Energizer 2005 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2005 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

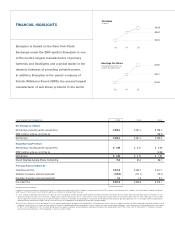

YEAR ENDED SEPTEMBER 30, 2005 2004 2003

Net Earnings (in millions)

Net Earnings, excluding certain unusual items $ 286.4 $ 267.4 $ 228.2

SWS inventory write-up, net of tax (a) (58.3)

Net Earnings $ 286.4 $ 267.4 $ 169.9

Diluted Earnings Per Share

Net Earnings, excluding certain unusual items $ 3.90 $ 3.21 $ 2.59

SWS inventory write-up, net of tax (a) (0.66)

Net Earnings $ 3.90 $ 3.21 $ 1.93

Diluted Weighted-Average Shares Outstanding 73.5 83.4 88.2

Free Cash Flow (in millions) (b)

Operating cash flow $ 316.8 $ 485.7 $ 442.1

Additions to property,plant and equipment (103.0) (121.4) (73.0)

Disposals of property, plant and equipment 5.4 4.3 9.0

Free Cash Flow $ 219.2 $ 368.6 $ 378.1

Non-GAAP Financial Presentation

In addition to its earnings presented in accordance with generally accepted accounting principles (GAAP), Energizer has presented certain non-GAAP measures in the table above which it believes are useful to readers in addition to traditional

GAAP measures. These measures should not be considered as an alternative to comparable GAAP measures.

(a) In 2003, earnings are presented with and without the impact of a write-up recorded on inventory acquired through the purchase of Schick-Wilkinson Sword (SWS) from Pfizer. GAAP requires inventory to be valued as if Energizer was a dis-

tributor purchasing the inventoryat fair market value, as opposed to its historical manufacturing cost. As a result, therewas a one-time allocation of purchase price to the acquired inventory which was $89.7 million, pre-tax, or $58.3 million,

after tax, higher than historical manufacturing cost. Because inventory value and cost of product sold for all product manufactured after the acquisition date are based upon actual production costs, as dictated by GAAP, Energizer believes

presenting earnings excluding the inventory write-up is useful to investors as an additional basis for comparison to prior and subsequent periods.

(b) Free cash flow is defined as net cash from operations, less net additions to and disposals of property,plant and equipment. The Company views free cash flow as an important indicator of its ability to repay debt, fund growth and return cash to

shareholders. Free cash flow is not a measure of the residual cash flow that is available for discretionary expenditures, since the Company has certain non-discretionary obligations, such as debt service, that are not deducted from the measure.

For April 1, 2000 to September 30, 2005, cumulative operating cash flow, additions to property, plant and equipment and disposals of property, plant and equipment were $1,880.0 million, $(458.1) million and $37.1, respectively. Cumulative

free cash flow for the period April 1, 2000 to September 30, 2005, was $1,459.0 million.

Energizer is traded on the New York Stock

Exchange under the ENR symbol. Energizer is one

of the world’s largest manufacturers of primary

batteries and flashlights and a global leader in the

dynamic business of providing portable power.

In addition, Energizer is the parent company of

Schick-Wilkinson Sword (SWS), the second largest

manufacturer of wet shave products in the world.

FINANCIAL HIGHLIGHTS

Net Sales

in billions

03 04 05

........... $2.99

.............................. $2.23

..................... $2.81

Earnings Per Share

Excluding unusual items as

noted in the tables below

03 04 05

........... $3.90

.............................. $2.59

..................... $3.21