Energizer 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 ENR 2005 Annual Report

¨In 2005, 2004 and 2003, $14.7, $16.2 and $12.2, respectively, of tax

benefits related to prior years’ losses were recorded. These were related

to foreign countries where the Company generated earnings and could

reasonably expect future profitability.

¨Adjustments were recorded in each of the three years to revise previously

recorded tax accruals, which were based on estimates when recorded.

Such adjustments decreased the income tax provision by $10.6, $8.5

and $7.0 in 2005, 2004 and 2003, respectively.

¨The current year includes $9.0 of additional taxes related to repatriation

of foreign earnings under provisions of the American Jobs Creation Act,

which provides for an 85% exclusion of qualifying dividends from normal

U.S. tax rates.

¨The tax benefit related to the write-up of acquired SWS inventory of

$89.7, all of which was recorded to cost of products sold in 2003, was

higher than the overall tax rate for the remainder of the business, and

thus reduced the overall tax rate by 1.8 percentage points.

Excluding the items discussed above, the income tax percentage

was 32.1% in 2005, 32.2% in 2004 and 36.1% in 2003. The

improved tax rate in 2004 reflects a significantly lower rate on

foreign income due to improved foreign earnings and overall

country mix. Such improvements reflect better battery results

as well as a favorable impact from the inclusion of SWS.

The Company’seffective tax rate is highly sensitive to country

mix from which earnings or losses are derived. To the extent future

earnings levels and countrymix aresimilar to the 2005 level and

excluding any unusual or non-recurring tax items, futuretax rates

would likely be in the 31-33% range. Declines in earnings in lower

tax rate countries, earnings increases in higher tax countries or

operating losses in the future could increase future tax rates.

Additionally,adjustments to prior year tax accrual estimates could

increase or decrease future tax provisions.

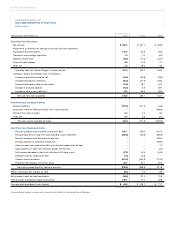

Liquidity and Capital Resources

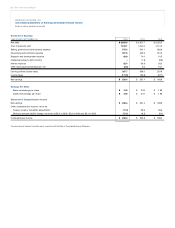

Cash flow from operations was $316.8 in 2005, a decrease of

$168.9 from 2004. The primary reasons for the decline relates to

working capital changes, while “operating cash flow before changes

in working capital” was roughly flat. Working capital was $625.9

and $468.8 at September 30, 2005 and 2004, respectively. Working

capital changes reflect higher accounts receivable, inventories and

other current assets, and lower short-term debt. Receivables are

higher primarily due to the launch of new products in the Razors

and Blades segment in late September 2005. Inventories are higher

primarily for North America Battery due to relatively low levels at

the end of 2004 following a high-demand hurricane season.

In 2004, cash flow from operations totaled $485.7, an increase of

$43.6 from 2003. The increase was due to higher “operating cash

flow beforechanges in working capital” of $164.5, partially offset by

lower conversion of working capital items to cash. The 2003 cash

flow reflects an unusually large change in inventory balance primarily

due to the SWS inventory write-up discussed in Note 3, which

accounts for the decline in 2004.

Capital expenditures totaled $103.0, $121.4 and $73.0 in 2005,

2004 and 2003, respectively. These expenditures were funded by

cash flow from operations. Capital expenditures decreased in 2005

due to lower production project spending in both businesses and

lower integration capital spending. Capital expenditures increased

in 2004 as a result of increases for battery production projects,

inclusion of SWS for a full year and corporate expenditures. See

Note 19 of the Consolidated Financial Statements for capital expen-

ditures by segment. Capital expenditures of approximately $113

are anticipated in 2006. Such expenditures are expected to be

financed with funds generated from operations.

Total long-term debt outstanding, including current maturities, was

$1,310.0 at September 30, 2005. The Company maintains total

committed debt facilities of $1,625.0, of which $315.0 remained

available as of September 30, 2005.

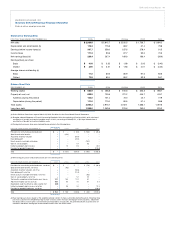

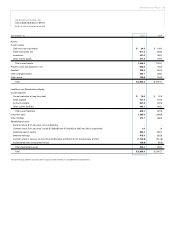

Asummary of the Company’s significant contractual obligations at

September 30, 2005 is shown below:

Less More

Than 1-3 3-5 Than

Total 1Year Years Years 5 Years

Long-term debt,

including current

maturities $1,310.0 $ 15.0 $ 145.0 $ 625.0 $ 525.0

Notes payable 101.2 101.2 – – –

Operating leases 53.4 14.0 18.7 12.5 8.2

Total $1,464.6 $130.2 $ 163.7 $ 637.5 $ 533.2

In November 2004, the Company entered into two new financing

agreements. A $300.0 long-term debt financing was completed,

with three, five and seven year maturities with fixed rates ranging

from 3.4% to 4.4%. Proceeds from these notes were used to pay

down all existing long-termdebt in a revolving credit facility and to

partially retire short-term debt within a secured financing arrange-

ment. In addition, the Company renegotiated its existing U.S. revolv-

ing credit facility in order to extend the maturity to five years and

to realize more favorable borrowing spreads. In August 2005, the

Company entered into a new Singaporemulti-currency syndication

of $325.0 in order to extend the maturity to 2010 and to realize more

favorable borrowing spreads. Proceeds from this borrowing were

used to refinance an existing revolving credit facility in Singapore,

allow for the repayment of intercompany debt and notes, and the

repatriation of funds in connection with the American Jobs Creation

Act. During September 2005, the Company refinanced $325.0 of

variable interest private placement debt with $325.0 of fixed rate

private placement debt with interest rates ranging from 4.9% to

5.2% and maturities from 2008 to 2015.

Under the terms of the Company’s debt facilities, the ratio of the

Company’s total indebtedness to its Earnings Before Interest, Taxes,

Depreciation and Amortization (EBITDA) (as defined by the facility

agreement) cannot be greater than 3.5 to 1, and the ratio of its

ENERGIZER HOLDINGS, INC.

Management’s Discussion and Analysis of Results of Operations and Financial Condition

(Dollars in millions, except per share and percentage data)