GE 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 GE 2011 ANNUAL REPORT

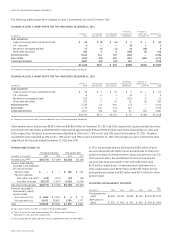

Plan fi duciaries set investment policies and strategies for the trust

and oversee its investment allocation, which includes selecting

investment managers and setting long-term strategic targets.

The primary strategic investment objectives are balancing invest-

ment risk and return and monitoring the plan’s liquidity position in

order to meet the near term benefi t payment and other cash

needs. Target allocation percentages are established at an asset

class level by plan fi duciaries. Target allocation ranges are guide-

lines, not limitations, and occasionally plan fi duciaries will approve

allocations above or below a target range.

Trust assets invested in short-term securities must generally

be invested in securities rated A-1/P-1 or better, except for 15%

of such securities that may be rated A-2/P-2 and other short-term

securities as may be approved by the plan fi duciaries. According

to statute, the aggregate holdings of all qualifying employer

securities (e.g., GE common stock) and qualifying employer real

property may not exceed 10% of the fair value of trust assets at

the time of purchase. GE securities represented 4.7% and 4.5% of

trust assets at year-end 2011 and 2010, respectively.

Retiree life plan assets were $1,004 million and $1,125 mil-

lion at December 31, 2011 and 2010, respectively. Equity and

debt securities amounting to $760 million and $942 million

represented approximately 74% and 78% of total investments

at December 31, 2011 and 2010, respectively. The plans’ invest-

ments were classifi ed as 32% Level 1, 42% Level 2 and 26% Level

3 at December 31, 2011. The plans’ investments were classifi ed as

39% Level 1, 39% Level 2 and 22% Level 3 at December 31, 2010.

The changes in Level 3 investments were insignifi cant for the

years ended December 31, 2011 and 2010.

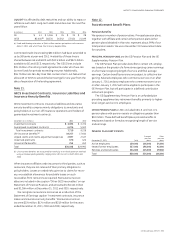

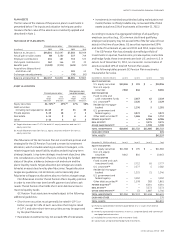

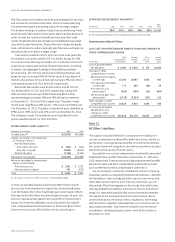

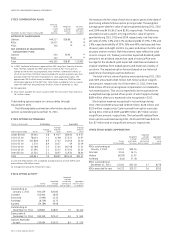

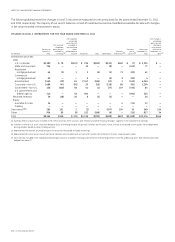

RETIREE BENEFIT ASSET (LIABILITY)

December 31 (In millions) 2011 2010

Funded status (a) $(12,052) $(10,885)

Liability recorded in the Statement

of Financial Position

Retiree health plans

Due within one year $ (602) $ (644)

Due after one year (9,684) (8,922)

Retiree life plans (1,766) (1,319)

Net liability recognized $(12,052) $(10,885)

Amounts recorded in shareowners’

equity (unamortized)

Prior service cost $ 2,901 $ 3,523

Net actuarial loss (gain) 401 (671)

Total $ 3,302 $ 2,852

(a) Fair value of assets less APBO, as shown in the preceding tables.

In 2012, we estimate that we will amortize $575 million of prior

service cost from shareowners’ equity into retiree benefi t plans

cost. Estimated 2012 retiree health plan gain amortization offsets

the expected amortization of retiree life plans losses. As such, the

amount of actuarial loss (gain) to be recycled from shareowners’

equity into retiree benefi t plans cost is expected to be insignifi -

cant. Comparable amortized amounts in 2011 were $647 million

of prior service cost and $110 million of net actuarial gains.

ESTIMATED FUTURE BENEFIT PAYMENTS

(a)

(In millions) 2012 2013 2014 2015 2016

2017–

2021

$800 $815 $830 $840 $840 $4,180

(a) Net of expected Medicare Part D subsidy of about $5 million annually.

