GE 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 GE 2011 ANNUAL REPORT

Note 1.

Summary of Significant Accounting Policies

Accounting Principles

Our fi nancial statements are prepared in conformity with U.S.

generally accepted accounting principles (GAAP).

Consolidation

Our fi nancial statements consolidate all of our affi liates—entities

in which we have a controlling fi nancial interest, most often

because we hold a majority voting interest. To determine if we

hold a controlling fi nancial interest in an entity we fi rst evaluate if

we are required to apply the variable interest entity (VIE) model to

the entity, otherwise the entity is evaluated under the voting

interest model.

Where we hold current or potential rights that give us the

power to direct the activities of a VIE that most signifi cantly impact

the VIE’s economic performance combined with a variable inter-

est that gives us the right to receive potentially signifi cant benefi ts

or the obligation to absorb potentially signifi cant losses, we have

a controlling fi nancial interest in that VIE. Rights held by others

to remove the party with power over the VIE are not considered

unless one party can exercise those rights unilaterally. When

changes occur to the design of an entity we reconsider whether it

is subject to the VIE model. We continuously evaluate whether we

have a controlling fi nancial interest in a VIE.

We hold a controlling fi nancial interest in other entities where

we currently hold, directly or indirectly, more than 50% of the

voting rights or where we exercise control through substantive

participating rights or as a general partner. Where we are a gen-

eral partner we consider substantive removal rights held by other

partners in determining if we hold a controlling fi nancial interest.

We reevaluate whether we have a controlling fi nancial interest

in these entities when our voting or substantive participating

rights change.

Associated companies are unconsolidated VIEs and other enti-

ties in which we do not have a controlling fi nancial interest, but

over which we have signifi cant infl uence, most often because we

hold a voting interest of 20% to 50%. Associated companies are

accounted for as equity method investments. Results of associ-

ated companies are presented on a one-line basis. Investments

in, and advances to, associated companies are presented on a

one-line basis in the caption “All other assets” in our Statement of

Financial Position, net of allowance for losses, that represents our

best estimate of probable losses inherent in such assets.

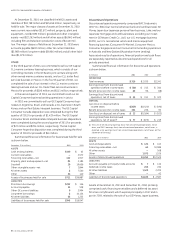

Financial Statement Presentation

We have reclassifi ed certain prior-year amounts to conform to the

current-year’s presentation.

Financial data and related measurements are presented in the

following categories:

• GE—This represents the adding together of all affi liates other

than General Electric Capital Services, Inc. (GECS), whose oper-

ations are presented on a one-line basis.

• GECS—This affi liate owns all of the common stock of General

Electric Capital Corporation (GECC). GECC and its respective

affi liates are consolidated in the accompanying GECS columns

and constitute the majority of its business.

• Consolidated—This represents the adding together of GE and

GECS, giving effect to the elimination of transactions between

GE and GECS.

• Operating Segments—These comprise our six busi-

nesses, focused on the broad markets they serve: Energy

Infrastructure, Aviation, Healthcare, Transportation, Home &

Business Solutions and GE Capital. Prior-period information

has been reclassifi ed to be consistent with how we managed

our businesses in 2011.

Unless otherwise indicated, information in these notes to consoli-

dated fi nancial statements relates to continuing operations.

Certain of our operations have been presented as discontinued.

See Note 2.

On February 22, 2012, we merged our wholly-owned sub-

sidiary, GECS, with and into GECS’ wholly-owned subsidiary,

GECC. The merger simplifi ed our fi nancial services’ corporate

structure by consolidating fi nancial services entities and assets

within our organization and simplifying Securities and Exchange

Commission and regulatory reporting. Upon the merger, GECC

became the surviving corporation and assumed all of GECS’ rights

and obligations and became wholly-owned directly by General

Electric Company. Our fi nancial services segment, GE Capital, will

continue to comprise the continuing operations of GECC, which

now includes the run-off insurance operations previously held

and managed in GECS. References to GECS, GECC and the GE

Capital segment in these consolidated fi nancial statements relate

to the entities or segment as they existed during 2011 and do not

refl ect the February 22, 2012 merger.

The effects of translating to U.S. dollars the fi nancial state-

ments of non-U.S. affi liates whose functional currency is the

local currency are included in shareowners’ equity. Asset and

liability accounts are translated at year-end exchange rates, while

revenues and expenses are translated at average rates for the

respective periods.

Preparing fi nancial statements in conformity with U.S. GAAP

requires us to make estimates based on assumptions about

current, and for some estimates future, economic and market

conditions (for example, unemployment, market liquidity, the real

estate market, etc.), which affect reported amounts and related

disclosures in our fi nancial statements. Although our current esti-

mates contemplate current conditions and how we expect them to

change in the future, as appropriate, it is reasonably possible that

in 2012 actual conditions could be worse than anticipated in those

estimates, which could materially affect our results of operations

and fi nancial position. Among other effects, such changes could

result in future impairments of investment securities, goodwill,

intangibles and long-lived assets, incremental losses on fi nancing

receivables, establishment of valuation allowances on deferred tax

assets and increased tax liabilities.