GE 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.80 GE 2011 ANNUAL REPORT

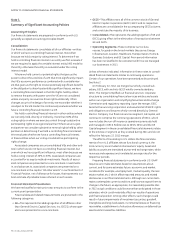

forecasts. In addition to evaluating these factors, we deem a Real

Estate loan to be impaired if its projected loan-to-value ratio at

maturity is in excess of 100%, even if the loan is currently pay-

ing in accordance with its contractual terms. The allowance for

losses on Real Estate fi nancing receivables is based on a dis-

counted cash fl ow methodology, except in situations where the

loan is within 24 months of maturity or foreclosure is deemed

probable, in which case reserves are based on collateral values.

If foreclosure is deemed probable or if repayment is dependent

solely on the sale of collateral, we also include estimated selling

costs in our reserve. Collateral values for our Real Estate loans are

determined based upon internal cash fl ow estimates discounted

at an appropriate rate and corroborated by external appraisals,

as appropriate. Collateral valuations are updated at least annu-

ally, or more frequently for higher risk loans. A majority of our Real

Estate impaired loans have specifi c reserves that are determined

based on the underlying collateral values. Further discussion

on determination of fair value is in the Fair Value Measurements

section below.

Experience is not available for new products; therefore, while

we are developing that experience, we set loss allowances based

on our experience with the most closely analogous products in

our portfolio.

Our loss mitigation strategy intends to minimize economic

loss and, at times, can result in rate reductions, principal forgive-

ness, extensions, forbearance or other actions, which may cause

the related loan to be classifi ed as a TDR.

We utilize certain loan modifi cation programs for borrowers

experiencing temporary fi nancial diffi culties in our Consumer

loan portfolio. These loan modifi cation programs are primarily

concentrated in our non-U.S. residential mortgage and non-U.S.

installment and revolving portfolios and include short-term (three

months or less) interest rate reductions and payment deferrals,

which were not part of the terms of the original contract. We

sold our U.S. residential mortgage business in 2007 and as such,

do not participate in the U.S. government-sponsored mortgage

modifi cation programs.

Our allowance for losses on fi nancing receivables on these

modifi ed consumer loans is determined based upon a formulaic

approach that estimates the probable losses inherent in the port-

folio based upon statistical analyses of the portfolio. Data related

to redefault experience is also considered in our overall reserve

adequacy review. Once the loan has been modifi ed, it returns to

current status (re-aged) only after receipt of at least three consec-

utive minimum monthly payments or the equivalent cumulative

amount, subject to a re-aging limitation of once a year, or twice

in a fi ve-year period in accordance with the Federal Financial

Institutions Examination Council guidelines on Uniform Retail

Credit Classifi cation and Account Management policy issued in

June 2000. We believe that the allowance for losses would not be

materially different had we not re-aged these accounts.

For commercial loans, we evaluate changes in terms and

conditions to determine whether those changes meet the

criteria for classifi cation as a TDR on a loan-by-loan basis. In

Commercial Lending and Leasing (CLL), these changes primarily

include: changes to covenants, short-term payment deferrals and

maturity extensions. For these changes, we receive economic

consideration, including additional fees and/or increased inter-

est rates, and evaluate them under our normal underwriting

standards and criteria. Changes to Real Estate’s loans primar-

ily include maturity extensions, principal payment acceleration,

changes to collateral terms, and cash sweeps, which are in

addition to, or sometimes in lieu of, fees and rate increases. The

determination of whether these changes to the terms and condi-

tions of our commercial loans meet the TDR criteria includes our

consideration of all of the relevant facts and circumstances. When

the borrower is experiencing fi nancial diffi culty, we carefully eval-

uate these changes to determine whether they meet the form of

a concession. In these circumstances, if the change is deemed to

be a concession, we classify the loan as a TDR.

When we repossess collateral in satisfaction of a loan, we

write down the receivable against the allowance for losses.

Repossessed collateral is included in the caption “All other assets”

in the Statement of Financial Position and carried at the lower of

cost or estimated fair value less costs to sell.

For Consumer loans, we write off unsecured closed-end

installment loans when they are 120 days contractually past due

and unsecured open-ended revolving loans at 180 days con-

tractually past due. We write down consumer loans secured by

collateral other than residential real estate when such loans are

120 days past due. Consumer loans secured by residential real

estate (both revolving and closed-end loans) are written down to

the fair value of collateral, less costs to sell, no later than when

they become 360 days past due. Unsecured consumer loans in

bankruptcy are written off within 60 days of notifi cation of fi ling

by the bankruptcy court or within contractual write-off periods,

whichever occurs earlier.

Write-offs on larger balance impaired commercial loans are

based on amounts deemed uncollectible and are reviewed quar-

terly. Write-offs on Real Estate loans are recorded upon initiation

of foreclosure or early settlement by the borrower, or in some

cases, based on the passage of time depending on specifi c facts

and circumstances. In CLL, loans are written off when deemed

uncollectible (e.g., when the borrower enters restructuring, collat-

eral is to be liquidated or at 180 days past due for smaller balance,

homogeneous loans).

Partial Sales of Business Interests

Gains or losses on sales of affi liate shares where we retain a

controlling fi nancial interest are recorded in equity. Gains or

losses on sales that result in our loss of a controlling fi nancial

interest are recorded in earnings along with remeasurement

gains or losses on any investments in the entity that we retained.