GE 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

’

52 GE 2011 ANNUAL REPORT

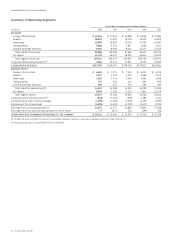

Financing receivables Nonearning receivables Allowance for losses

December 31 (In millions) 2011 2010 2011 2010 2011 2010

COMMERCIAL

CLL

Americas (a) $ 80,505 $ 88,558 $1,862 $ 2,573 $ 889 $1,288

Europe 36,899 37,498 1,167 1,241 400 429

Asia 11,635 11,943 269 406 157 222

Other (a) 436 664 11 646

Total CLL 129,475 138,663 3,309 4,226 1,450 1,945

Energy Financial Services 5,912 7,011 22 62 26 22

GECAS 11,901 12,615 55 —17 20

Other 1,282 1,788 65 102 37 58

Total Commercial 148,570 160,077 3,451 4,390 1,530 2,045

REAL ESTATE

Debt (b) 24,501 30,249 541 961 949 1,292

Business Properties (c) 8,248 9,962 249 386 140 196

Total Real Estate 32,749 40,211 790 1,347 1,089 1,488

CONSUMER

Non-U.S. residential mortgages (d) 36,170 40,011 3,349 3,738 706 803

Non-U.S. installment and revolving credit 18,544 20,132 263 289 717 937

U.S. installment and revolving credit 46,689 43,974 990 1,201 2,008 2,333

Non-U.S. auto 5,691 7,558 43 46 101 168

Other 7,244 8,304 419 478 199 259

Total Consumer 114,338 119,979 5,064 5,752 3,731 4,500

Total $295,657 $320,267 $9,305 $11,489 $6,350 $8,033

(a) During 2011, we transferred our Railcar lending and leasing portfolio from CLL Other to CLL Americas. Prior-period amounts were reclassified to conform to the current-

period presentation.

(b) Financing receivables included $0.1 billion and $0.2 billion of construction loans at December 31, 2011 and December 31, 2010, respectively.

(c) Our Business Properties portfolio is underwritten primarily by the credit quality of the borrower and secured by tenant and owner-occupied commercial properties.

(d) At December 31, 2011, net of credit insurance, approximately 25% of our secured Consumer non-U.S. residential mortgage portfolio comprised loans with introductory,

below market rates that are scheduled to adjust at future dates; with high loan-to-value ratios at inception (greater than 90%); whose terms permitted interest-only

payments; or whose terms resulted in negative amortization. At origination, we underwrite loans with an adjustable rate to the reset value. Of these loans, 79% are in our

U.K. and France portfolios, which comprise mainly loans with interest-only payments and introductory below market rates, have a delinquency rate of 15%, have a loan-to-

value ratio at origination of 76% and have re-indexed loan-to-value ratios of 84% and 56%, respectively. At December 31, 2011, 6% (based on dollar values) of these loans in

our U.K. and France portfolios have been restructured.

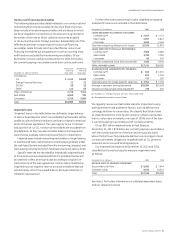

The portfolio of fi nancing receivables, before allowance for losses,

was $295.7 billion at December 31, 2011, and $320.3 billion at

December 31, 2010. Financing receivables, before allowance for

losses, decreased $24.6 billion from December 31, 2010, primarily

as a result of collections exceeding originations ($14.9 billion)

(which includes sales), write-offs ($7.2 billion) and the stronger

U.S. dollar ($1.5 billion), partially offset by acquisitions ($3.6 billion).

The $24.6 billion decline in fi nancing receivables excludes fi nanc-

ing receivables of $11.5 billion, previously reported in

Discontinued operations or Assets of businesses held for sale

(primarily non-U.S. residential mortgages and non-U.S. install-

ment and revolving credit) associated with 2011 business and

portfolio dispositions. See Note 2.

Related nonearning receivables totaled $9.3 billion (3.1% of

outstanding receivables) at December 31, 2011, compared with

$11.5 billion (3.6% of outstanding receivables) at December 31,

2010. Nonearning receivables decreased from December 31, 2010,

primarily due to write-offs and discounted payoffs in Real Estate,

improved performance in Commercial and improvements in our

entry rates in Consumer.

The allowance for losses at December 31, 2011 totaled

$6.4 billion compared with $8.0 billion at December 31, 2010,

representing our best estimate of probable losses inherent in

the portfolio. Allowance for losses decreased $1.7 billion from

December 31, 2010, primarily because provisions were lower than

write-offs, net of recoveries by $1.5 billion, which is attributable

to a reduction in the overall fi nancing receivables balance and an

improvement in the overall credit environment. The allowance

for losses as a percent of total fi nancing receivables decreased

from 2.5% at December 31, 2010 to 2.1% at December 31, 2011

primarily due to a decrease in the allowance for losses as dis-

cussed above, partially offset by a decline in the overall fi nancing

receivables balance as collections exceeded originations. Further

information surrounding the allowance for losses related to each

of our portfolios is detailed below.

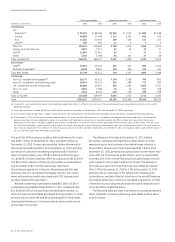

The following table provides information surrounding selected

ratios related to nonearning fi nancing receivables and the allow-

ance for losses.