GE 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.’

GE 2011 ANNUAL REPORT 51

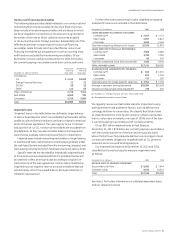

INVENTORIES for GE totaled to $13.7 billion at December 31, 2011,

up $2.3 billion from the end of 2010. This increase refl ected higher

inventories at Energy Infrastructure, partially due to acquisitions

($1.0 billion), Aviation and Transportation. GE inventory turnover

was 7.0 and 7.2 in 2011 and 2010, respectively. See Note 5.

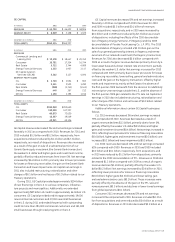

FINANCING RECEIVABLES is our largest category of assets and

represents one of our primary sources of revenues. Our portfolio

of fi nancing receivables is diverse and not directly comparable to

major U.S. banks. A discussion of the quality of certain elements

of the fi nancing receivables portfolio follows.

Our consumer portfolio is largely non-U.S. and primarily com-

prises mortgage, sales fi nance, auto and personal loans in various

European and Asian countries. Our U.S. consumer fi nancing

receivables comprise 16% of our total portfolio. Of those, approxi-

mately 65% relate primarily to credit cards, which are often

subject to profi t and loss-sharing arrangements with the retailer

(the results of which are refl ected in revenues), and have a smaller

average balance and lower loss severity as compared to bank

cards. The remaining 35% are sales fi nance receivables, which

provide electronics, recreation, medical and home improvement

fi nancing to customers. In 2007, we exited the U.S. mortgage

business and we have no U.S. auto or student loans.

Our commercial portfolio primarily comprises senior, secured

positions with comparatively low loss history. The secured receiv-

ables in this portfolio are collateralized by a variety of asset

classes, which for our CLL business primarily include: industrial-

related facilities and equipment, vehicles, corporate aircraft, and

equipment used in many industries, including the construction,

manufacturing, transportation, media, communications, entertain-

ment and healthcare industries. The portfolios in our Real Estate,

GECAS and Energy Financial Services businesses are collateral-

ized by commercial real estate, commercial aircraft and operating

assets in the global energy industry, respectively. We are in a

secured position for substantially all of our commercial portfolio.

Losses on fi nancing receivables are recognized when they are

incurred, which requires us to make our best estimate of probable

losses inherent in the portfolio. The method for calculating the

best estimate of losses depends on the size, type and risk char-

acteristics of the related fi nancing receivable. Such an estimate

requires consideration of historical loss experience, adjusted for

current conditions, and judgments about the probable effects of

relevant observable data, including present economic conditions

such as delinquency rates, fi nancial health of specifi c custom-

ers and market sectors, collateral values (including housing price

indices as applicable), and the present and expected future lev-

els of interest rates. The underlying assumptions, estimates and

assessments we use to provide for losses are updated periodi-

cally to refl ect our view of current conditions. Changes in such

estimates can signifi cantly affect the allowance and provision for

losses. It is possible to experience credit losses that are different

from our current estimates.

Our risk management process includes standards and policies

for reviewing major risk exposures and concentrations, and eval-

uates relevant data either for individual loans or fi nancing leases,

or on a portfolio basis, as appropriate.

Loans acquired in a business acquisition are recorded at fair

value, which incorporates our estimate at the acquisition date

of the credit losses over the remaining life of the portfolio. As a

result, the allowance for losses is not carried over at acquisition.

This may have the effect of causing lower reserve coverage ratios

for those portfolios.

For purposes of the discussion that follows, “delinquent” receiv-

ables are those that are 30 days or more past due based on their

contractual terms; and “nonearning” receivables are those that

are 90 days or more past due (or for which collection is otherwise

doubtful). Nonearning receivables exclude loans purchased at a

discount (unless they have deteriorated post acquisition). Under

FASB ASC 310, Receivables, these loans are initially recorded at

fair value and accrete interest income over the estimated life of

the loan based on reasonably estimable cash fl ows even if the

underlying loans are contractually delinquent at acquisition. In

addition, nonearning receivables exclude loans that are paying on

a cash accounting basis but classifi ed as nonaccrual and impaired.

“Nonaccrual” fi nancing receivables include all nonearning receiv-

ables and are those on which we have stopped accruing interest.

We stop accruing interest at the earlier of the time at which col-

lection of an account becomes doubtful or the account becomes

90 days past due. Recently restructured fi nancing receivables are

not considered delinquent when payments are brought current

according to the restructured terms, but may remain classifi ed as

nonaccrual until there has been a period of satisfactory payment

performance by the borrower and future payments are reasonably

assured of collection.

Further information on the determination of the allowance

for losses on fi nancing receivables and the credit quality and cat-

egorization of our fi nancing receivables is provided in the Critical

Accounting Estimates section and Notes 1, 6 and 23.