Energizer 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 ENR 2005 Annual Report

ENERGIZER HOLDINGS, INC.

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)

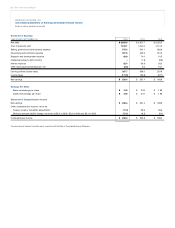

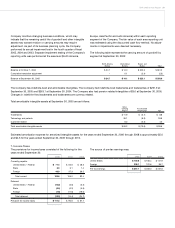

Asummary of nonqualified ENR stock options outstanding is as follows (shares in millions):

2005 2004 2003

Weighted-Average Weighted-Average Weighted-Average

Shares Exercise Price Shares Exercise Price Shares Exercise Price

Outstanding on October 1, 6.62 $22.49 7.12 $19.75 7.69 $18.14

Granted 0.26 48.73 0.68 43.98 0.95 28.99

Exercised (2.08) 19.04 (1.15) 18.04 (1.52) 17.37

Cancelled (0.04) 30.15 (0.03) 26.04 – –

Outstanding on September 30, 4.76 25.38 6.62 22.49 7.12 19.75

Exercisable on September 30, 3.08 $19.58 3.99 $18.08 3.36 $17.67

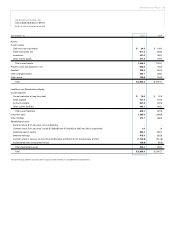

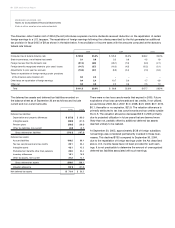

Information about ENR nonqualified options at September 30, 2005 is summarized below (shares in millions):

Outstanding Stock Options Exercisable Stock Options

Weighted-Average

Remaining Contractual Weighted-Average Weighted-Average

Range of Exercise Prices Shares Life (Years) Exercise Price Shares Exercise Price

$16.81 to $25.05 2.89 4.8 $17.76 2.73 $17.55

$25.21 to $37.84 0.97 7.4 $29.65 0.23 $30.52

$37.85 to $44.67 0.90 8.7 $45.34 0.12 $43.97

$16.81 to $44.67 4.76 6.0 $25.38 3.08 $19.58

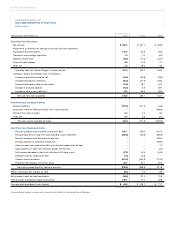

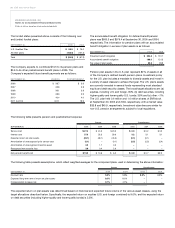

10. Pension Plans and Other Postretirement Benefits

The Company has several defined benefit pension plans covering

substantially all of its employees in the U.S. and certain employees

in other countries. The plans provide retirement benefits based on

years of service and earnings.

During the fourth quarter of fiscal 2004, the Company announced

a Voluntary Enhanced Retirement Option (VERO) offered to

approximately 600 eligible employees in the U.S. of which 321

employees accepted. A charge of $15.2, pre-tax, was recorded

during the fourth quarter of fiscal 2004 related to the VERO and

certain other special pension benefits, and the estimated impact

of such benefits on the Company’s pension plan is reflected in the

amounts presented below.

The Company also sponsors or participates in a number of other

non-U.S. pension arrangements, including various retirement and

termination benefit plans, some of which are required by local law or

coordinated with government-sponsored plans, which are not signif-

icant in the aggregate and therefore are not included in the informa-

tion presented below.

The Company currently provides other postretirement benefits,

consisting of health care and life insurance benefits for certain

groups of retired employees. Certain retirees are eligible for a fixed

subsidy, provided by the Company, toward their total cost of health

care benefits. Retiree contributions for health care benefits are

adjusted periodically, to cover the increase in the total costs of the

plan cost inflation and program change. Cost trend rates no longer

materially impact future cost of the plan.