Energizer 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2005 Annual Report 35

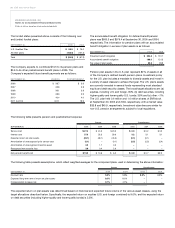

11. Defined Contribution Plan

The Company sponsors a defined contribution plan, which extends

participation eligibility to substantially all U.S. employees. The

Company matches 50% of participants’ before-tax contributions

up to 6% of eligible compensation. In addition, participants can

make after-tax contributions into the plan. The participant’s first

1% of eligible compensation after-tax contribution is matched with

a325% Company contribution to the participant’s pension plan.

Amounts charged to expense during fiscal 2005, 2004 and 2003

were $5.2, $5.4 and $4.4, respectively, and are reflected in SG&A and

cost of products sold in the Consolidated Statement of Earnings.

As of March 29, 2003, U.S. employees of the newly acquired

SWS business were eligible to participate in the Company’s defined

contribution plan, but, as mandated by the terms of the Stock

and Asset Purchase Agreement with Pfizer, Inc. relating to the

acquisition of SWS (the Acquisition Agreement), until January 1,

2004, the Company was required to match 100% of the first 3%

of compensation contributed and 50% of the next 3% of com-

pensation contributed, consistent with the terms of the Pfizer-

sponsored defined contribution plan in which they had previously

participated. Contributions could be on either a before-tax or

after-tax basis. As of January1, 2004, U. S. participants received

matching contributions in accordance with the terms of the

Company’s defined contribution plan, but, as dictated by the

terms of the Acquisition Agreement, also received, until March 28,

2005, an additional contribution of 3.5% of compensation to the

participant’spension plan.

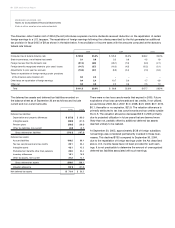

12. Debt

Notes payable at September 30, 2005 and 2004 consisted of notes

payable to financial institutions with original maturities of less than

one year of $101.2 and $162.3, respectively, and had a weighted-

average interest rate of 4.7% and 3.0%, respectively.

In September 2003, the Company prepaid $160.0 in long-term

debt with interest rates ranging from 7.8% to 8.0% and maturity

dates in 2005, 2007 and 2010. In September 2003, the Company

recorded a $20.0 pre-tax charge, or $12.4 after-tax, related to this

prepayment, which is recorded in other financing (income)/expense,

net in the Consolidated Statement of Earnings.

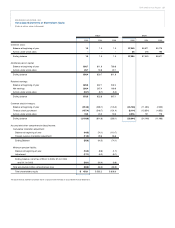

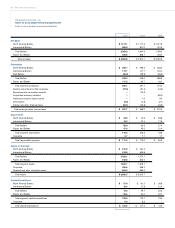

The detail of long-term debt at September 30 is as follows:

2005 2004

Private Placement, fixed interest rates ranging

from 2.3% to 5.2%, due 2006 to 2015 $1,000.0 $375.0

Private Placement, variable interest at LIBOR +

65 to 75 basis points –325.0

Singapore Bank Syndication, multi-currency

facility, variable interest at LIBOR + 55 basis

points, or 4.4%, due 2010 310.0 –

Singapore Bank Syndication, U.S. Dollar,

variable interest at SIBOR + 1% –105.0

Singapore Dollar Revolving Credit Facility,

variable interest rate –39.6

U.S. Revolving Credit Facility,variable interest

rate, 3.0% due 2006 –235.0

1,310.0 1,079.6

Less current portion 15.0 20.0

Total long-term debt $1,295.0 $ 1,059.6

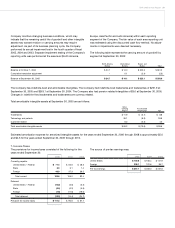

The Company maintains total committed debt facilities of $1,625.0,

of which $315.0 remained available as of September 30, 2005.

Under the terms of the facilities, the ratio of the Company’s total

indebtedness to its EBITDA cannot be greater than 3.5 to 1 and

the ratio of its EBIT to total interest expense must exceed 3 to 1.

Additional restrictive covenants exist under current debt facilities.

Failure to comply with the above ratios or other covenants could

result in acceleration of maturity, which could trigger cross defaults

on other borrowings. The Company believes that covenant violations

resulting in acceleration of maturity is unlikely. The Company’s fixed

rate debt is callable by the Company, subject to a “make whole”

premium, which would be required to the extent the underlying

benchmark U.S. treasury yield has declined since issuance.

Aggregate maturities on all long-term debt at September 30, 2005

are as follows: $15.0 in 2006, $10.0 in 2007, $135.0 in 2008, $20.0

in 2009, $605.0 in 2010, and $525.0 thereafter.

In November 2004, the Company entered into two new financing

agreements. A $300.0 long-term debt financing was completed, with

three, five and seven year maturities with fixed rates ranging from