Energizer 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)

30 ENR 2006 ANNUAL REPORT

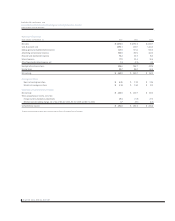

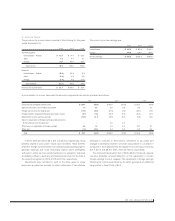

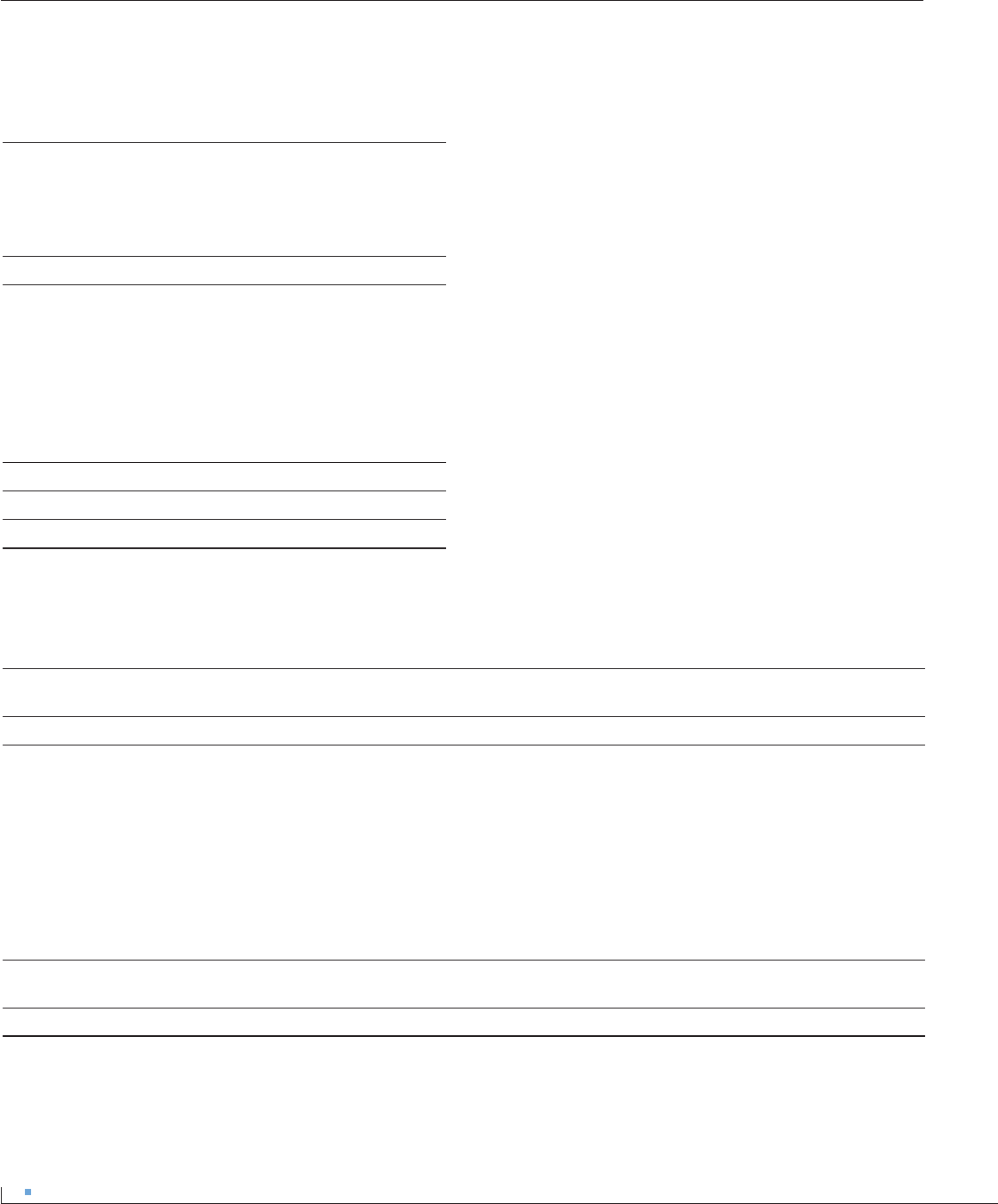

The deferred tax assets and deferred tax liabilities recorded on the

balance sheet as of September 30 are as follows and include current

and non-current amounts:

