Energizer 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2006 ANNUAL REPORT 33

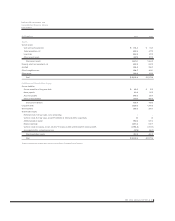

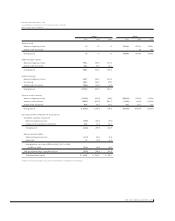

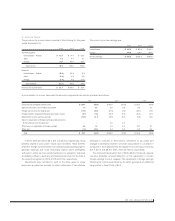

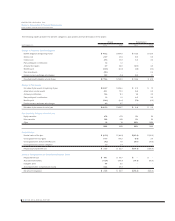

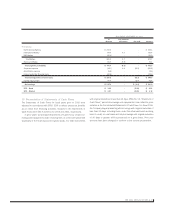

8. Pension Plans and Other Postretirement Benefits

The Company has several defined benefit pension plans covering

substantially all of its employees in the U.S. and certain employees in

other countries. The plans provide retirement benefits based on years

of service and earnings.

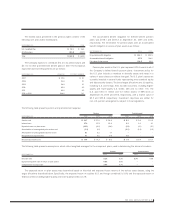

During fiscal 2006, the U.S. postretirement plan was amended to

eliminate disability benefits for participants who become disabled on or

after January 1, 2007. Simultaneously, the Company will begin providing

long-term disability insurance for U.S. employees. Current disabled

participants will continue to receive or accrue benefits under the plan

as of their disability date. The amendment reduced the plan’s projected

benefit obligation by $10.1.

In September 2006, the Company discovered that one of its non-U.S.

subsidiaries had failed over several years to adjust its statutory pension

accounting to U.S. GAAP, resulting in a cumulative understatement of its

pension liability by $4.5 at September 30, 2005. A charge of $4.5, or

$3.7 after-tax, was recorded in the fourth quarter of 2006 to correct the

cumulative understatement in prior years, in addition to the recording of

the 2006 additional U.S. GAAP expense of $0.6. The Company has deter-

mined the effect of this error is not material to any of its previously issued

quarterly or annual financial statements, including for the year ended 2006.

During the fourth quarter of fiscal 2004, the Company announced a

Voluntary Enhanced Retirement Option (VERO) offered to approximately

600 eligible employees in the U. S. of which 321 employees accepted.

A charge of $15.2, pre-tax, was recorded during the fourth quarter of

fiscal 2004 related to the VERO and certain other special pension

benefits, and the estimated impact of such benefits on the Company’s

pension plan is reflected in the amounts presented in the following tables.

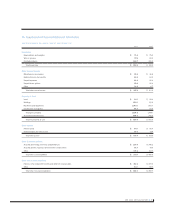

The Company also sponsors or participates in a number of other

non-U.S. pension arrangements, including various retirement and

termination benefit plans, some of which are required by local law or

coordinated with government-sponsored plans, which are not signifi-

cant in the aggregate and therefore are not included in the information

presented in the following tables.

The Company currently provides other postretirement benefits,

consisting of health care and life insurance benefits for certain groups

of

retired employees. Certain retirees are eligible for a fixed subsidy,

provided

by the Company, toward their total cost of health care

benefits. Retiree contributions for health care benefits are adjusted

periodically to cover the increase in total plan costs of the plan cost.

Cost trend rates no longer materially impact the Company’s future cost

of the plan.