Energizer 2005 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2005 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 ENR 2005 Annual Report

ENERGIZER HOLDINGS, INC.

Management’s Discussion and Analysis of Results of Operations and Financial Condition

(Dollars in millions, except per share and percentage data)

battery and razor and blades businesses, varying by country and

region of the world. Shared functions include product warehousing

and distribution, various transaction processing functions, legal and

environmental activities, and in some countries, combined sales

forces and management. For shared business functions, the Razors

and Blades segment has been charged only the actual incremental

cost of assuming additional SWS work. Such amounts are less than

fully allocated costs and do not represent the costs of such services

if performed on a stand-alone basis.

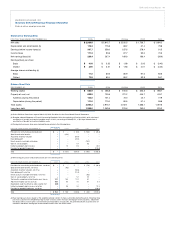

NORTH AMERICA BATTERY

2005 2004 2003

Net sales $1,173.1 $1,117.6 $ 1,041.9

Segment profit $ 295.7 $298.2 $ 283.5

For the year ended September 30, 2005, sales increased $55.5, or

5%, as incremental sales volume of $91.1 and favorable Canadian

currency translation of $7.3 was partially offset by unfavorable

pricing and product mix of $42.9. Current year sales included

approximately $21 of hurricane-related incremental sales compared

to approximately $40 last year. Energizer MAX volume for the year

increased 8%, as higher general demand was partially offset by

lower hurricane-related sales in 2005 compared to 2004. Higher

performing Energizer rechargeable and e2 lithium product sales

increased in excess of 20%. Overall pricing and product mix were

unfavorable in 2005 due to a continuing shift to trade channels that

feature larger package sizes with lower per-unit prices, and pricing

and product mix declines in non-Energizer branded products.

Gross margin dollars declined $6.4 in 2005. The margin contribution

of higher sales volume and favorable currency translation of $6.6

weresubstantially offset by unfavorable pricing and product mix.

Product cost was unfavorable $13.4 as higher commodity-based

material costs of approximately $17 was partially offset by other

production cost savings. Segment profit declined $2.5 as lower

gross margin was partially offset by lower overheads and A&P.

For the year ended September 30, 2004, sales increased $75.7, or

7%, primarily due to higher volume and favorable Canadian currency

translation of $7.7. The impact of four major hurricanes in 2004

contributed approximately $22 of incremental sales volume com-

pared to disaster-related sales in 2003. Apart from event-driven

volume and currency impacts, sales volume grew approximately

$46, or 4.5%, primarily against 2003 results which weredampened

by reductions in retail inventory levels. Adjusting for events and retail

inventory reductions last year,alkaline sales wererelatively flat in

2004, while the remainder of Energizer’s major product lines experi-

enced double-digit growth. Overall pricing and product mix were

slightly unfavorable for the year,as categorypricing and promotional

stability continued throughout the year, but minor unfavorable mix

was experienced due to growth of larger pack sizes.

In 2004, segment profit increased $14.7, or 5%, compared to 2003,

with currency accounting for $4.3 of the improvement. Incremental

gross margin from higher sales of $30.7 and currency impact was

partially offset by higher SG&A, A&P and product costs.

Looking ahead, material costs continue at higher levels than in

recent years. Additionally, a portion of the production costs savings

realized in 2005 resulted from plant efficiencies related to exception-

ally high production volume following the high-demand hurricane

season of 2004. If product sold during 2005 had been produced

at anticipated 2006 production costs, the result would have been

additional costs of approximately $13. Energizer initiated a general

price increase in the U.S. in August 2005, and all major competitors

have followed. Holiday promotional commitments have delayed

realization of the price increase. As such, first quarter results will

reflect unfavorable product cost with only a modest price increase

offset. Higher pricing in calendar 2006 is expected to mitigate

material cost inflation experienced in 2005 and 2004; however,

the battery category remains highly competitive.

INTERNATIONAL BATTERY

2005 2004 2003

Net sales $ 885.9 $827.0 $757.6

Segment profit $ 173.7 $147.7 $ 122.4

For the year ended September 30, 2005, net sales rose $58.9, or

7%, with currency impacts accounting for $32.4 of the increase.

Absent currencies, sales increased $26.5 or 3% on contributions

of higher sales volume of $35.1, partially offset by unfavorable

European pricing and product mix. Segment profit increased $26.0

for the year, including a $15.8 favorable impact from currencies.

Absent currencies, segment profit increased $10.2 as a $9.0 gross

margin increase from higher sales and lower A&P was partially

offset by higher SG&A.

For the year ended September 30, 2004, net sales increased $69.4, or

9%, on favorable currency impacts of $51.6 and contributions of higher

sales volume of $28.7, partially offset by unfavorable pricing and product

mix, primarily in Europe. Segment profit increased $25.3 for the year,

including a $26.6 favorable impact from currencies. Absent currencies,

segment profit decreased $1.3 as a $6.1 gross margin increase from

higher sales was offset by higher SG&A and A&P expenses.

The International Batterysegment has also experienced higher

material costs in recent years, but other production cost savings

have fully mitigated the increase. Current material costs and

production forecasts indicate overall product cost is likely to be

unfavorable in 2006 by approximately $5. However,actual results

will be subject to a number of variables.

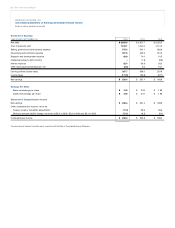

RAZORS AND BLADES

2005 2004 2003 PRO FORMA

Net sales $930.8 $868.1 $745.0

Segment profit $117.3 $ 85.7 $ 56.9