Energizer 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2006 ANNUAL REPORT 3

Focus on Strategies

To overcome these competitive pressures and market forces, we

continue to focus on the proven strategies we have in place and on our

mission of delivering portable power and wet shave solutions to

consumers and trade customers better than anyone else – something

we do by intensely focusing on innovation and cost discipline.

Batteries and Lighting Products. The battery category remains healthy

and Energizer is best positioned in the growing parts of the market. U.S.

households currently own 2.2 billion battery-powered devices, a number

projected to continue growing 8 percent annually – and one-fourth are

high-drain devices. We continue to follow clearly defined strategies to

build sales and share in our Batteries and Lighting Products segment.

1. Broad Portfolio – Offering the broadest range of portable power solutions gives

us multiple opportunities to meet diverse consumer and customer needs with

a strong platform to trade up consumers to more premium products.

2. Brand Support – Brands matter in the battery category, and we aggressively

support our well-known Energizer®and Eveready®brands with meaningful

advertising and promotional support.

3. Minimize Overhead – A lean overhead structure enables us to fund our brand-

building efforts, while delivering healthy operating margins and generating

strong cash flow.

Razors and Blades. In the Razors and Blades segment, our proven

strategies produced record profits last year and have fueled a com-

pounded annual sales growth of 8 percent over the past three years.

1. Encourage Trade-Up – Through continuous product innovation and strong

brand support, we seek to trade up consumers to new improved products

in each area where we compete – men’s and women’s wet shaving systems

and disposables.

2. Geographic Expansion – We continue to expand the global presence and

sales of Schick-Wilkinson Sword (SWS), introducing shaving solutions in

more countries and classes of trade where we currently market batteries.

3. Minimize Overhead – Low overhead cost allows us to fund brand-building

programs and improve operating margins.

Focus on Innovation

Creatively focusing on innovation in products and technology, Energizer

is able to compete successfully against larger rivals. Examples of

innovation are numerous across our battery and blade businesses –

from the world’s first four-bladed razor and first all in one razor to the

only battery line harnessing the power of lithium in a 1.5 volt cell, from an

akaline battery with patented titanium technology to advanced titanium

blade-coating technology, from the world’s only hearing aid battery

dispenser to the proprietary intelligent power management technology

in our new cell phone charger.

Focus on Cost Containment

While introducing innovative new products and building our brands,

we maintain an equally intent focus on continuous improvement across

our manufacturing operations. Our goal is to drive non-value added

activities out of all business processes.

Lean transformation. Focusing on cost containment throughout

the organization, our lean transformation continues to gain traction.

The essence of our lean initiative, which has totally transformed our

battery manufacturing over the last three years, is to focus on things

that add the most value to customers and consumers, and eliminate

the least important. These efforts have resulted in significant cost savings

over the past three years, helping offset the impact of rising material

and fuel costs.

European restructuring. A major cost-reduction effort is under way to

streamline our commercial structure in Europe and use our resources

more efficiently. The initial phase, restructuring of our European supply

chain, was substantially completed in the fourth quarter of 2006 at a total

cost of $24.1 million, pre-tax, and is expected to produce annual cost

savings of approximately $6 million beginning in fiscal 2007. Currently,

we are combining our battery and blade commercial management,

sales and certain support functions within selected countries. This

phase is expected to cost $27-$33 million, of which $13.3 million

was recognized in 2006. Once fully implemented, annual cost savings of

$15-$20 million are expected.

Outlook for the Future

All around the world, Energizer colleagues continue to achieve excep-

tional results. This highly experienced and talented team is passionate

about delivering portable power and wet shave solutions – and energized

about doing it better than anyone else. Our team-oriented, small-

company culture, world-class brands and global distribution system – and

our collective focus on innovation and cost control – continue to be a

profitable combination for our long-term shareholders.

Ward M. Klein

Chief Executive Officer

Energizer Holdings, Inc.

November 15, 2006

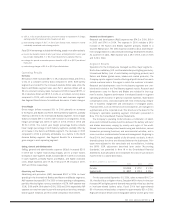

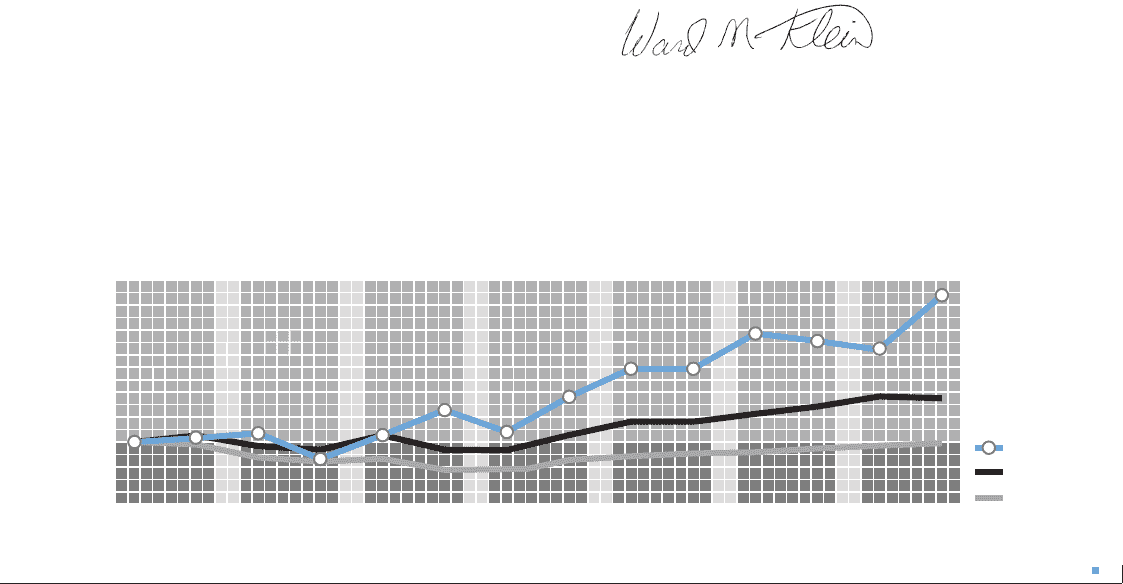

Apr 00 Apr 01 Apr 02 Apr 03 Apr 04Oct 00 Oct 01 Oct 02 Oct 03 Oct 04

$300

$100

$200

Energizer

S&P 400

S&P 500

Apr 05 Apr 06Oct 05 Oct 06

Stock Price Performance

Comparison of Cumulative

Total Return on $100 invested

in Energizer Holdings, Inc. on

its first day of trading, April 1,

2000, versus the S&P 500 and

S&P 400 Mid Cap Indices

through September 29, 2006.