Energizer 2005 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2005 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

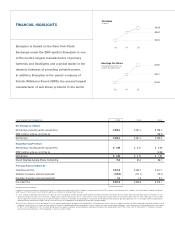

Sales of performance brands climbed 44

percent in fiscal 2005 and are becoming

akey profit contributor. Growth of our

Energizer®e2® Lithium brand has acceler-

ated in recent years due to the emergence

of digital devices for which this product is

ideally suited. Demand continues to out-

pace production and we areaggressively

adding capacity.

Competing in a relatively stable environ-

ment over time, our Batteries and Lighting

Products business provides steady cash

flow and is solidly positioned in the growing

segments of the market.

Razors and Blades. Our growth strategies

for SWS have been in place for two and a

half years and continue to deliver solid

results. Our foremost priority is to trade up

current SWS consumers to higher-priced,

higher-margin shaving systems through

product innovation. The success of this

effort in both men’s and women’s systems

is undeniable – in fact, products introduced

since our acquisition of SWS today account

for over one-third of total SWS sales.

Our second growth strategy is to expand

the SWS product line into new and under-

developed geographic markets by leveraging

our existing battery company infrastructure

and commercial platforms. Since the aquisi-

tion, we introduced shaving products in

southernLatin America, Southeast Asia and

areas of central and eastern Europe where

SWS had minimal presence and Energizer

had large operations. By fiscal year-end,

SWS sales in these underdeveloped mar-

kets had increased 23 percent collectively

over the prior year.

The third strategy is to reduce overhead

costs by continuing to lean our processes

down and to integrate SWS and Energizer,

whereappropriate. Todate, we have com-

pletely consolidated our batteryand blade

organizations in Latin America and many

parts of Asia, and consolidated certain

back-office functions in North America and

westernEurope. Our lean initiatives together

with our integration efforts have yielded

annualized savings of $18 million to date,

and we continue to exploreadditional cost

reduction opportunities, particularly in the

areas of global purchasing and logistics.

AChange in Leadership

During the year, the Board of Directors

increased the size of the Boardfrom 10 to

12. At the annual meeting in January 2005,

shareholders elected two new outside

directors – Bill G. Armstrong and John C.

Hunter – who bring a wealth of business

and leadership experience to our company.

The annual meeting also marked the retire-

ment of two inspirational leaders who have

had an immeasurable impact on the suc-

cess of this company.

J. Patrick Mulcahy served as Chief

Executive Officer of the company since its

spin-off in 2000 and devoted most of his

career to Energizer and its former parent,

Ralston Purina. Pat has been a leader, a

mentor and friend – fortunately for us and

the company, he continues to serve on the

Board as Vice Chairman.

Dr. William H. Danforth, Chancellor Emeritus

of Washington University in St. Louis, served

on the Board and various committees since

our spin-offand on the Boardof Ralston

Purina beginning in 1969. He is a man of

exceptional integrity and intellect, and his

wise counsel has served our company well.

Looking to the Future

We expect the future to be no less challeng-

ing than the present. The overall battery

market remains healthy and digital device

growth continues unabated. In the wet shave

market, we offer more and better products

than ever beforeand consumers continue

to trade up.

Going forward, we arefocused on two clearly

defined financial objectives – to generate

consistent annual earnings per share growth

and to maximize free cash flow. We fully

intend to achieve those objectives by suc-

cessfully executing our ongoing business

strategies – investing in our brands for

future growth, using cash flow to acquire

operating earnings and opportunistically

repurchasing our shares.

ENR 2005 Annual Report 3

David P. Hatfield

Executive Vice President

Chief Marketing Officer

Daniel J. Sescleifer

Executive Vice President

Chief Financial Officer

Ward M. Klein

Chief Executive Officer

Joseph E. Lynch

President and Chief

Executive Officer,

Schick-Wilkinson Sword

Gayle G. Stratmann

Vice President and

General Counsel

Joseph W.

McClanathan

President and Chief

Executive Officer,

Energizer Battery

Peter J. Conrad

Vice President, Human

Resources

Ward M. Klein

Chief Executive Officer

Energizer Holdings, Inc.

November 18, 2005