2006 2005

Deferred tax liabilities:

Depreciation and property differences $ (80.8) $ (87.8)

Intangible assets (41.7) (38.5)

Pension plans (30.9) (39.0)

Other tax liabilities (3.2) (4.8)

Gross deferred tax liabilities (156.6) (170.1)

Deferred tax assets:

Accrued liabilities 63.9 62.2

Deferred and stock-related compensation 69.7 57.5

Tax loss carryforwards and tax credits 24.0 29.1

Intangible assets 36.7 42.1

Postretirement benefits other than pensions 28.4 29.9

Inventory differences 18. 9 18.1

Other tax assets 31.2 31.2

Gross deferred tax assets 272.8 270.1

Valuation allowance (10.7) (15.1)

Net deferred tax assets $ 105.5 $ 84.9

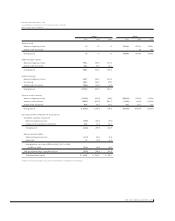

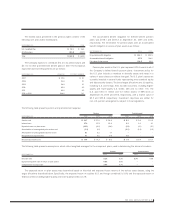

There were no tax loss carryforwards that expired in 2006. Future

expirations of tax loss carryforwards and tax credits, if not utilized, are

as follows: 2007, $0.3; 2008, $0.2; 2009, $1.0; 2010, $1.3; 2011, $10.6;

thereafter or no expiration, $10.6. The valuation allowance is attributed

to tax loss carryforwards and tax credits outside the U.S. The valuation

allowance decreased $4.4 in 2006 primarily due to projected utilization

in future years that are deemed more likely than not, partially offset by

additional deferred tax assets deemed unlikely to be realized.

At September 30, 2006, approximately $235 of foreign subsidiary

net earnings was considered permanently invested in those businesses.

U.S. income taxes have not been provided for such earnings. It is not

practicable to determine the amount of unrecognized deferred tax

liabilities associated with such earnings.

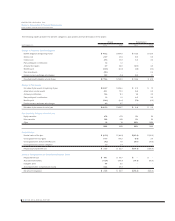

5. Restructuring and Related Charges

The Company continually reviews its battery and razor and blades

business models to identify potential improvements and cost savings. A

project commenced in 2006 to improve effectiveness and lower costs of

European packaging, warehouse and distribution activities, including the

closing of the Company’s battery packaging facility in Caudebec, France,

as well as consolidation of warehouse and distribution activities. Total

project charges of $24.1 were recorded in fiscal 2006, including $15.9

of exit costs charged to SG&A expense representing employee sever-

ance, contract terminations and other exit costs. Other costs associated

with the project were $8.2. As of September 30, 2006, the project is

substantially complete and virtually all charges have been recorded.

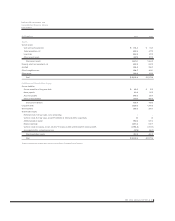

The exit cost liability for this project is as follows: Total Contract Other Exit Total Exit

Severance Terminations Costs Costs

Provision $ 12.4 $ 1.4 $ 2.1 $ 15.9

Activity (4.0) (0.1) (0.4) (4.5)

Balance at September 30, 2006 $ 8.4 $ 1.3 $ 1.7 $ 11.4

The Company has also commenced a project to integrate battery

and razor and blades commercial management, sales and adminis-

trative functions in certain European countries. Specific actions related

to this project are in various stages of evaluation, planning and execu-

tion. It is anticipated that the total project will result in charges to

pre-tax earnings of $27 to $33, the bulk of which will occur by the end

of 2007. Total pre-tax charges related to the project were $13.3 in

fiscal 2006, recorded in SG&A expense and include exit costs of

$12.3 which represent employee severance, contract terminations and

other exit costs as well as $1.0 for other costs related to the project.

The exit cost liability for this project is as follows: Total Contract Total Exit

Severance Terminations Costs

Provision $ 10.6 $1.7 $12.3

Activity (1.6) – (1.6)

Balance at September 30, 2006 $ 9.0 $ 1.7 $ 10.7