Energizer 2006 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2006 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

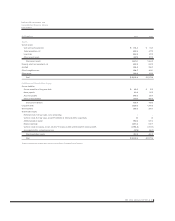

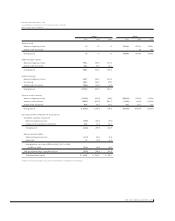

ENERGIZER HOLDINGS, INC.

Management’s Discussion and Analysis of Results of Operations and Financial Condition

(Dollars in millions, except per share and percentage data)

18 ENR 2006 ANNUAL REPORT

limit the Company’s ability to meet future operating expenses and

liquidity requirements, fund capital expenditures or service its debt as it

becomes due. Unknown environmental liabilities and greater than antic-

ipated remediation expenses or environmental control expenditures

could have a material impact on the Company’s financial position.

Estimates of environmental liabilities are based upon, among other things,

the Company’s payments and/or accruals with respect to each reme-

diation site; the number, ranking and financial strength of other responsible

parties (PRPs); the status of the proceedings, including various settlement

agreements, consent decrees or court orders; allocations of volumetric

waste contributions and allocations of relative responsibility among PRPs

developed by regulatory agencies and by private parties; remediation

cost estimates prepared by governmental authorities or private technical

consultants; and the Company’s historical experience in negotiating and

settling disputes with respect to similar sites – and such estimates

may prove to be inaccurate. The Company’s overall tax rate in future

years may be higher than anticipated because of unforeseen changes in

the tax laws or applicable rates, higher taxes on repatriated earnings or

increased foreign losses. Economic turmoil and currency fluctuations

could increase the Company’s risk from unfavorable impact on variable-

rate debt, currency derivatives and other financial instruments. Deferred

compensation liabilities reflecting the value of the Common Stock may

increase significantly, depending on market fluctuation and employee

elections, but such increase may not be reflected in a comparable increase

in the value of the prepaid share option. Adjustments to accruals for

promotional programs and calculations of impairment of long-lived

assets may be more significant than anticipated. The impact of decreases

in the expected returns from pension assets may have a greater than antic-

ipated impact on pension expenses. Additional risks and uncertainties

include those detailed from time to time in the Company’s publicly filed

documents, including its Registration Statement on Form 10, as amended,

and its Current Report on Form 8-K dated April 25, 2000.