GE 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

tested. We are restructuring our

European operations to sustain our

profi tability at lower levels of growth.

We accelerated global and technical

investments, ahead of competition,

during the downturn to ensure growth

in a choppy environment. We redeployed

capital from NBCU to support $11 billion

of Energy acquisitions, which should

provide an earnings boost in 2012. We

fi nished 2011 with $200 billion of product

and service backlog, more than at any

time in our history.

We also have a talented and committed

team. In December, I had dinner with

our Aviation supply chain leaders from

around the world. I do this regularly

with different operating teams. It allows

me to “go deep” and understand chal-

lenges through their eyes. My dinner

partners are the ones who have to

meet record engine demand with high

quality and low cost. They are also the

leaders of our fi ne frontline workforce,

the best in the world. They understand

technology, globalization, innovation

and lean manufacturing. Their tough-

minded, competitive attitude inspires

me. I know that with our team, we will

succeed in this environment.

GE Works for investors, and you should

benefi t from our people and our prep-

aration. As business leaders, we cannot

create the environment, but we can

shape our own destiny. Today, GE has

a stronger portfolio, large-scale

competitive advantage, product and

technology leadership, and strength in

the growth markets. We are ready

to compete. We are positioned to win

right now.

WE HAVE BUILT A

STRONGER PORTFOLIO

We have our strongest portfolio in

recent history. This year, we expect to

have organic growth of 5 to 10% with

expanding margins. GE Capital is

smaller and focused on specialty

fi nance, particularly in mid-market

segments. We expect GE Capital’s

earnings rebound to continue in 2012.

Together, this portfolio is built to grow

earnings and return cash to investors.

Our top strategic priority has been to

build a strong, competitively advan-

taged infrastructure business that

grows ahead of our peers and faster

than the global GDP. Over the last

decade, we have refashioned GE from

an “industrial conglomerate” to an

“infrastructure leader.” This has been

disruptive at times, but it has several

advantages. Infrastructure businesses

use GE’s core strengths in technology,

globalization and services. Infra struc-

ture is also positioned to benefi t from

several long-term tailwinds, especially

growth in emerging markets. Infra-

structure requires scale and fi nancial

strength. Deep customer relationships,

built on long-term thinking, really count.

We have diversifi ed and strengthened

our core businesses, like Energy.

Historically, this business was based

largely on selling one product—heavy

duty gas turbines—in one market—the

U.S. That kind of concentration creates

volatility as markets rise and fall.

Today, we have a broad Energy portfolio,

including a range of gas power

generation products, oil and gas tech-

nology, renewables, smart grid

services, energy management tech-

nologies and controls; these products

and services are sold around the world.

As an energy leader, our earnings are

more diversifi ed, less volatile and

should grow through the cycles. This is

the same model we are using in the

rest of our businesses.

We have boosted the growth rate

of our infrastructure portfolio by

investing in adjacencies, promising

opportunities that are outside of, but

closely related to, our core businesses.

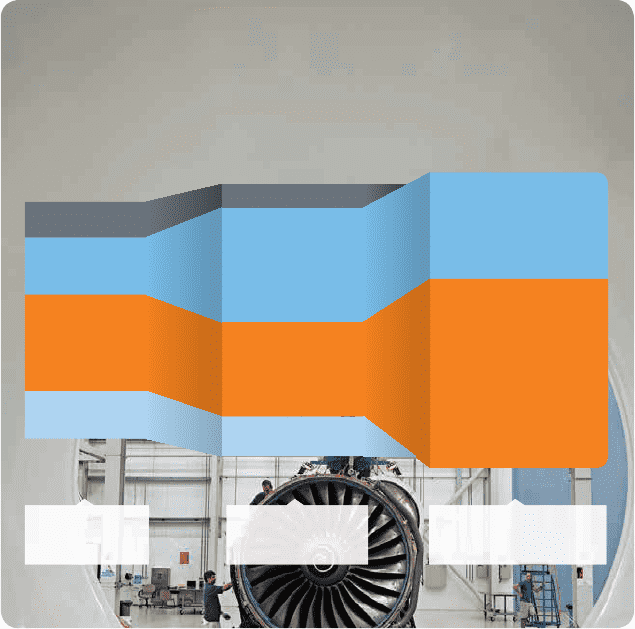

PORTFOLIO STRATEGY

Improved portfolio positioned for a variety of outcomes

Revenue ~$150B

+ $100B of cash: 2012–2016

+ Fund growth and reward investors

EARLY DECADE

Transformation

Begins

MID-DECADE

Reposition, Simplify

and Invest

GOING FORWARD

Growth and Value

Creation

GE Capital

24%

Insurance

15%

Plastics, Media

20%

Infrastructure

41%

36%

Focused Leader

Simple and Safe

64%

High Tech

Global Leader

High Margin/

Returns

15%

8%

43%

34%

4 GE 2011 ANNUAL REPORT