Energizer 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)

28 ENR 2006 ANNUAL REPORT

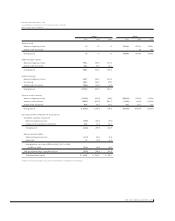

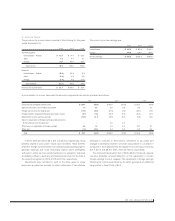

North America International Razors and

Battery Battery Blades Total

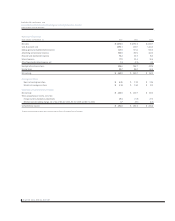

Balance at October 1, 2005 $ 24.7 $ 14.1 $ 320.1 $ 358.9

Cumulative translation adjustment –0.4 5.2 5.6

Balance at September 30, 2006 $ 24.7 $ 14.5 $ 325.3 $ 364.5

The Company has indefinite-lived and amortizable intangibles. The Company had indefinite-lived trademarks and tradenames of $265.8

at September 30, 2006 and $261.9 at September 30, 2005. Changes in indefinite-lived trademarks and tradenames are currency related.

The Company also had pension related intangibles of $4.4 at September 30, 2006 and $3.6 at September 30, 2005.

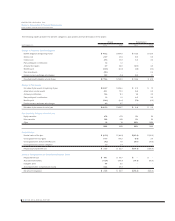

Total amortizable intangible assets at September 30, 2006 are as follows:

Gross

Carrying Accumulated

Amount Amortization Net

Tradenames $12.2 $ (4.4) $ 7.8

Technology and patents 35.5 (11.8) 23.7

Customer-related 8.1 (3.1) 5.0

Total amortizable intangible assets $ 55.8 $ (19.3) $ 36.5

Amortization expense for intangible assets totaled $5.6 for the current year. Estimated amortization expense for amortized intangible assets for

the years ended September 30, 2007 and 2008 is approximately $5.4, and $5.0 for the years ended September 30, 2009 through 2011.

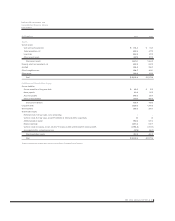

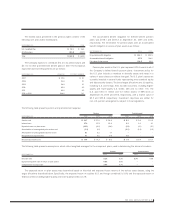

3. Goodwill and Intangible Assets and Amortization

The Company has allocated goodwill and other intangible assets to

individual countries or areas for battery businesses. The battery

business intangible assets are comprised of trademarks primarily

related to the Energizer brand. These intangible assets are deemed

indefinite-lived.

The Company allocated goodwill, indefinite-lived trademarks and

other intangible assets to the SWS business at acquisition. The other

intangible assets include trademarks, tradenames, technology, patents

and customer-related assets with lives ranging from five to 15 years.

Goodwill and intangible assets deemed to have an indefinite life are

not amortized, but reviewed annually for impairment of value. The

Company monitors changing business conditions, which may indicate

that the remaining useful life of goodwill and other intangible assets

may warrant revision or carrying amounts may require adjustment. As

part of its business planning cycle, the Company performed its annual

impairment test in the fourth quarter of fiscal 2006, 2005 and 2004.

Impairment testing of the Company’s reporting units was performed at

the area level (North America, Europe, Asia Pacific and Latin America)

within each reporting segment of the Company. The fair value of each

area reporting unit was estimated using the discounted cash flow

method. No adjustments or impairments were deemed necessary.

The following table represents the carrying amount of goodwill by

segment at September 30, 2006: