Energizer 2006 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2006 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2006 ANNUAL REPORT 13

$12.9 increase in the fourth quarter primarily in support of Quattro

Titanium. The decline in A&P for the year reflects lower consumer pro-

motions and sampling, partially offset by higher advertising. R&D and

marketing and selling spending increased $4.6 and $2.5, respectively.

Sales in 2005 increased $62.7, or 7%, in 2005 including favorable

currency impacts of $23.9. Absent currencies, sales increased $38.8,

or 4%, as incremental sales of Quattro for Women, Quattro Power and

Quattro Energy totaling $67.8, and higher disposable and replacement

blade sales were partially offset by lower sales of base Quattro and

Intuition razor handles, as those product sales normalized following

significant trial-generating promotional activity in the U.S. and initial

product launches in international markets. Legacy brands also declined

as sales shifted to newer products.

Segment profit for 2005 increased $31.3 with favorable currency

impacts accounting for $6.6. Absent currencies, segment profit

increased 32% as margin contribution from higher sales of $21.0 and

lower A&P expense of $12.2 were partially offset by higher SG&A

of $8.6. The decline in A&P in 2005 reflects a return to normalized

spending levels following major launches in international markets last

year. The increase in SG&A spending reflects increased investment

in resources to support business growth; however, this increase repre-

sents a slight reduction in SG&A as a percent of sales.

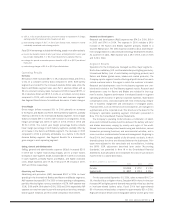

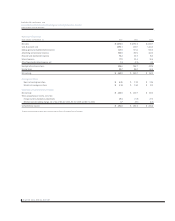

GENERAL CORPORATE AND OTHER EXPENSES

2006 2005 2004

General corporate expenses $ 87.0 $92.6 $ 62.2

Restructuring and related charges 37.4 5.7 5.2

Initial integration of SWS –3.4 17.9

Foreign pension charge 4.5 ––

Special pension termination benefits ––15.2

General corporate and other expenses $ 128.9 $101.7 $ 100.5

% of total net sales 4.2% 3.4% 3.6%

General Corporate Expenses

General corporate expenses decreased $5.6 in 2006 compared to

2005, due to lower incentive and stock-based compensation and legal

expenses. General corporate expenses in 2005 increased $30.4 com-

pared to 2004, due to higher expenses for incentive and stock-based

compensation, retirement plans, financial compliance, information

systems and litigation.

Restructuring and Related Charges

The Company continually reviews its battery and razor and blades

business models to identify potential improvements and cost savings.

A project commenced in 2006 to improve effectiveness and lower costs

of European packaging, warehouse and distribution activities, including

the closing of the Company’s battery packaging facility in Caudebec,

France, as well as consolidation of warehouse and distribution activities.

Total project charges of $24.1 were recorded in fiscal 2006, including

$15.9 of exit costs charged to SG&A expense representing employee

severance, contract terminations and other exit costs. Other costs asso-

ciated with the project were $8.2. Annual cost savings of $6.2 are

expected, commencing in fiscal 2007. As of September 30, 2006, the proj-

ect is substantially complete and virtually all charges have been recorded.

The Company has also commenced a project to integrate battery

and razor and blades commercial management, sales and administrative

functions in certain European countries. Specific actions related to this

project are in various stages of evaluation, planning and execution. It is

anticipated that the total project will result in charges to pre-tax

earnings of $27 to $33, the bulk of which will occur by the end of 2007.

Total pre-tax charges related to the project were $13.3 in fiscal 2006,

recorded in SG&A expense, and include exit costs of $12.3 which

represent employee severance, contract terminations and other exit

costs as well as $1.0 for other costs related to the project. It is expected

the project will result in $15 to $20 of annualized cost savings once fully

implemented. Cost savings of $2 have been realized in 2006.

See Note 5 to the Consolidated Financial Statements for further

information on 2006 restructuring activities.

Initial Integration of SWS

Major integration activities related to the SWS acquisition were completed

as of September 30, 2004. Integration savings in 2004 were approxi-

mately $13, increasing to approximately $18 in 2005 and thereafter.

Foreign Pension Charge

In September 2006, the Company discovered that one of its non-U.S.

subsidiaries had failed over several years to adjust its statutory pension

accounting to U.S. GAAP, resulting in a cumulative understatement of

its pension liability by $4.5 at September 30, 2005. A charge of $4.5,

or $3.7 after-tax, was recorded in the fourth quarter of 2006 to correct

the cumulative understatement in prior years, in addition to the recording

of the 2006 additional U.S. GAAP expense of $0.6. The Company has

determined the effect of this error is not material to any of its previously

issued quarterly or annual financial statements, including for the year

ended September 30, 2006.

Special Pension Termination Benefits

During the fourth quarter of fiscal 2004, Energizer announced a

Voluntary Enhanced Retirement Option (VERO) offered to approximately

600 eligible employees in the U.S. of which 321 employees accepted.

A charge of $15.2, pre-tax, was recorded in fiscal 2004 related to the

VERO and certain other special pension benefits and the estimated

impact of such benefits on the Company’s pension plan. Cost savings

from the VERO program were $6 in 2005, increasing to approximately

$10 in 2006 and beyond.

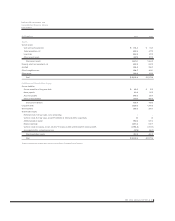

Interest and Other Financing Items

Interest expense increased $25.5 in 2006 and $21.6 in 2005 due to

higher average borrowings resulting from share repurchases and higher

interest rates.

Other financing expense was unfavorable $3.6 in 2006 compared

to 2005 and favorable $4.3 in 2005 compared to 2004, primarily due

to lower currency exchange losses in 2005 than in 2006 and 2004.