Energizer 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FASB Staff Position 109-1 (FSP 109-1), “Application of FASB

Statement No. 109, Accounting for Income Taxes, to the Tax

Deduction on Qualified Production Activities Provided by the

American Jobs Creation Act of 2004,” requires companies eligible

for a tax deduction resulting from “qualified production activities

income” to treat this as a reduction to the income tax provision as

realized. This deduction will not impact the Company until fiscal

2006. This deduction, combined with the phase-out of the export

incentive, is not expected to have a material impact on the

Consolidated Financial Statements of the Company.

The FASB issued SFAS 154, “Accounting Changes and Error

Corrections – a replacement of APB Opinion No. 20 and FASB

Statement No. 3” (SFAS 154), which requires retrospective applica-

tion to prior periods’ financial statements of changes in accounting

principle, unless it is impracticable to determine either the period-

specific effects or the cumulative effect of the change. It also

requires that a change in depreciation, amortization or depletion

method for long-lived, nonfinancial assets be accounted for as a

change in accounting estimate effected by a change in accounting

principle. The Company is not currently contemplating an accounting

change which would be impacted by SFAS 154.

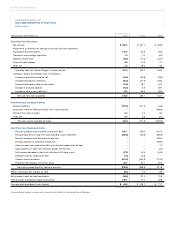

3. Acquisition of SWS

On March 28, 2003, the Company acquired the worldwide Schick-

Wilkinson Sword (SWS) business from Pfizer, Inc. for $930 plus

acquisition costs and subject to adjustment based on acquired

working capital level. The final purchase price and acquisition costs

totaled $975.8. A $550.0 bridge loan, together with existing available

credit facilities and cash, wereused to fund the acquisition. In 2003,

the Company refinanced the bridge loan into longer term financing.

SWS is the second largest manufacturer and marketer of men’s

and women’s wet shave products in the world, and its products

were marketed in over 80 countries at the time of the acquisition.

Its primary markets are the U.S. and Canada, Japan and the larger

countries of WesternEurope.

At acquisition, the Company recorded SWS inventory acquired at fair

value, as required by GAAP. The fair value of finished goods acquired

is sales value, less costs to sell and a reasonable profit margin on

the selling activity. As such, the inventory is valued equivalent to

what a distributor would pay,rather than the historical cost basis

of a manufacturer of such inventory. This accounting resulted in an

allocation of purchase price to acquired inventory which was $89.7

higher than the historical manufactured cost of SWS (the SWS

inventory write-up). Inventory value and cost of products sold will

be based on the post-acquisition SWS production costs for all

product manufactured after the acquisition date. The entire $89.7

of the SWS inventorywrite-up was recognized in cost of products

sold in 2003, reducing net earnings by $58.3, after taxes.

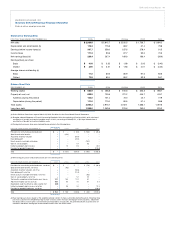

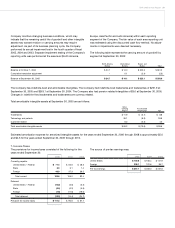

The Consolidated Statement of Earnings includes results of SWS

operations for fiscal 2005, 2004 and the final six months of fiscal

2003. The following table represents the Company’s pro forma

consolidated results of operations as if the acquisition of SWS had

occurred at the beginning 2003. Such results have been prepared

by adjusting the historical Company results to include SWS results

of operations and incremental interest and other expenses related

to acquisition debt. The pro forma results do not include any cost

savings resulting from the combination of Energizer and SWS

operations. The pro forma results may not necessarily reflect the

consolidated operations that would have existed had the acquisition

been completed at the beginning of such periods nor are they

necessarily indicative of future results.

UNAUDITED PRO FORMA FOR THE YEAR ENDED SEPTEMBER 30, 2003

Net sales $ 2,544.5

Net earnings 167.9

Basic earnings per share 1.95

Diluted earnings per share 1.90

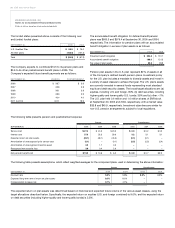

4. Intellectual Property Rights Income

The Company entered into agreements to license certain intellectual

property to other parties in separate transactions. Such agreements

do not require any future performance by the Company, thus all

committed consideration was recorded as income at the time each

agreement was executed. The Company recorded income related

to such agreements of $1.5 pre-tax, or $0.9 after-tax, and $8.5 pre-

tax, or $5.2 after-tax, in the years ended September 30, 2004 and

2003, respectively.

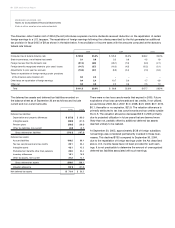

5. Fixed Asset Impairment

The Company recorded a pre-tax charge in 2004 for asset impairment

of $4.2 in research and development expense. The charge was to

write down to disposition value certain long-lived assets following

adecision to discontinue a project to develop alternative manufac-

turing methods. Additionally,the Company recorded a $1.9 pre-tax

asset impairment charge in 2004 in cost of products sold for impaired

assets used to produce products that have been discontinued. The

impaired long-lived assets had been carried in the North America

Battery segment.

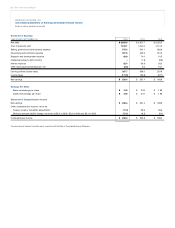

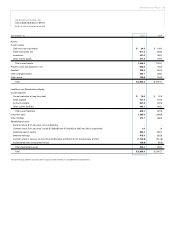

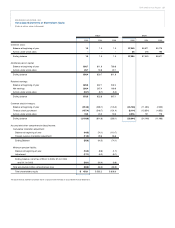

6. Goodwill and Intangible Assets and Amortization

The Company has allocated goodwill and other intangible assets

to individual countries or areas for battery businesses. The battery

business intangible assets arecomprised of trademarks primarily

related to the Energizer brand. These intangible assets are deemed

indefinite-lived.

The Company allocated goodwill, indefinite-lived trademarks and

other intangible assets to the SWS business at acquisition. The

other intangible assets include trademarks, tradenames, technology,

patents and customer-related assets with lives ranging from five

to 15 years.

Goodwill and intangible assets deemed to have an indefinite life are

not amortized, but reviewed annually for impairment of value. The

28 ENR 2005 Annual Report

ENERGIZER HOLDINGS, INC.

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)