Energizer 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2006 ANNUAL REPORT 43

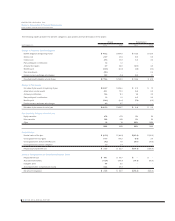

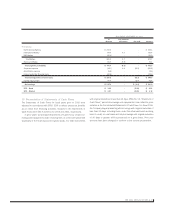

YEAR ENDED SEPTEMBER 30, 2004

As Fully Allocated

Reported Adjustment FAS 123R Adjusted

Profitability

North America Battery $ 298.2 – – $ 298.2

International Battery 147.7 4.7 – 152.4

R&D Battery (39.9) – – (39.9)

Total Battery 406.0 4.7 – 410.7

Razors and Blades 85.7 (9.5) – 76.2

Total segment profitability $ 491.7 (4.8) –$ 486.9

Corporate expense (95.1) 4.8 (10.2) (100.5)

Amortization expense (5.8) – – (5.8)

Interest and other financial items (32.8) – – (32.8)

Total earnings before income taxes $ 358.0 –(10.2) $ 347.8

Income tax provision 90.6 – (3.8) 86.8

Net earnings $ 267.4 –$ (6.4) $ 261.0

EPS –Basic $ 3.32 –(0.08) $ 3.24

EPS –Diluted $ 3.21 –(0.08) $ 3.13

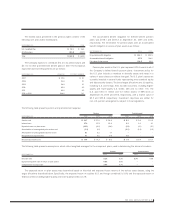

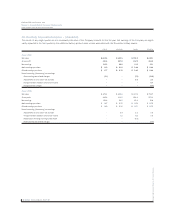

19. Presentation of Statements of Cash Flows

The Statements of Cash Flows for fiscal years prior to 2006 were

adjusted in accordance with SFAS 123R to reflect excess tax benefits

as an inflow from financing activities. Impacts to the Statements of

Cash Flows were $20.9 and $6.4 for 2005 and 2004, respectively.

In prior years’ Consolidated Statements of Cash Flows, certain bor-

rowings and repayments under revolving lines of credit were presented

separately in the financing section (gross basis). For debt instruments

with original maturities of less than 90 days, SFAS No. 95, “Statement of

Cash Flows,” permits borrowings and repayments to be netted for pres-

entation in the Consolidated Statements of Cash Flows. For fiscal 2006,

the Company began presenting all borrowings with original maturities of

less than 90 days, including those under the aforementioned revolving

lines of credit, on a net basis and only borrowings with original maturities

of 90 days or greater will be presented on a gross basis. Prior year

amounts have been changed to conform to the current presentation.