Energizer 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

Management’s Discussion and Analysis of Results of Operations and Financial Condition

(Dollars in millions, except per share and percentage data)

12 ENR 2006 ANNUAL REPORT

than 40%. Battery charger sales were up more than 50%, including

the launch of our new Energi To Go cell phone charger line. The price

portfolio, which includes carbon zinc and Eveready Gold alkaline batter-

ies, volume declined 2% in 2006. Overall pricing and product mix were

unfavorable $7.6 in 2006 as higher list prices, particularly in the latter

portion of the year, were more than offset by a continuing shift

to trade channels that feature larger package sizes with lower per

unit prices. Canadian currency translation favorably impacted sales by

$6.1 in 2006 compared to 2005.

Gross margin dollars increased $10.9 in 2006 as contribution from

higher sales was partially offset by $16.7 of unfavorable product costs.

Material and distribution costs were unfavorable $20, with zinc cost

increases accounting for the bulk of the total. Segment profit increased

$4.9, as higher gross margin was partially offset by higher A&P and

general and administrative expenses.

For the year ended September 30, 2005, sales increased $55.5,

or 5%, as incremental sales volume of $91.1 and favorable Canadian

currency translation of $7.3 was partially offset by unfavorable pricing

and product mix of $42.9. Fiscal 2005 sales included approximately

$21 of hurricane-related incremental sales compared to approximately

$40 in fiscal 2004. Energizer MAX volume for the year increased 8%, as

higher general demand was partially offset by lower hurricane-related

sales in 2005 compared to 2004. High performance rechargeable and

e2lithium product sales increased in excess of 20%. Overall pricing and

product mix were unfavorable in 2005 on the aforementioned mix shift,

and pricing declines in non-Energizer branded products.

Gross margin dollars declined $6.4 in 2005. The margin contribution

of higher sales volume and favorable currency translation of $6.6 were

substantially offset by unfavorable pricing and product mix. Product

cost was unfavorable $13.4 as higher commodity-based material costs

of approximately $17 were partially offset by other production cost savings.

Segment profit declined $2.4 as lower gross margin was partially offset

by lower general and administrative and A&P expenses.

Looking ahead, key commodity metal material costs are currently

above the already historically high costs of 2006. At current prices, zinc

costs for 2007 will be more than double the 2006 rates. If product sold

during 2006 had been produced at anticipated 2007 production costs,

the result would have been additional costs of $31 to $34. Previously

implemented price increases will improve the pricing early in fiscal

2007, but will be insufficient to cover the entire current cost increase

in the first fiscal quarter. Energizer has announced a price increase in

the U.S. as of January 2007, which is intended to cover the bulk of

the material cost increase. Per unit gross margin will continue to be

unfavorable until the January 2007 price increase takes effect.

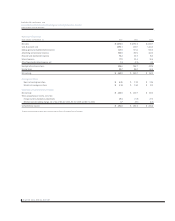

INTERNATIONAL BATTERY

2006 2005 2004

Net sales $ 913.3 $ 885.9 $ 827.0

Segment profit $ 177.3 $ 178.5 $ 152.4

For the year ended September 30, 2006, net sales increased $27.4,

or 3%. Excluding currency impacts, International Battery sales increased

$38.3, or 4%, on higher volume partially offset by unfavorable pricing and

product mix, primarily in Europe. An extremely competitive European

pricing environment, combined with sales shifting to larger package sizes

that sell at lower per unit prices, account for the unfavorable pricing.

Gross margin declined $9.7 in 2006, including $7.0 of unfavorable

currency impact. Absent currencies, gross margin declined $2.7 in spite

of higher sales as the contribution of higher volume was more than offset

by unfavorable pricing and product mix and higher material costs. Overall

product cost was unfavorable $9.6 as higher material and distribution

costs of $16 were partially offset by other production cost savings.

Segment profit declined $1.2, including $4.2 unfavorable currency

impact. Absent currencies, segment profit increased 2% as lower A&P

expense more than offset gross margin declines and higher selling costs.

For the year ended September 30, 2005, net sales increased $58.9,

or 7%, on favorable currency impacts of $32.4 and contributions of

higher sales volume of $35.1, partially offset by unfavorable pricing and

product mix, primarily in Europe. Segment profit increased $26.1 for the

year, including a $15.8 favorable impact from currencies. Absent cur-

rencies, segment profit increased $10.3 as a $9.0 gross margin increase

from higher sales and lower A&P was partially offset by higher SG&A.

As discussed above, material costs will be unfavorable in 2007.

If product sold during 2006 had been produced at anticipated

2007 production costs, the result would have been additional costs of

$29 to $31. Pricing actions have been taken in 2006 in a number of

markets, with additional increases scheduled during 2007. Given the

competitive situation in many markets, it is not yet known whether

pricing in 2007 will be sufficient to offset product cost increases. Per

unit gross margin will continue to be unfavorable until the 2007 price

increase takes effect.

RAZORS AND BLADES

2006 2005 2004

Net sales $ 929.8 $ 930.8 $ 868.1

Segment profit $127.7 $ 107.5 $ 76.2

Razors and Blades sales in 2006 declined $1.0 in absolute dollars but

increased $17.5, or 2%, on a constant currency basis. The increase on a

constant currency basis reflects incremental sales of newly launched

products, partially offset by declines in older technology products.

Excluding currency impacts, Quattro for Women and Intuition contributed

$44 of sales growth while disposables and the men's Quattro franchise

grew $15 and $8, respectively. These increases were partially offset by

declines in older technology systems and ancillary product lines.

Segment profit increased $20.2 in absolute dollars and $27.8, or

26%, on a constant currency basis. Excluding currency, higher sales,

lower product cost and cost mix accounted for the bulk of the improved

profitability. In spite of higher commodities, plant cost containment

activities delivered net razors and blades product cost savings of $13.

In addition, the segment profit comparison benefited from several

one-time product cost items in the prior year that were not repeated

this year and a favorable cost mix. A&P expense declined $9.8 for the

year as significant reductions in early 2006 were partially offset by a