GE 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.’

64 GE 2011 ANNUAL REPORT

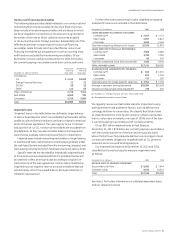

Critical Accounting Estimates

Accounting estimates and assumptions discussed in this section

are those that we consider to be the most critical to an under-

standing of our fi nancial statements because they involve

signifi cant judgments and uncertainties. Many of these estimates

include determining fair value. All of these estimates refl ect our

best judgment about current, and for some estimates future,

economic and market conditions and their effects based on

information available as of the date of these fi nancial statements.

If these conditions change from those expected, it is reasonably

possible that the judgments and estimates described below could

change, which may result in future impairments of investment

securities, goodwill, intangibles and long-lived assets, incremen-

tal losses on fi nancing receivables, increases in reserves for

contingencies, establishment of valuation allowances on deferred

tax assets and increased tax liabilities, among other effects. Also

see Note 1, Summary of Signifi cant Accounting Policies, which

discusses the signifi cant accounting policies that we have

selected from acceptable alternatives.

LOSSES ON FINANCING RECEIVABLES are recognized when they are

incurred, which requires us to make our best estimate of probable

losses inherent in the portfolio. The method for calculating the

best estimate of losses depends on the size, type and risk charac-

teristics of the related fi nancing receivable. Such an estimate

requires consideration of historical loss experience, adjusted for

current conditions, and judgments about the probable effects of

relevant observable data, including present economic conditions

such as delinquency rates, fi nancial health of specifi c customers

and market sectors, collateral values (including housing price

indices as applicable), and the present and expected future levels

of interest rates. The underlying assumptions, estimates and

assessments we use to provide for losses are updated periodi-

cally to refl ect our view of current conditions. Changes in such

estimates can signifi cantly affect the allowance and provision for

losses. It is possible that we will experience credit losses that are

different from our current estimates. Write-offs in both our con-

sumer and commercial portfolios can also refl ect both losses that

are incurred subsequent to the beginning of a fi scal year and

information becoming available during that fi scal year which may

identify further deterioration on exposures existing prior to the

beginning of that fi scal year, and for which reserves could not

have been previously recognized. Our risk management process

includes standards and policies for reviewing major risk expo-

sures and concentrations, and evaluates relevant data either for

individual loans or fi nancing leases, or on a portfolio basis,

as appropriate.

Further information is provided in the Global Risk Management

section and Financial Resources and Liquidity—Financing

Receivables sections, the Asset Impairment section that follows

and in Notes 1, 6 and 23.

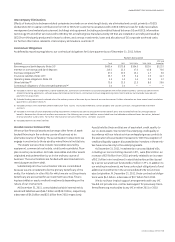

REVENUE RECOGNITION ON LONG-TERM PRODUCT SERVICES

AGREEMENTS

requires estimates of profi ts over the multiple-year

terms of such agreements, considering factors such as the fre-

quency and extent of future monitoring, maintenance and

overhaul events; the amount of personnel, spare parts and other

resources required to perform the services; and future billing rate

and cost changes. We routinely review estimates under product

services agreements and regularly revise them to adjust for

changes in outlook. We also regularly assess customer credit risk

inherent in the carrying amounts of receivables and contract

costs and estimated earnings, including the risk that contractual

penalties may not be suffi cient to offset our accumulated invest-

ment in the event of customer termination. We gain insight into

future utilization and cost trends, as well as credit risk, through

our knowledge of the installed base of equipment and the close

interaction with our customers that comes with supplying critical

services and parts over extended periods. Revisions that affect a

product services agreement’s total estimated profi tability result

in an adjustment of earnings; such adjustments increased earn-

ings by $0.4 billion in 2011, decreased earnings by $0.2 billion in

2010 and increased earnings by $0.2 billion in 2009. We provide

for probable losses when they become evident.

Further information is provided in Notes 1 and 9.

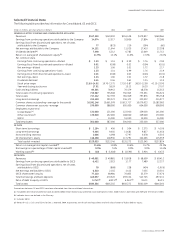

ASSET IMPAIRMENT assessment involves various estimates and

assumptions as follows:

Investments. We regularly review investment securities for

impairment using both quantitative and qualitative criteria.

Effective April 1, 2009, the FASB amended ASC 320 and modifi ed

the requirements for recognizing and measuring other-than-

temporary impairment for debt securities. If we do not intend to

sell the security and it is not more likely than not that we will be

required to sell the security before recovery of our amortized

cost, we evaluate other qualitative criteria to determine whether

a credit loss exists, such as the fi nancial health of and specifi c

prospects for the issuer, including whether the issuer is in compli-

ance with the terms and covenants of the security. Quantitative

criteria include determining whether there has been an adverse

change in expected future cash fl ows. For equity securities, our

criteria include the length of time and magnitude of the amount

that each security is in an unrealized loss position. Our other-

than-temporary impairment reviews involve our fi nance, risk and

asset management functions as well as the portfolio manage-

ment and research capabilities of our internal and third-party

asset managers. See Note 1, which discusses the determination

of fair value of investment securities.

Further information about actual and potential impairment

losses is provided in the Financial Resources and Liquidity—

Investment Securities section and in Notes 1, 3 and 9.