Energizer 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 ENR 2005 Annual Report

1. Basis of Presentation

Preparation of the financial statements in conformity with generally

accepted accounting principles in the United States (GAAP) requires

Energizer Holdings, Inc. and its subsidiaries (the Company) to make

estimates and assumptions that affect the reported amounts of

assets and liabilities, disclosure of contingent assets and liabilities

and the reported amounts of revenues and expenses. On an ongoing

basis, the Company evaluates its estimates, including those related

to customer programs and incentives, product returns, bad debts,

inventories, intangible and other long-lived assets, income taxes,

financing, pensions and other postretirement benefits, contingencies

and acquisitions. Actual results could differ from those estimates.

2. Summary of Significant Accounting Policies

The Company’s significant accounting policies, which conform

to GAAP and are applied on a consistent basis among all years

presented, except as indicated, aredescribed below.

Principles of Consolidation The financial statements include the

accounts of Energizer and its majority-owned subsidiaries. All signif-

icant intercompany transactions are eliminated. Investments in affili-

ated companies, 20% through 50% owned, are carried at equity.

Foreign Currency Translation Financial statements of foreign opera-

tions wherethe local currency is the functional currency are translated

using end-of-period exchange rates for assets and liabilities, and

average exchange rates during the period for results of operations.

Related translation adjustments are reported as a component within

accumulated other comprehensive income in the shareholders equity

section of the Consolidated Balance Sheet.

For foreign operations where the U.S. dollar is the functional currency

and for countries that areconsidered highly inflationary, translation

practices differ in that inventories, properties, accumulated depreci-

ation and depreciation expense are translated at historical rates

of exchange, and related translation adjustments are included in

earnings. Gains and losses from foreign currency transactions are

generally included in earnings.

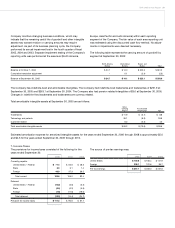

Financial Instruments and Derivative Securities The Company

uses financial instruments, from time to time, in the management

of foreign currency, interest rate and other risks that are inherent to

its business operations. Such instruments arenot held or issued for

trading purposes.

Foreign exchange (F/X) instruments, including currency forwards,

purchased options and zero-cost option collars, are used primarily

to reduce transaction exposures and, to a lesser extent, to manage

other translation exposures. F/X instruments used are selected based

on their risk reduction attributes and the related market conditions.

The terms of such instruments are generally 12 months or less.

For derivatives not designated as hedging instruments for accounting

purposes, realized and unrealized gains or losses from such instru-

ments are recognized currently in other financing (income)/expense,

net in the Consolidated Statement of Earnings. The Company has

not designated any financial instruments as hedges for accounting

purposes in the three years ended September 30, 2005.

Cash Equivalents For purposes of the Consolidated Statement of

Cash Flows, cash equivalents are all considered to be highly liquid

investments with a maturity of three months or less when purchased.

Accounts Receivable Valuation Accounts receivable are stated

at their net realizable value. The allowance for doubtful accounts

reflects the Company’s best estimate of probable losses inherent

in the receivables portfolio determined on the basis of historical

experience, specific allowances for known troubled accounts and

other currently available information. Bad debt expense is included

in selling, general and administrative (SG&A) expense in the

Consolidated Statement of Earnings.

Inventories Inventories are valued at the lower of cost or market,

with cost generally being determined using average cost or the

first-in, first-out (FIFO) method.

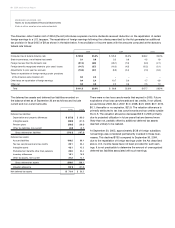

Capitalized SoftwareCosts Capitalized softwarecosts areincluded in

Other Assets. These costs areamortized using the straight-line method

over periods of related benefit ranging from three to seven years.

Property at Cost Expenditures for new facilities and expenditures

that substantially increase the useful life of property,including

interest during construction, are capitalized. Maintenance, repairs

and minor renewals areexpensed as incurred. When property is

retired or otherwise disposed of, the related cost and accumulated

depreciation are removed from the accounts, and gains or losses

on the disposition are reflected in earnings. The carrying value of

assets held for disposal under several previous restructuring plans

was $4.6 at September 30, 2005.

Depreciation Depreciation is generally provided on the straight-line

basis by charges to costs or expenses at rates based on estimated

useful lives. Estimated useful lives range from two to 25 years for

machinery and equipment and three to 30 years for buildings.

Depreciation expense was $111.0, $110.0 and $80.5 in 2005, 2004

and 2003, respectively.

Goodwill and Other Intangible Assets Goodwill and indefinite-

lived intangibles are not amortized, but are evaluated annually for

impairment as part of the Company’s annual business planning

cycle in the fourth quarter. The fair value of each reporting unit is

estimated using the discounted cash flow method. Intangible assets

with finite lives are amortized on a straight-line basis over expected

lives of three to 15 years. Such intangibles are also evaluated for

impairment annually.

Impairment of Long-Lived Assets The Company reviews long-

lived assets for impairment when events or changes in business

ENERGIZER HOLDINGS, INC.

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)