GE 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2011 ANNUAL REPORT 99

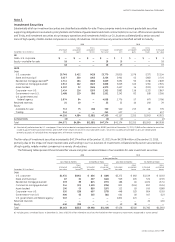

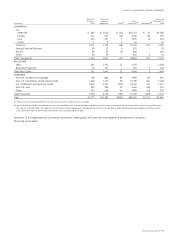

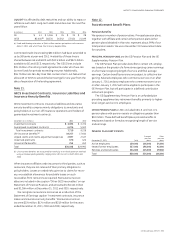

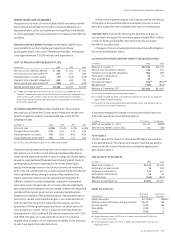

INTANGIBLE ASSETS SUBJECT TO AMORTIZATION

December 31 (In millions)

Gross

carrying

amount

Accumulated

amortization Net

GE

2011

Customer-related $ 5,638 $(1,117) $ 4,521

Patents, licenses and trademarks 5,797 (2,104) 3,693

Capitalized software 4,743 (2,676) 2,067

All other 176 (140) 36

Total $16,354 $(6,037) $10,317

2010

Customer-related $ 4,386 $ (902) $ 3,484

Patents, licenses and trademarks 4,778 (2,063) 2,715

Capitalized software 4,230 (2,449) 1,781

All other 45 (41) 4

Total $13,439 $(5,455) $ 7,984

GECS

2011

Customer-related $ 1,186 $ (697) $ 489

Patents, licenses and trademarks 250 (208) 42

Capitalized software 2,048 (1,597) 451

Lease valuations 1,470 (944) 526

Present value of future profits (a) 491 (491) —

All other 327 (289) 38

Total $ 5,772 $(4,226) $ 1,546

2010

Customer-related $ 1,112 $ (588) $ 524

Patents, licenses and trademarks 599 (532) 67

Capitalized software 2,026 (1,528) 498

Lease valuations 1,646 (917) 729

Present value of future profits (a) 461 (461) —

All other 333 (268) 65

Total $ 6,177 $(4,294) $ 1,883

(a) Balance at December 31, 2011 and December 31, 2010 reflects an adjustment of

$391 million and $423 million, respectively, to the present value of future profits

in our run-off insurance operations to reflect the effects that would have been

recognized had the related unrealized investment securities holding gains and

losses actually been realized in accordance with ASC 320-10-S99-2.

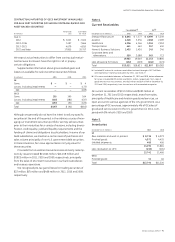

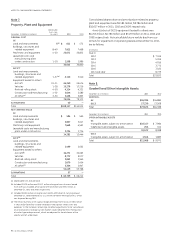

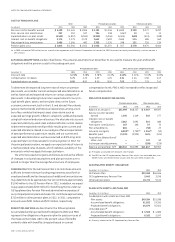

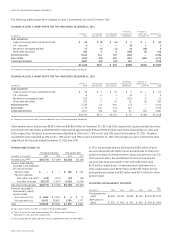

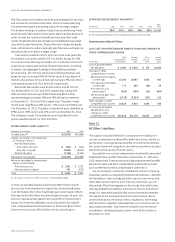

During 2011, we recorded additions to intangible assets subject

to amortization of $3,609 million, primarily as a result of the acqui-

sition of Dresser, Inc. ($844 million), Converteam ($814 million), the

Well Support division of John Wood Group PLC ($571 million),

Wellstream PLC ($258 million) and Lineage Power Holdings, Inc.

($122 million). The components of fi nite-lived intangible assets

acquired during 2011 and their respective weighted-average

amortizable period are: $1,427 million—Customer-related

(20.0 years); $1,366 million—Patents, licenses and trademarks

(17.2 years); $785 million—Capitalized software (4.0 years); and

$31 million—All other (11.4 years).

Consolidated amortization related to intangible assets was

$1,732 million, $1,747 million and $2,083 million for 2011, 2010

and 2009, respectively. We estimate annual pre-tax amortiza-

tion for intangible assets over the next fi ve calendar years to be

as follows: 2012—$1,647 million; 2013—$1,491 million; 2014—

$1,326 million; 2015—$1,189 million; and 2016—$1,070 million.

