying value over the

estimated fair value of our Real Estate Equity Investments, which

approximated $4.1 billion at that time. Other drivers for the favor-

able outcome include the unrealized losses in the Real Estate fi nance

receivable portfolio and the fair value premium on the Real Estate

reporting unit allocated debt. The results of the second step analy-

sis are highly sensitive to these measurements, as well as the key

assumptions used in determining the estimated fair value of the Real

Estate reporting unit.

Estimating the fair value of reporting units requires the use of

estimates and signifi cant judgments that are based on a number

of factors including actual operating results. If current conditions

persist longer or deteriorate further than expected, it is reason-

ably possible that the judgments and estimates described above

could change in future periods.