Energizer 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 ENR 2005 Annual Report

value of the assets acquired and liabilities assumed is recognized as

goodwill. The valuation of the acquired assets and liabilities will impact

the determination of future operating results. The Company uses a variety

of information sources to determine the value of acquired assets and

liabilities including: third-party appraisers for the value and lives of

property, identifiable intangibles and inventories; actuaries for defined

benefit retirement plans; and legal counsel or other experts to assess

the obligations associated with legal, environmental and other claims.

Recently Issued Accounting Standards

See discussion in Note 2 to the Consolidated Financial Statements.

Forward-Looking Information

Statements in the Management’s Discussion and Analysis of Results

of Operations and Financial Condition and other sections of this

Annual Report to Shareholders that are not historical, particularly

statements regarding increases in overall battery consumption, the

impact of changes in the value of local currencies on segment

profitability, Energizer’s estimates of its share of total U.S. retail

battery market and SWS share of the wet shave category in various

markets, Energizer’spositioning to meet consumer demand and the

benefits of its portfolio of products, the Company’s assessment of

the wet shave products category and the ability of the SWS business

to increase sales and margins, the potential for future restructuring

activity,the unfavorability of product costs in the coming year,the

amount of future cost savings from the VERO program, the esti-

mates of the Company’sfuturetax rates, estimated capital expendi-

tures for fiscal 2006 and their source of financing, the likelihood of

acceleration of the Company’s debt covenants, the anticipated

adequacy of cash flows and the Company’sability to meet liquidity

requirements, the Company’s ability to mitigate future material, labor

and transportation cost increases, the materiality of future expenditures

for environmental matters and environmental control equipment, the

impact of adverse changes in interest rates, the market risk of foreign

currency derivatives, the mitigating impact of changes in value of

the prepaid share option on deferred compensation liabilities, the

impact of variations from assumptions on pension asset returns on

the Company’s pre-tax pension expense, and the potential initiation

of realignment activities and the anticipated amount of charges to

earnings associated therewith, may be considered forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. The Company cautions readers not to place

undue reliance on any forward-looking statements, which speak

only as of the date made.

The Company advises readers that various risks and uncertainties

could affect its financial performance and could cause the

Company’sactual results for future periods to differ materially from

those anticipated or projected. Battery consumption trends could

be negatively impacted by general economic conditions or product

innovations. Energizer’s estimates of its U.S. alkaline market share,

and estimates of SWS share of the wet shave category may be

inaccurate, or may not reflect segments of the retail market. Shifts

in consumer demands or needs, competitive activity or product

improvements, or further retailer consolidations may dilute or defeat

the benefits of the Company’s consumer positioning and strategy.

General economic conditions, retailer pressure and competitive

activity may negatively impact the outlook for the wet shave products

category. Because of that competitive activity, the SWS business

may not be able to increase sales or margins, and could lose current

market position. Unforeseen fluctuations in levels of the Company’s

operating cash flows, or inability to maintain compliance with its

debt covenants, could limit the Company’s ability to meet future

operating expenses and liquidity requirements, fund capital expen-

ditures or service its debt as it becomes due. U.S. or international

political or economic crises, natural disasters, or increasing global

demands for raw materials and energy, could result in higher

product

costs and higher levels of inflation in general than currently

anticipated,

and the Company may not be able to realize cost

reductions, productivity improvements or price increases which

are substantial enough to counter the inflationary impact. Unknown

environmental liabilities and greater than anticipated remediation

expenses or environmental control expenditures could have a

material impact on the Company’s financial position. Estimates of

environmental liabilities are based upon, among other things, the

Company’s payments and/or accruals with respect to each

remediation site; the number,ranking and financial strength of other

responsible parties (PRPs), the status of the proceedings, including

various settlement agreements, consent decrees or courtorders;

allocations of volumetric waste contributions and allocations of

relative responsibility among PRPs developed by regulatory agencies

and by private parties; remediation cost estimates prepared by

governmental authorities or private technical consultants; and the

Company’shistorical experience in negotiating and settling disputes

with respect to similar sites – and such estimates may prove to be

inaccurate. Anticipated long-termcost savings associated with job

eliminations or replacements with lower-priced workers as a result

of the VERO may not materialize, depending upon longer-term

production needs and the competitive job market in communities

where the Company’s facilities are located. The Company’s overall

tax rate in futureyears may be higher than anticipated because of

unforeseen changes in the tax laws or applicable rates, higher taxes

on repatriated earnings or increased foreign losses. Economic turmoil

and currency fluctuations could increase the Company’s risk from

unfavorable impact on variable-rate debt, currency derivatives

and other financial instruments. Deferred compensation liabilities

reflecting the value of the Common Stock may increase significantly,

depending on market fluctuation and employee elections, but such

increase may not be reflected in a comparable increase in the value

of the prepaid shareoption. The impact of decreases in the expected

returns from pension assets may have a greater than anticipated

impact on pension expenses. Management’s determination of the

relative value of potential savings opportunities versus expenses

associated with supply chain realignment activity may recommend

against the initiation of such activity. Current assumptions of associ-

ated charges are preliminary and may not reflect all termination or

distribution expenses or other charges which may actually be

incurred. Additional risks and uncertainties include those detailed

from time to time in the Company’spublicly filed documents, includ-

ing its Registration Statement on Form 10, as amended, and its

Current Report on Form 8-K dated April 25, 2000.

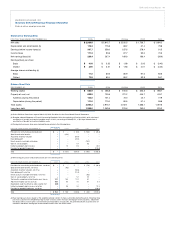

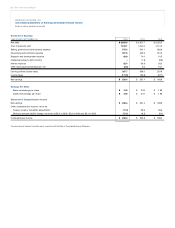

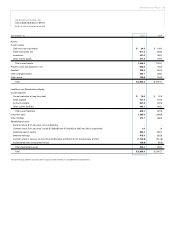

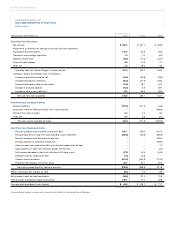

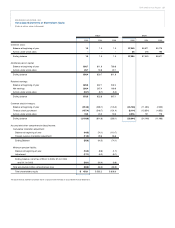

ENERGIZER HOLDINGS, INC.

Management’s Discussion and Analysis of Results of Operations and Financial Condition

(Dollars in millions, except per share and percentage data)