Energizer 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 ENR 2005 Annual Report

Design: Falk Harrison Creative, St. Louis, Missouri

ENERGIZER HOLDINGS, INC.

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)

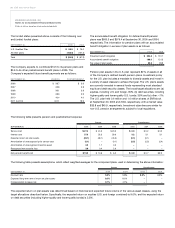

Through fiscal 2004, the Company recorded advertising and promo-

tion expense (A&P) in each interim period based on a method that

recognized the forecasted full year A&P ratably to forecasted revenues.

When forecasts of A&P or revenues changed during the year, A&P

rates were changed to reflect the new forecasts. Effective October 1,

2004, the Company began to expense A&P in the quarter incurred

(As Incurred Method). The new method of accounting was adopted

as it reduces the level of estimation in recording interim results and

improves transparency of timing of A&P spending. The change in

methods has no impact on the total results for the year. The prior

year financial information presented above has not been restated

for the new accounting method. The following presents net earnings

and basic and diluted earnings per share for the quarterly periods

in fiscal 2004 on the as incurred basis.

FIRST SECOND THIRD FOURTH

Fiscal 2004

Net earnings $ 115.9 $ 55.1 $ 40.6 $ 55.8

Basic earnings per share $1.38 $ 0.67 $ 0.50 $ 0.74

Diluted earnings per share $1.33 $ 0.65 $ 0.48 $ 0.72

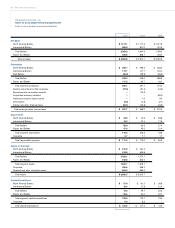

21. Business Realignment

Energizer continually reviews its battery and razor and blades busi-

ness model, including its product supply chain, sales, marketing

and administrative organizations. Such reviews may trigger business

realignment activities with potentially significant futurecharges to

earnings. In this regard, the Company is currently reviewing its

global supply chain complex for improvement opportunities and

may initiate activities during fiscal 2006, which may involve charges

to earnings in the future of up to $30.