Energizer 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)

34 ENR 2006 ANNUAL REPORT

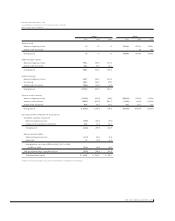

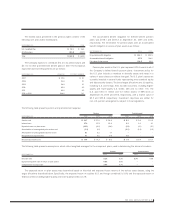

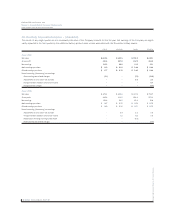

The following tables present the benefit obligation, plan assets and funded status of the plans:

Pension Postretirement

SEPTEMBER 30, 2006 2005 2006 2005

Change in Projected Benefit Obligation

Benefit obligation at beginning of year $ 740.2 $ 659.8 $ 61.5 $ 53.5

Service cost 24.7 27.4 0.3 0.3

Interest cost 37.6 37.3 3.3 3.2

Plan participants’ contributions 1.2 1.2 – –

Actuarial loss/(gain) 4.7 64.0 (12.1) 4.0

Benefits paid (36.6) (48.1) (1.6) (3.2)

Plan amendments (10.1) ––2.6

Foreign currency exchange rate changes 10.9 (1.4) 0.2 1.1

Projected benefit obligation at end of year $ 772.6 $ 740.2 $ 51.6 $ 61.5

Change in Plan Assets

Fair value of plan assets at beginning of year $ 655.7 $ 608.6 $ 2.2 $ 1.9

Actual return on plan assets 49.1 79.2 0.4 0.3

Company contributions 13.6 14 .1 1.4 3.0

Plan participants’ contributions 1.2 1.2 6.0 3.5

Benefits paid (36.6) (48.1) (7.6) (6.5)

Foreign currency exchange rate changes 6.3 0.7 ––

Fair value of plan assets at end of year $ 689.3 $ 655.7 $ 2.4 $ 2.2

Plan Assets by Category at end of year

Equity securities 67% 67% 0% 0%

Debt securities 32% 32% 0% 0%

Other 1% 1% 100% 100%

100% 100% 100% 100%

Funded Status

Funded status of the plan $ (83.3) $ (84.5) $ (49.2) $ (59.3)

Unrecognized net loss/(gain) 117. 7 108.2 (9.0) 3.6

Unrecognized prior service (benefit)/cost (9.2) 7.8 (28.1) (30.3)

Unrecognized net transition obligation 1.3 1.4 ––

Prepaid (accrued) benefit cost $ 26.5 $ 32.9 $ (86.3) $ (86.0)

Amounts Recognized in the Consolidated Balance Sheet

Prepaid benefit cost $ 88.1 $ 85.9 $–$ –

Accrued benefit liability (112.4) (105.9) (86.3) (86.0)

Intangible asset 4.4 3.6 ––

Accumulated other comprehensive income 46.4 49.3 ––

Net amount recognized $ 26.5 $ 32.9 $ (86.3) $(86.0)