Energizer 2006 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2006 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

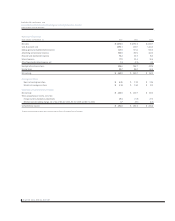

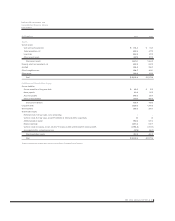

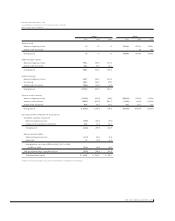

ENERGIZER HOLDINGS, INC.

Management’s Discussion and Analysis of Results of Operations and Financial Condition

(Dollars in millions, except per share and percentage data)

16 ENR 2006 ANNUAL REPORT

Company entered into a prepaid share option with a financial institution

to mitigate this risk as discussed in Note 13 to the Consolidated

Financial Statements. The change in fair value of the prepaid share

option is recorded in SG&A expense. Changes in value of the prepaid

share option should substantially mitigate changes in the after-tax

deferred compensation liabilities tied to the Company’s stock price.

Market value of the prepaid share option was $50.8 and $20.4 at

September 30, 2006 and 2005, respectively. The change in fair value of

the prepaid share option for the year ended September 30, 2006 and

2005 resulted in income of $10.8 and $5.4, respectively.

Seasonal Factors

The Company’s battery segment results are significantly impacted in the

first quarter of the fiscal year by the additional sales volume associated

with the December holiday season, particularly in North America. First

quarter battery sales accounted for 31% of total battery net sales in

2006, 2005 and 2004. In addition, natural disasters, such as hurricanes,

can create conditions that drive exceptional needs for portable power

and spike battery sales.

Environmental Matters

The operations of the Company, like those of other companies engaged

in the battery and shaving products businesses, are subject to various

federal, state, foreign and local laws and regulations intended to protect

the public health and the environment. These regulations primarily relate

to worker safety, air and water quality, underground fuel storage tanks

and waste handling and disposal. The Company has received notices from

the U.S. Environmental Protection Agency, state agencies and/or private

parties seeking contribution, that it has been identified as a “potentially

responsible party” (PRP) under the Comprehensive Environmental

Response, Compensation and Liability Act, and may be required to

share in the cost of cleanup with respect to seven federal “Superfund”

sites. It may also be required to share in the cost of cleanup with

respect to two state-designated sites or other sites outside of the U.S.

Accrued environmental costs at September 30, 2006 were $8.3, of

which $1.9 is expected to be spent in fiscal 2007. This accrual is

not measured on a discounted basis. It is difficult to quantify with

certainty the cost of environmental matters, particularly remediation

and future capital expenditures for environmental control equipment.

Nevertheless, based on information currently available, the Company

believes the possibility of material environmental costs in excess of the

accrued amount is remote.

Inflation

Management recognizes that inflationary pressures may have an adverse

effect on the Company, through higher material, labor and transportation

costs, asset replacement costs and related depreciation, and other

costs. In general, the Company has been able to offset or minimize

inflation effects through other cost reductions and productivity

improvements through mid-2005, thus inflation was not a significant

factor to that point. Recently, the cost of zinc, nickel, steel, oil and other

commodities used in the Company’s production and distribution has

increased to levels well above those of prior years. Of these materials,

zinc is by far the largest impact on Energizer’s profit. Each $0.01 per

pound increase in the zinc price increases the Company’s annualized

pre-tax costs by approximately $0.8. The Company’s ability to fully

mitigate such cost increases through cost cutting and productivity or to

raise prices in the future are not certain.

Critical Accounting Policies

The Company identified the policies below as critical to its business

operations and the understanding of its results of operations. The impact

and any associated risks related to these policies on its business

operations is discussed throughout Management’s Discussion and

Analysis of Results of Operations and Financial Condition where such

policies affect the reported and expected financial results.

Preparation of the financial statements in conformity with generally

accepted accounting principles (GAAP) in the U.S. requires the

Company to make estimates and assumptions that affect the reported

amounts of assets and liabilities, disclosure of contingent assets and

liabilities and the reported amounts of revenues and expenses. On an

ongoing basis, the Company evaluates its estimates, including those

related to customer programs and incentives, product returns, inventories,

intangible assets and other long-lived assets, income taxes, financing,

pensions and other postretirement benefits, and contingencies. Actual

results could differ from those estimates. This listing is not intended to

be a comprehensive list of all of the Company’s accounting policies.

Revenue Recognition The Company’s revenue is from the sale of its products.

Revenue is recognized when title, ownership and risk of loss passes to the

customer. When discounts are offered to customers for early payment, an

estimate of such discounts is recorded as a reduction of net sales in the same

period as the sale. Standard sales terms are final and returns or exchanges are

not permitted unless a special exception is made; reserves are established and

recorded in cases where the right of return does exist for a particular sale.

The Company offers a variety of programs, primarily to its retail customers,

designed to promote sales of its products. Such programs require periodic

payments and allowances based on estimated results of specific programs and

are recorded as a reduction to net sales. The Company accrues at the time

of sale the estimated total payments and allowances associated with each

transaction. Additionally, the Company offers programs directly to consumers

to promote the sale of its products. Promotions which reduce the ultimate

consumer sale prices are recorded as a reduction of net sales at the time

the promotional offer is made, generally using estimated redemption and

participation levels.

The Company continually assesses the adequacy of accruals for customer

and consumer promotional program costs not yet paid. To the extent total

program payments differ from estimates, adjustments may be necessary.

Historically, these adjustments have not been material to annual results.

Pension Plans and Other Postretirement Benefits The determination of the

Company’s obligation and expense for pension and other postretirement

benefits is dependent on certain assumptions developed by the Company and

used by actuaries in calculating such amounts. Assumptions include, among

others, the discount rate, future salary increases and the expected long-term

rate of return on plan assets. Actual results that differ from assumptions made

are accumulated and amortized over future periods and, therefore, generally

affect the Company’s recognized expense and recorded obligation in future

periods. Significant differences in actual experience or significant changes in

assumptions may materially affect pension and other postretirement obliga-