Energizer 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2006 ANNUAL REPORT 29

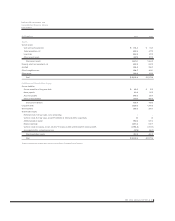

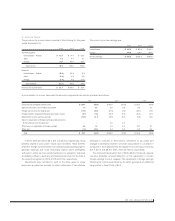

A reconciliation of income taxes with the amounts computed at the statutory federal rate follows:

2006 2005 2004

Computed tax at federal statutory rate $ 124.8 35.0% $ 136.0 35.0% $ 121.7 35.0%

State income taxes, net of federal tax benefit 1.9 0.5 3.0 0.8 3.0 0.9

Foreign tax less than the federal rate (17. 7) (5 . 0 ) (27.4) (7.0) (26.1) (7.5)

Foreign benefits recognized related to prior years’ losses (5.7) (1.6) (14.7) (3.8) (16.2) (4.7)

Adjustments to prior year tax accruals (10.9) (3.1) (10.6) (2.7) (8.5) (2.4)

Taxes on repatriation of foreign earnings under provisions

of the American Jobs Creation Act –– 9.0 2.3 – –

Other taxes on repatriation of foreign earnings 4.5 1.3 9.4 2.4 10.7 3.1

Other, net (1.2) (0.3) 3.3 0.8 2.2 0.6

Total $ 95.7 26.8% $ 108.0 27.8% $ 86.8 25.0%

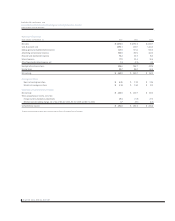

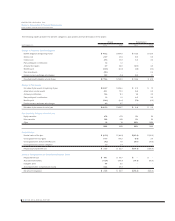

4. Income Taxes

The provisions for income taxes consisted of the following for the years

ended September 30:

2006 2005 2004

Currently payable:

United States – Federal $ 63.7 $ 71.4 $ 62.6

State 3.6 5.3 5.1

Foreign 51.7 46.9 37.3

Total current 119.0 123.6 105.0

Deferred:

United States – Federal (15.8) (12.3) (5.1)

State (0.6) (1.7) (1.5)

Foreign (6.9) (1.6) (11. 6)

Total deferred (23.3) (15.6) (18.2)

Provision for income taxes $ 95.7 $ 108.0 $ 86.8

The source of pre-tax earnings was:

2006 2005 2004

United States $ 160.2 $ 150.6 $ 156.2

Foreign 196.4 238.1 191.6

Pre-tax earnings $ 356.6 $ 388.7 $ 347.8

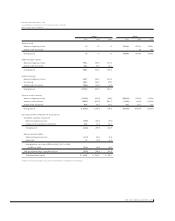

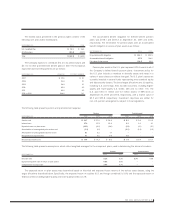

In 2006, 2005 and 2004, $5.7, $14.7 and $16.2, respectively, of tax

benefits related to prior years’ losses were recorded. These benefits

related to foreign countries where our subsidiary subsequently began to

generate earnings and could reasonably expect future profitability

sufficient to utilize tax loss carryforwards prior to expiration. Improved

profitability in Mexico, Germany and Switzerland account for the bulk of

the amount recognized in 2006, 2005 and 2004, respectively.

Adjustments were recorded in each of the three years to revise

previously recorded tax accruals to reflect refinement of tax attribute

estimates to amounts in filed returns, settlement of tax audits and

changes in estimates related to uncertain tax positions in a number of

jurisdictions. Such adjustments decreased the income tax provision by

$10.9, $10.6 and $8.5 in 2006, 2005 and 2004, respectively.

The American Jobs Creation Act of 2004 (AJCA) introduced a special

one-time dividends received deduction on the repatriation of certain

foreign earnings to a U.S. taxpayer. The repatriation of foreign earnings

following the criteria prescribed by the AJCA generated an additional

tax provision in fiscal 2005 of $9.0.