Energizer 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)

36 ENR 2006 ANNUAL REPORT

9. Defined Contribution Plan

The Company sponsors a defined contribution plan, which extends

participation eligibility to substantially all U.S. employees. The Company

matches 50% of participants’ before-tax contributions up to 6% of eligible

compensation. In addition, participants can make after-tax contribu-

tions into the plan. The participant’s after-tax contribution of 1% of

eligible compensation is matched with a 325% Company contribution

to the participant’s pension plan. Amounts charged to expense during

fiscal 2006, 2005 and 2004 were $5.4, $5.2 and $5.4, respectively,

and are reflected in SG&A and cost of products sold in the Consolidated

Statement of Earnings.

10. Debt

Notes payable at September 30, 2006 and 2005 consisted of notes

payable to financial institutions with original maturities of less than one

year of $63.6 and $101.2, respectively, and had a weighted-average

interest rate of 6.0% and 4.7%, respectively.

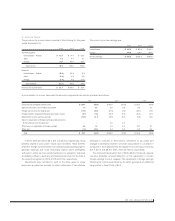

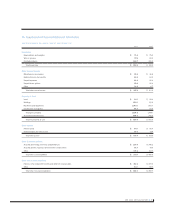

The detail of long-term debt at September 30 is as follows:

2006 2005

Private Placement, fixed interest rates ranging

from 2.7% to 6.2%, due 2007 to 2016 $ 1,485.0 $ 1,000.0

Singapore Bank Syndication, multi-currency

facility, variable interest at LIBOR + 55 basis

points, or 6.7%, due 2010 225.0 310.0

Total long-term debt, including current maturities 1,710.0 1, 310.0

Less current portion 85.0 15 . 0

Total long-term debt $ 1,625.0 $ 1,295.0

The Company maintains total committed debt facilities of $2,185.0,

of which $475.0 remained available as of September 30, 2006.

Under the terms of the facilities, the ratio of the Company’s total

indebtedness to its EBITDA generally cannot be greater than 3.5 to 1

and the ratio of its EBIT to total interest expense must exceed 3 to 1.

Additional restrictive covenants exist under current debt facilities.

Failure to comply with the above ratios or other covenants could result

in acceleration of maturity, which could trigger cross defaults on other

borrowings. The Company believes that covenant violations resulting

in acceleration of maturity is unlikely. The Company’s fixed rate debt

is callable by the Company, subject to a “make whole” premium, which

would be required to the extent the underlying benchmark U.S. treasury

yield has declined since issuance.

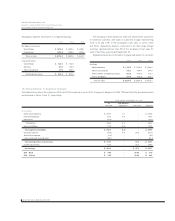

Aggregate maturities on all long-term debt at September 30, 2006

are as follows: $85.0 in 2007, $135.0 in 2008, $100.0 in 2009, $445.0

in 2010, $165.0 in 2011, and $780.0 thereafter.

In July 2006, the Company completed a new $500.0 long-term

financing agreement. Maturities on the new debt are as follows: $80.0

in 2009 and $140.0 each in 2011, 2014 and 2016 with fixed rates ranging

from 6.0% to 6.2%. Approximately $420 of the proceeds from these

notes were used to pay down existing variable rate debt with the

remaining proceeds being held for general corporate purposes.

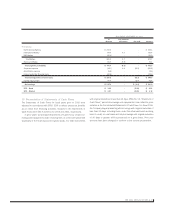

11. Preferred Stock

The Company’s Articles of Incorporation authorize the Company to

issue up to 10 million shares of $0.01 par value of preferred stock.

During the three years ended September 30, 2006, there were no

shares of preferred stock outstanding.

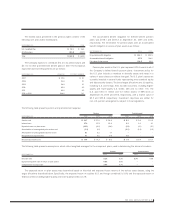

12. Shareholders Equity

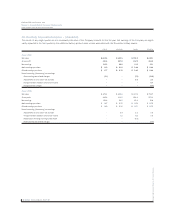

On March 16, 2000, the Board of Directors declared a dividend of one

share purchase right (Right) for each outstanding share of ENR com-

mon stock. Each Right entitles a shareholder of ENR stock to purchase

an additional share of ENR stock at an exercise price of $150.00, which

price is subject to anti-dilution adjustments. Rights, however, may only

be exercised if a person or group has acquired, or commenced a public

tender for 20% or more of the outstanding ENR stock, unless the acqui-

sition is pursuant to a tender or exchange offer for all outstanding

shares of ENR stock and a majority of the Board of Directors deter-

mines that the price and terms of the offer are adequate and in the best

interests of shareholders (a Permitted Offer). At the time that 20% or

more of the outstanding ENR stock is actually acquired (other than in

connection with a Permitted Offer), the exercise price of each Right will

be adjusted so that the holder (other than the person or member of

the group that made the acquisition) may then purchase a share of ENR

stock at one-third of its then-current market price. If the Company

merges with any other person or group after the Rights become

exercisable, a holder of a Right may purchase, at the exercise price,

common stock of the surviving entity having a value equal to twice the

exercise price. If the Company transfers 50% or more of its assets or

earnings power to any other person or group after the Rights become

exercisable, a holder of a Right may purchase, at the exercise price,

common stock of the acquiring entity having a value equal to twice the

exercise price.

The Company can redeem the Rights at a price of $0.01 per Right at

any time prior to the time a person or group actually acquires 20% or

more of the outstanding ENR stock (other than in connection with a

Permitted Offer). In addition, following the acquisition by a person or

group of at least 20%, but not more than 50% of the outstanding ENR

stock (other than in connection with a Permitted Offer), the Company

may exchange each Right for one share of ENR stock. The Company’s

Board of Directors may amend the terms of the Rights at any time

prior to the time a person or group acquires 20% or more of the

outstanding ENR stock (other than in connection with a Permitted

Offer) and may amend the terms to lower the threshold for exercise of

the Rights. If the threshold is reduced, it cannot be lowered to a per-

centage that is less than 10% or, if any shareholder holds 10% or more

of the outstanding ENR stock at that time, the reduced threshold must

be greater than the percentage held by that shareholder. The Rights will

expire on April 1, 2010.

At September 30, 2006, there were 300 million shares of ENR stock

authorized, of which approximately 4.7 million shares were reserved for

issuance under the 2000 Incentive Stock Plan.

Beginning in September 2000, the Company’s Board of Directors

has approved a series of resolutions authorizing the repurchase of