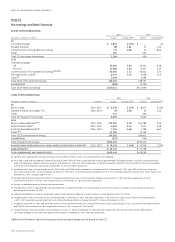

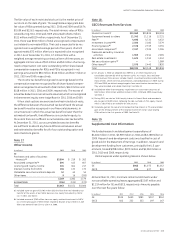

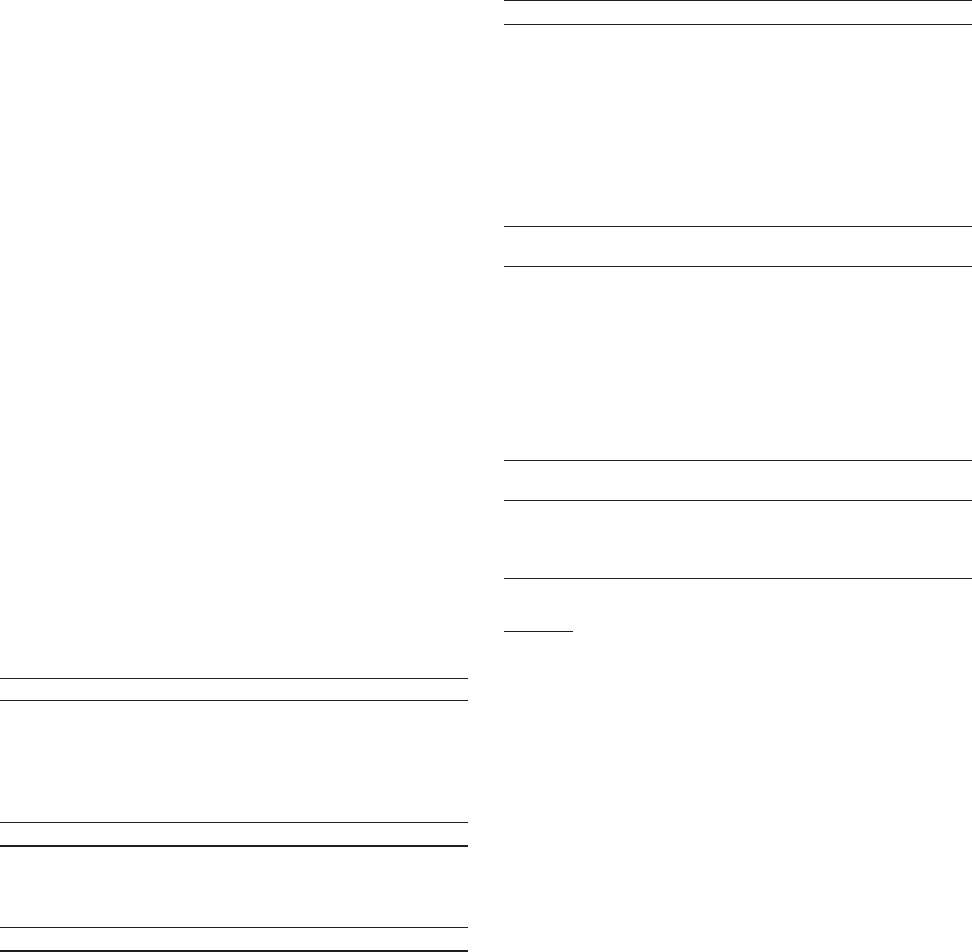

Postretirement Benefit Plans

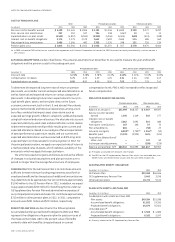

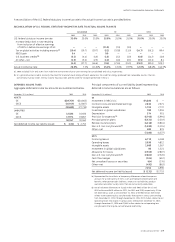

2011 COST OF POSTRETIREMENT BENEFIT PLANS AND CHANGES IN

OTHER COMPREHENSIVE INCOME

Total

postretirement

(In millions) benefit plans

Principal

pension

plans

Other

pension

plans

Retiree

benefit

plans

Cost of postretirement

benefit plans $ 4,084 $ 2,446 $ 378 $1,260

Changes in other

comprehensive income

Net actuarial loss (gain)—

current year 13,293 10,655 1,676 962

Prior service cost (credit)—

current year 771 804 (58) 25

Prior service cost

amortization (854) (194) (13) (647)

Net actuarial gain (loss)

amortization (2,376) (2,335) (151) 110

Total changes in other

comprehensive income 10,834 8,930 1,454 450

Cost of postretirement

benefit plans and

changes in other

comprehensive income $14,918 $11,376 $1,832 $1,710

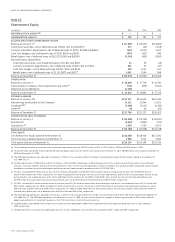

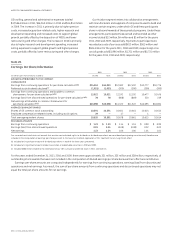

Note 13.

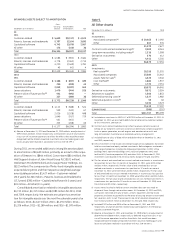

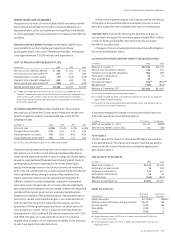

All Other Liabilities

This caption includes liabilities for various items including non-

current compensation and benefi ts, deferred income, interest on

tax liabilities, unrecognized tax benefi ts, environmental remedia-

tion, asset retirement obligations, derivative instruments, product

warranties and a variety of sundry items.

Accruals for non-current compensation and benefi ts amounted

to $39,430 million and $25,356 million at December 31, 2011 and

2010, respectively. These amounts include postretirement benefi ts,

pension accruals, and other compensation and benefi t accruals

such as deferred incentive compensation. See Note 12.

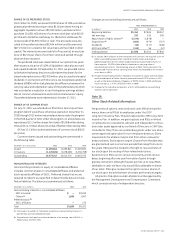

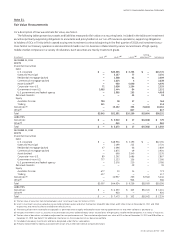

We are involved in numerous remediation actions to clean up

hazardous wastes as required by federal and state laws. Liabilities

for remediation costs exclude possible insurance recoveries and,

when dates and amounts of such costs are not known, are not

discounted. When there appears to be a range of possible costs

with equal likelihood, liabilities are based on the low end of such

range. It is reasonably possible that our environmental remedia-

tion exposure will exceed amounts accrued. However, due to

uncertainties about the status of laws, regulations, technology

and information related to individual sites, such amounts are not

reasonably estimable. Total reserves related to environmental

remediation, including asbestos claims, were $3,361 million at

December 31, 2011.