Energizer 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)

32 ENR 2006 ANNUAL REPORT

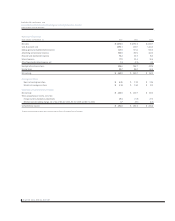

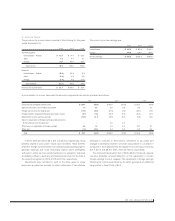

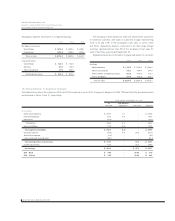

was $15.27 and $14.81 per option, respectively. This was estimated at

the grant date using the Black-Scholes option-pricing model with the

following weighted-average assumptions:

2005 2004

Risk-free interest rate 3.86% 3.92%

Expected life of option 6 years 7.5 years

Expected volatility of ENR stock 22.2% 19.4%

Expected dividend yield on ENR stock – –

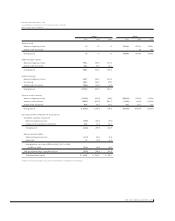

As of September 30, 2006, there was $3.6 of total unrecognized

compensation costs related to stock options granted, which will be

recognized over a weighted-average period of approximately six months.

For outstanding nonqualified stock options, the weighted average

remaining contractual life is 5.1 years.

The following table summarizes nonqualified ENR stock option

activity during the current year (shares in millions):

Weighted-Average

Shares Exercise Price

Outstanding on October 1, 2005 4.76 $ 25.38

Exercised (0.92) 23.33

Cancelled (0.03) 28.57

Outstanding on September 30, 2006 3.81 25.85

Exercisable on September 30, 2006 2.79 $ 21.45

Restricted Stock Equivalents (RSE)

In October 2005, the Board of Directors approved two different grants

of RSE. First, a grant to key employees, included approximately 73,000

shares that vest ratably over four years. The second grant for 80,000

shares was awarded to a group of key senior management and consists

of two pieces: 1) 25% of the total restricted stock equivalents granted

vest on the third anniversary of the date of grant; 2) the remainder vests

on the date that the Company publicly releases its earnings for its 2008

fiscal year contingent upon the Company’s compound annual growth in

earnings per share (CAGR) for the three year period ending on

September 30, 2008. If a CAGR of 10% is achieved, an additional 25% of

the grant vests. The remaining 50% will vest in its entirety on the third

anniversary of the grant date, only if the Company achieves a CAGR at or

above 15%, with smaller percentages of that remaining 50% vesting if

the Company achieves a CAGR between 11% and 15%. The total award

expected to vest is amortized over the vesting period.

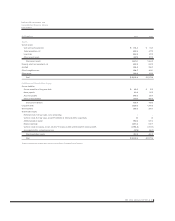

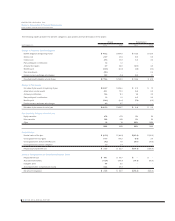

The following table summarizes RSE activity during the current year

(shares in millions):

Weighted-Average

Grant Date

Shares Fair Value

Nonvested RSE at October 1, 2005 0.52 $ 36.76

Granted 0.15 52.81

Vested (0.13) 33.43

Cancelled (0.01) 29.60

Nonvested RSE at September 30, 2006 0.53 $ 42.44

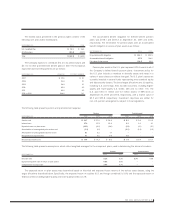

As of September 30, 2006, there was $11.6 of total unrecognized

compensation costs related to RSE granted under the Plan, which will be

recognized over a weighted-average period of approximately 2.7 years.

The weighted-average fair value for RSE granted in 2006, 2005 and

2004 was $52.81, $48.90 and $38.77, respectively. The fair value of RSE

vested in 2006, 2005 and 2004 was $6.9, $1.9 and $4.5, respectively.

Subsequent to year-end, in October 2006, the Board of Directors

approved two grants of RSE. First, a grant to key employees, included

approximately 108,225 shares that vest ratably over four years. The

second grant for 303,000 shares was awarded to key senior manage-

ment with similar performance and vesting requirements to the RSE

award granted in 2005, as described above.

Other Share-Based Compensation

During the quarter ended December 31, 2005, the Board of Directors

approved an award for officers of the Company. This award totaled

196,800 share equivalents and has the same features as the restricted

stock award granted to senior management discussed above, but will be

settled in cash and mandatorily deferred until the individual’s retirement

or other termination of employment. The total award expected to vest is

amortized over the three year vesting period and the amortized portion is

recorded at the closing market price of Energizer stock at each period

end. As of September 30, 2006, there was $9.4 of total unrecognized

compensation costs related to this award. The related liability is reflected

in Other Liabilities in the Company’s Consolidated Balance Sheet.