Energizer 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 ENR 2005 Annual Report

ENERGIZER HOLDINGS, INC.

Notes to Consolidated Financial Statements

(Dollars in millions, except per share and percentage data)

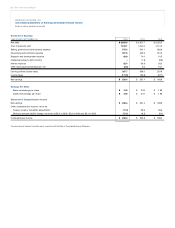

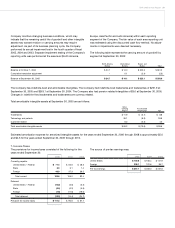

The deferred tax assets and deferred tax liabilities recorded on

the balance sheet as of September 30 are as follows and include

current and non-current amounts:

2005 2004

Deferred tax liabilities:

Depreciation and property differences $(87.8) $(93.0)

Intangible assets (38.5) (31.2)

Pension plans (39.0) (38.6)

Other tax liabilities, non-current (4.8) (5.1)

Gross deferred tax liabilities (170.1) (167.9)

Deferred tax assets:

Accrued liabilities 106.2 99.4

Tax loss carryforwards and tax credits 29.1 33.4

Intangible assets 42.1 42.3

Postretirement benefits other than pensions 29.9 32.4

Inventory differences 18.1 16.9

Other tax assets, non-current 31.2 14.7

Gross deferred tax assets 256.6 239.1

Valuation allowance (15.1) (21.0)

Net deferred tax assets $71.4 $50.2

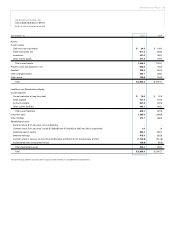

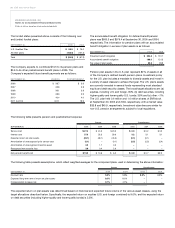

There were no tax loss carryforwards that expired in 2005. Future

expirations of tax loss carryforwards and tax credits, if not utilized,

areas follows: 2006, $0.4; 2007, $1.5; 2008, $4.5; 2009, $0.7; 2010,

$0.1; thereafter or no expiration, $21.9. The valuation allowance is

primarily attributed to tax loss carryforwards and tax credits outside

the U.S. The valuation allowance decreased $5.9 in 2005 primarily

due to projected utilization in future years that are deemed more

likely than not, partially offset by additional deferred tax assets

deemed unlikely to be realized.

At September 30, 2005, approximately $138 of foreign subsidiary

net earnings was considered permanently invested in those busi-

nesses. This declined $135 compared to September 30, 2004,

due to the repatriation of foreign earnings under the Act described

above. U.S. income taxes have not been provided for such earn-

ings. It is not practicable to determine the amount of unrecognized

deferred tax liabilities associated with such earnings.

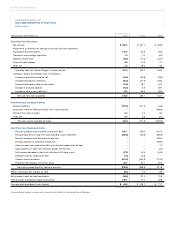

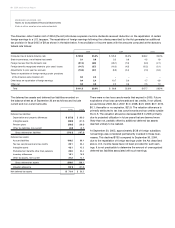

The American Jobs Creation Act of 2004 (the Act) introduces a special one-time dividends received deduction on the repatriation of certain

foreign earnings to a U.S. taxpayer. The repatriation of foreign earnings following the criteria prescribed by the Act generated an additional

tax provision in fiscal 2005 of $9 as shown in the table below. A reconciliation of income taxes with the amounts computed at the statutory

federal rate follows:

2005 2004 2003

Computed tax at federal statutory rate $139.2 35.0% $125.3 35.0% $ 83.2 35.0%

State income taxes, net of federal tax benefit 3.1 0.8 3.2 0.9 4.5 1.9

Foreign tax less than the domestic rate (27.4) (6.9) (26.1) (7.3) (5.0) (2.1)

Foreign benefits recognized related to prior years’ losses (14.7) (3.7) (16.2) (4.5) (12.2) (5.1)

Adjustments to prior year tax accruals (10.6) (2.7) (8.5) (2.4) (7.0) (3.0)

Taxes on repatriation of foreign earnings under provisions

of the American Jobs Creation Act 9.0 2.3 –– ––

Other taxes on repatriation of foreign earnings 9.4 2.4 10.7 3.0 1.7 0.8

Other, net 3.3 0.8 2.2 0.6 2.5 1.0

Total $111.3 28.0% $ 90.6 25.3% $ 67.7 28.5%