Energizer 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2006 ANNUAL REPORT 19

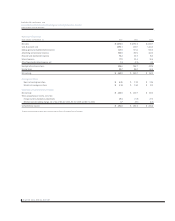

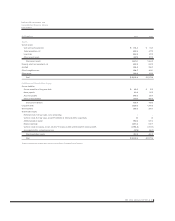

Statement of Earnings Data

FOR THE YEAR ENDED SEPTEMBER 30, 2006 2005 2004 2003(a) 2002

Net sales $ 3,076.9 $ 2,989.8 $ 2,812.7 $ 2,232.5 $ 1,739.7

Depreciation and amortization 117. 5 116.3 115.8 83.2 57.4

Earnings before income taxes (b) 356.6 388.7 347.8 227.3 265.3

Income taxes 95.7 108.0 86.8 63.8 86.9

Net earnings (c) 260.9 280.7 261.0 163.5 178.4

Earnings per share:

Basic $ 4.26 $ 3.95 $ 3.24 $ 1.90 $ 1.96

Diluted $ 4.14 $ 3.82 $ 3.13 $ 1.85 $ 1.92

Average shares outstanding:

Basic 61.2 71.0 80.6 85.9 91.0

Diluted 63.1 73.5 83.4 88.2 92.8

Balance Sheet Data

SEPTEMBER 30, 2006 2005 2004 2003(a) 2002

Working capital $ 708.2 $ 626.4 $ 469.2 $ 516.0 $ 363.0

Property, plant and equipment, net 659.9 682.5 705.6 701.2 455.7

Total assets 3,132.6 2,973.8 2,931.7 2,747.3 1,603.6

Long-term debt 1,625.0 1,295.0 1,059.6 913.6 160.0

(a) Schick-Wilkinson Sword was acquired March 28, 2003.

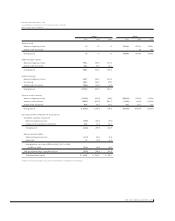

(b) Earnings before income taxes were (reduced)/increased due to the following items:

FOR THE YEAR ENDED SEPTEMBER 30, 2006 2005 2004 2003 2002

Provisions for restructuring and related costs $ (37.4) $ (5.7) $ (5.2) $ (0.2) $ (10.3)

Foreign pension charge (4.5) ––––

Special termination benefits ––(15.2) – –

Acquisition inventory valuation –––(89.7)–

Early debt payoff –– – (20.0) –

Kmart accounts receivable write-down –– –– (15.0)

Gain on sale of property –– –5.7 6.3

Intellectual property rights income –– 1.58.5 –

Total $ (41.9) $ (5.7) $ (18.9) $ (95.7) $ (19.0)

(c) Net earnings were (reduced)/increased due to the following items:

FOR THE YEAR ENDED SEPTEMBER 30, 2006 2005 2004 2003 2002

Provisions for restructuring and related costs, net of tax $ (24.9) $ (3.7) $ (3.8) $ – $ (7.8)

Foreign pension charge, net of tax (3.7) ––––

Special termination benefits, net of tax –– (9.6) – –

Acquisition inventory valuation, net of tax –– – (58.3) –

Early debt payoff, net of tax –– –(12.4)–

Kmart accounts receivable write-down, net of tax –– ––(9.3)

Gain on sale of property, net of tax –– –5.7 5.0

Tax benefits recognized related to prior years’ losses 5.7 14. 7 16. 2 12.2 6 . 7

Adjustments to prior year tax accruals 10.9 10.6 8.5 7.0 5.1

Repatriation under the American Jobs Creation Act –(9.0) – – –

Intellectual property rights income, net of tax –– 0.9 5.2 –

Total $ (12.0) $ 12.6 $ 12.2 $ (40.6) $ (0.3)

ENERGIZER HOLDINGS, INC.

Summary Selected Historical Financial Information

(Dollars in millions, except per share data)