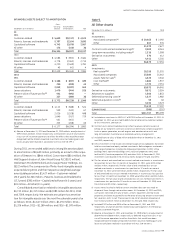

Note 9.

All Other Assets

December 31 (In millions) 2011 2010

GE

Investments

Associated companies (a) $ 20,463 $ 2,092

Other 607 535

21,070 2,627

Contract costs and estimated earnings (b) 9,008 8,061

Long-term receivables, including notes (c) 1,316 1,098

Derivative instruments 370 412

Other 4,911 5,256

36,675 17,454

GECS

Investments

Real estate (d)(e) 28,255 31,555

Associated companies 23,589 25,662

Assets held for sale (f) 4,525 3,540

Cost method (e) 1,882 1,937

Other 1,722 2,251

59,973 64,945

Derivative instruments 9,671 5,034

Advances to suppliers 1,560 1,853

Deferred borrowing costs (g) 1,327 1,982

Deferred acquisition costs (h) 55 60

Other 3,032 3,323

75,618 77,197

ELIMINATIONS (586) (352)

Total $111,707 $94,299

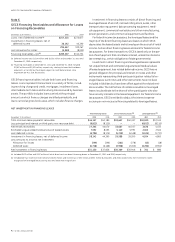

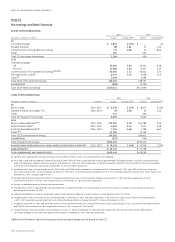

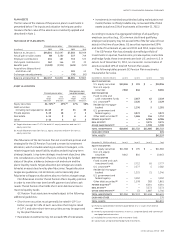

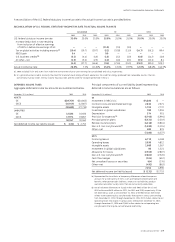

(a) Included our investment in NBCU LLC of $17,955 million at December 31, 2011. At

December 31, 2011, we also had $4,880 million of deferred tax liabilities related

to this investment. See Note 14.

(b) Contract costs and estimated earnings reflect revenues earned in excess of

billings on our long-term contracts to construct technically complex equipment

(such as power generation, aircraft engines and aeroderivative units) and

long-term product maintenance or extended warranty arrangements.

(c) Included loans to GECS of $388 million and $856 million at December 31, 2011

and 2010, respectively.

(d) GECS investments in real estate consisted principally of two categories: real estate

held for investment and equity method investments. Both categories contained a

wide range of properties including the following at December 31, 2011: office

buildings (46%), apartment buildings (14%), industrial properties (10%), retail

facilities (8%), franchise properties (8%) and other (14%). At December 31, 2011,

investments were located in the Americas (48%), Europe (27%) and Asia (25%).

(e) The fair value of and unrealized loss on cost method investments in a continuous

loss position for less than 12 months at December 31, 2011, were $425 million

and $61 million, respectively. The fair value of and unrealized loss on cost

method investments in a continuous loss position for 12 months or more at

December 31, 2011, were $65 million and $3 million, respectively. The fair value

of and unrealized loss on cost method investments in a continuous loss position

for less than 12 months at December 31, 2010, were $396 million and $55 million,

respectively. The fair value of and unrealized loss on cost method investments in

a continuous loss position for 12 months or more at December 31, 2010, were

$16 million and $2 million, respectively.

(f) Assets were classified as held for sale on the date a decision was made to

dispose of them through sale or other means. At December 31, 2011 and 2010,

such assets consisted primarily of loans, aircraft, equipment and real estate

properties, and were accounted for at the lower of carrying amount or estimated

fair value less costs to sell. These amounts are net of valuation allowances of

$122 million and $115 million at December 31, 2011 and 2010, respectively.

(g) Included $329 million and $916 million at December 31, 2011 and 2010,

respectively, of unamortized fees related to our participation in the Temporary

Liquidity Guarantee Program.

(h) Balance at December 31, 2011 and December 31, 2010 reflects an adjustment of

$810 million and $860 million, respectively, to deferred acquisition costs in our

run-off insurance operations to reflect the effects that would have been

recognized had the related unrealized investment securities holding gains and

losses actually been realized in accordance with ASC 320-10-S99-2.