Energizer 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

While it was a year marked by a change in

leadership, our basic approach to business

and underlying management philosophy

remain constant. We are structured for

success – financially,operationally,organi-

zationally – and well positioned to execute

our business strategies going forward.

Financial Performance

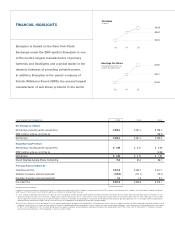

For our fiscal year ended September 30,

2005, Energizer’s net earnings grew 7

percent to $286.4 million compared to

$267.4 million the prior year,and earnings

per share climbed 21 percent to $3.90

compared to $3.21 the year before. Net

sales for the year reached nearly $3.0 bil-

lion, an increase of 6 percent over sales

of $2.8 billion in fiscal 2004.

Energizer remains cash-flow driven. Since

our spin-off as an independent company,

Energizer has generated nearly $1.5 billion

of free cash flow.* Cash flow provides the

resources to build our brands and develop

new products, to maintain a strong balance

sheet and take advantage of opportunities.

The opportunities we have focused on

in recent years have been the acquisition

of Schick-Wilkinson Sword and share

repurchase – and both have proven highly

successful and rewarding for shareholders.

SWS Acquisition

The performance of Schick-Wilkinson

Sword(SWS) has greatly exceeded our

expectations. This business was stagnant

and sales had slipped to $625 million in

2002, the year beforeour acquisition.

Fueled by the successful launch of several

new products, this business has achieved

impressive sales growth – $745 million in

fiscal 2003, $868 million in fiscal 2004 and

$931 this year, representing compound

annual growth of 12 percent.

Based on the success of this acquisition,

we continue to exploreopportunities to add

acomplementary consumer packaged

goods business to our operations.

Share Repurchase

During fiscal 2005, the company repur-

chased 8.1 million shares of common

stock, and in early November, the Board

approved a new authorization for up to

10 million shares. Over the past five fiscal

years, share repurchases have exceeded

$1.3 billion and total morethan 34 million

shares at an average purchase price of

$38.72, well below current market price.

While we believe investing in our company

is a sound financial strategy that rewards

long-term shareholders, the use of cash

flow for share repurchase remains situa-

tional and opportunistic.

Sound Business Strategies

Today, the environment in which we com-

pete is increasingly challenging – challenges

that include competitor consolidation,

retailer consolidation, rising raw material

costs and more.

In response, Energizer remains highly focused

on the businesses in which we choose to

compete – the portable power and wet

shave arenas. We define success as provid-

ing solutions to our trade customers and

consumers better than anyone else.

We believe in the power of the brand, and

we understand that building healthy brands

requires constant innovation and continued

investment. The results of our emphasis on

innovation are evident throughout this report.

Energizer boasts an international footprint

that provides broad geographic diversifica-

tion, with approximately half of our sales

generated outside of North America. As a

result, we are able to operate on a global

scale with a few large, high-output produc-

tion facilities and to lessen our dependency

on any one market, customer or currency.

Successful Brand Strategies

Energizer competes in the consumer

packaged goods market in two distinct

categories with two strong, complementary

business units, each with clearly defined

objectives. Batteries and Lighting

Products focuses on consistently generat-

ing strong, stable cash flows, and Razors

and Blades focuses on delivering organic

top-line growth through innovation and

the opportunity for margin improvement.

Batteries and Lighting Products.

Capitalizing on the industry’s most compre-

hensive product line with two world-class

brands – Energizer®and Eveready®–we

remain focused on generating healthy mar-

gins in the premium segment and growing

through innovation in the performance and

specialty segments.

We hold a significant share of the profitable

premium battery market with our flagship

Energizer®MAX®alkaline. While aggressively

defending our U.S. market share, we are

focused on building brand equity and grow-

ing volume that is not sold on promotion.

As a result, the portion of non-promoted

premium volume has steadily increased

over the past year.

To Our Shareholders

2ENR 2005 Annual Report

Fiscal 2005 was another excellent year for Energizer, boldly underscored

by a substantial double-digit earnings increase, improved operating margin

and healthy top-line growth – plus the continued strengthening of our

widely recognized, world-class brands and innovative product offerings.

Ward M. Klein

Chief Executive Officer

*See financial highlights on the inside front cover for a definition of Free Cash Flow and a reconciliation to reported GAAP financial measures.